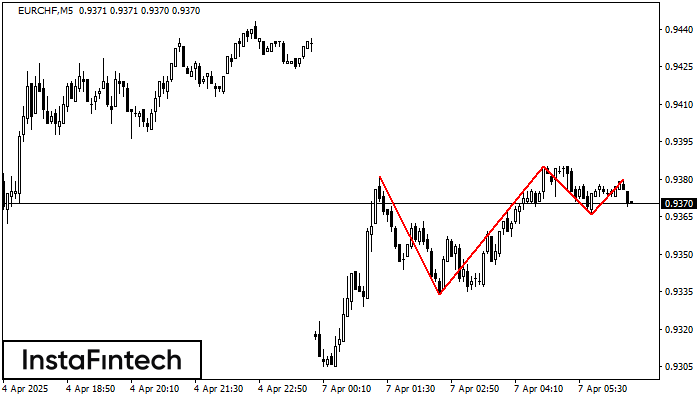

Triple Top

was formed on 07.04 at 05:36:16 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the EURCHF M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 0.9334/0.9366 with the upper limit 0.9381/0.9380; the projection of the width is 47 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 0.9334, the price is most likely to continue the downward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

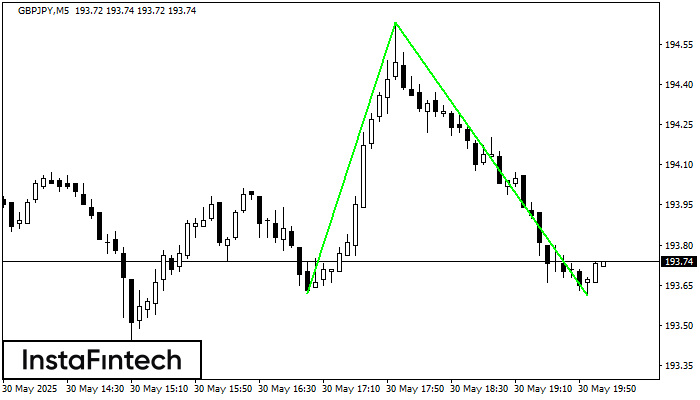

ডাবল বটম

was formed on 30.05 at 19:05:16 (UTC+0)

signal strength 1 of 5

M5 চার্টে, GBPJPY-এর ডাবল বটম প্যাটার্নটি গঠিত হয়েছে। উপরের সীমানা হল 194.63; নীচের সীমানা হল 193.61। প্যাটার্নের প্রস্থ হল 101 পয়েন্ট। 194.63-এর উপরের সীমানা ভেদ করার ক্ষেত্রে, প্রবণতা পরিবর্তনের পূর্বাভাস

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window

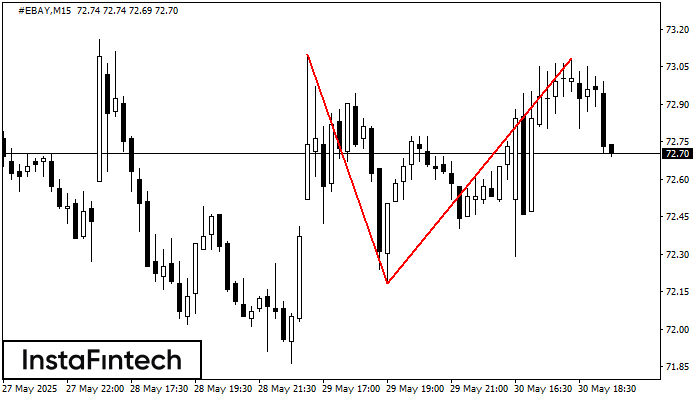

ডাবল টপ

was formed on 30.05 at 18:30:13 (UTC+0)

signal strength 2 of 5

M15 চার্টে, #EBAY-এর ডাবল টপ রিভার্সাল বা বিপরীতমুখী প্যাটার্ন গঠিত হয়েছে। বৈশিষ্ট্য: উপরের সীমানা 73.10; নীচের সীমানা 72.18; প্যাটার্নের প্রস্থ হল 90 পয়েন্ট। 72.18 71.96 স্তরের দিকে সম্ভাব্য মুভমেন্টের সাথে

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window

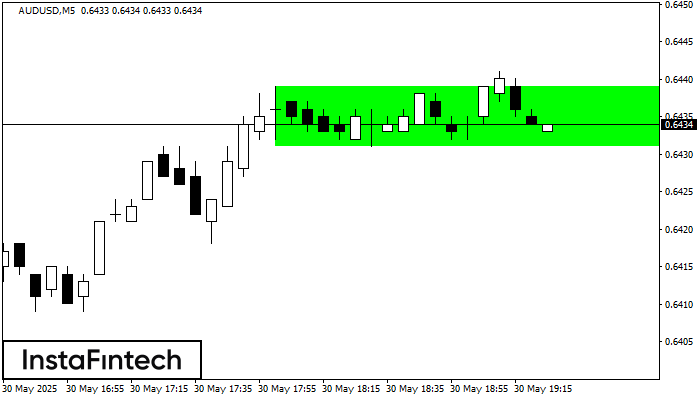

বুলিশ রেক্ট্যাঙ্গেল

was formed on 30.05 at 18:25:46 (UTC+0)

signal strength 1 of 5

M5 চার্ট অনুযায়ী, AUDUSD বুলিশ রেক্ট্যাঙ্গেল গঠন করেছে। এই প্যাটার্ন এই ধরনের প্রবণতার ধারাবাহিকতার নির্দেশ করে. এটি দুটি স্তর নিয়ে গঠিত: 0.6439 -এর রেজিস্ট্যান্স এবং 0.6431 -এর সাপোর্ট৷ রেজিস্ট্যান্স স্তর

M5 এবং M15 টাইম ফ্রেমে আরও ভুল এন্ট্রি পয়েন্ট থাকতে পারে।

Open chart in a new window