#FTSE (FTSE 100). Exchange rate and online charts.

Currency converter

04 Apr 2025 23:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the largest market capitalization. The index was launched in 1984. FTSE stands for Financial Times Stock Exchange. The FTSE 100 is seen as an indicator of the strength of the UK economy and is on the most important indices in Europe. The FTSE 100 companies make up about 80% of the UK stock market.

Since its inception in 1984, most companies that formed the FTSE 100 have been removed from it. Members in the list of FTSE 100 are revised every quarter based on their performance and change in overall market capital.

About 60% of FTSE 100 companies' revenues come from sales made outside the UK. Interestingly, most companies listed in the index provide their earnings reports in US dollars. So, the FTSE 100 is one of the major world indices, thus sensitive to global events.

Thanks to its structure, oil and mining companies prevail in the FTSE 100, thus representing over 30% of the index.

To trade the FTSE 100 successfully, you should learn about the companies that comprise it. It is important to stress that the FTSE 100 is a market-capitalization weighted index covering a broad range of industries.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 4-7, 2025: sell below $3,120 or buy above $3,025 (21 SMA - rebound)

If the gold price breaks the uptrend channel again and consolidates below 3,090 in the coming hours, we could expect it to continue falling, and the price could reach 3,070 and even the 7/8 Murray level around 3,046 or 3,025.Author: Dimitrios Zappas

17:37 2025-04-04 UTC+2

2098

USD/JPY: Simple Trading Tips for Beginner Traders � April 4th (U.S. Session)Author: Jakub Novak

20:08 2025-04-04 UTC+2

1843

EUR/USD: Trading Plan for the U.S. Session on April 4th (Review of Morning Trades)Author: Miroslaw Bawulski

19:52 2025-04-04 UTC+2

1768

- Gold declines amid slight repositioning ahead of U.S. employment data

Author: Irina Yanina

11:50 2025-04-04 UTC+2

1753

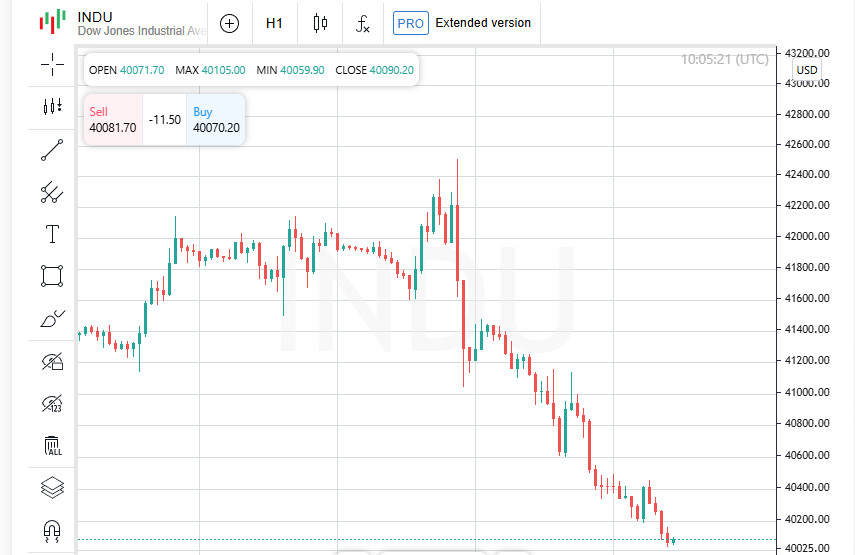

All Three Indexes Fall After Trump Tariff Announcement Apple Leads Big Tech Losers Retail Stocks Fall on Asian Tariff Worries Wall Street Fear Gauge Hits 3-Week HighAuthor: Thomas Frank

12:09 2025-04-04 UTC+2

1738

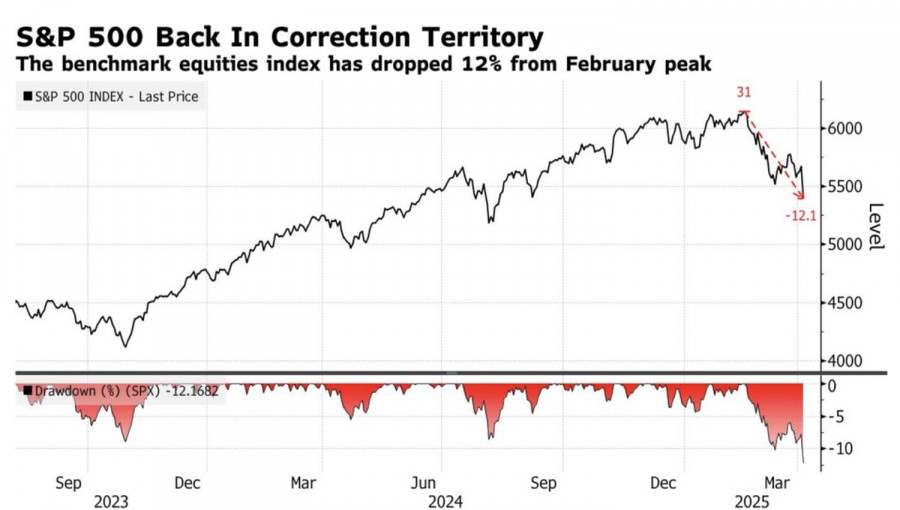

The once foolproof S&P 500 'buy the dip' strategy no longer works in today's new realityAuthor: Marek Petkovich

