Triple Bottom

was formed on 23.04 at 12:15:11 (UTC+0)

signal strength 2 of 5

The Triple Bottom pattern has formed on the chart of the USDJPY M15 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case of breakdown of 142.25/141.96.

The M5 and M15 time frames may have more false entry points.

See Also

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Double Top

was formed on 06.06 at 05:05:28 (UTC+0)

signal strength 1 of 5

Corak pembalikan Double Top telah dibentuk pada GBPJPY M5. Ciri-ciri: sempadan atas %P0.000000; sempadan bawah 195.21; sempadan bawah 194.97; lebar corak adalah 24 mata. Dagangan menjual adalah lebih baik untuk

Carta masa M5 dan M15 mungkin mempunyai lebih banyak titik kemasukan palsu.

Open chart in a new window

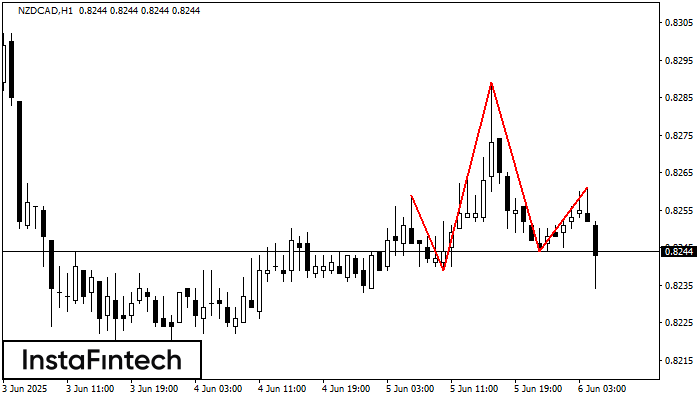

Head dan Shoulders

was formed on 06.06 at 05:01:27 (UTC+0)

signal strength 4 of 5

Corak teknikal yang dipanggil Head dan Shoulders telah muncul pada carta NZDCAD H1. Terdapat alasan yang berat untuk menunjukkan bahawa harga akan mengatasi garisan Neck 0.8239/0.8244 selepas Shoulder kanan telah

Open chart in a new window

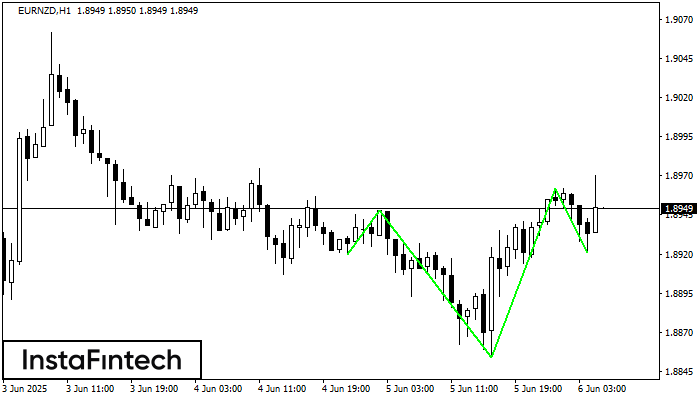

Inverse Head dan Shoulder

was formed on 06.06 at 05:00:19 (UTC+0)

signal strength 4 of 5

According to H1, EURNZD is shaping the technical pattern – the Inverse Head dan Shoulder. In case the Neckline 1.8948/1.8962 is broken out, the instrument is likely to move toward

Open chart in a new window