11:10 2025-04-04 UTC+2

1738

- Market news on April 4

Author: Jozef Kovach

11:14 2025-04-04 UTC+2

1663

Bears have left the marketAuthor: Samir Klishi

10:21 2025-04-04 UTC+2

1648

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 4-7, 2025: sell below $3,120 or buy above $3,025 (21 SMA - rebound)

If the gold price breaks the uptrend channel again and consolidates below 3,090 in the coming hours, we could expect it to continue falling, and the price could reach 3,070 and even the 7/8 Murray level around 3,046 or 3,025.Author: Dimitrios Zappas

17:37 2025-04-04 UTC+2

2098

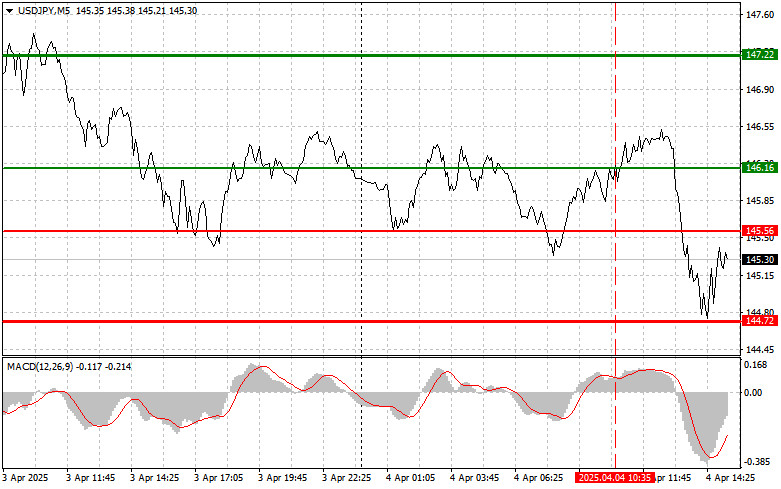

- USD/JPY: Simple Trading Tips for Beginner Traders � April 4th (U.S. Session)

Author: Jakub Novak

20:08 2025-04-04 UTC+2

1843

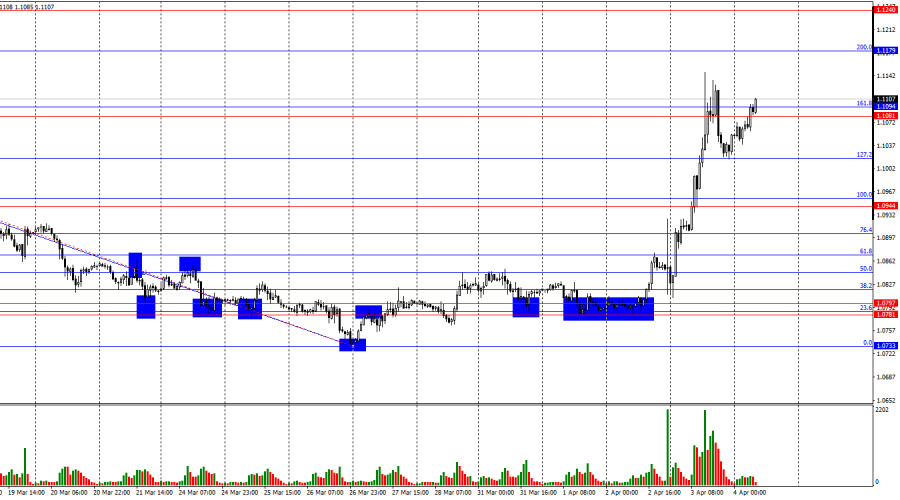

- EUR/USD: Trading Plan for the U.S. Session on April 4th (Review of Morning Trades)

Author: Miroslaw Bawulski

19:52 2025-04-04 UTC+2

1768

- Gold declines amid slight repositioning ahead of U.S. employment data

Author: Irina Yanina

11:50 2025-04-04 UTC+2

1753

- All Three Indexes Fall After Trump Tariff Announcement Apple Leads Big Tech Losers Retail Stocks Fall on Asian Tariff Worries Wall Street Fear Gauge Hits 3-Week High

Author: Thomas Frank

12:09 2025-04-04 UTC+2

1738

- The once foolproof S&P 500 'buy the dip' strategy no longer works in today's new reality

Author: Marek Petkovich

11:10 2025-04-04 UTC+2

1738

- Bears have left the market

Author: Samir Klishi

10:21 2025-04-04 UTC+2

1648