Bullish Symmetrical Triangle

was formed on 08.04 at 08:31:09 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDJPY formed the Bullish Symmetrical Triangle pattern. Description: This is the pattern of a trend continuation. 82.82 and 82.45 are the coordinates of the upper and lower borders respectively. The pattern width is measured on the chart at 37 pips. Outlook: If the upper border 82.82 is broken, the price is likely to continue its move by 82.80.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

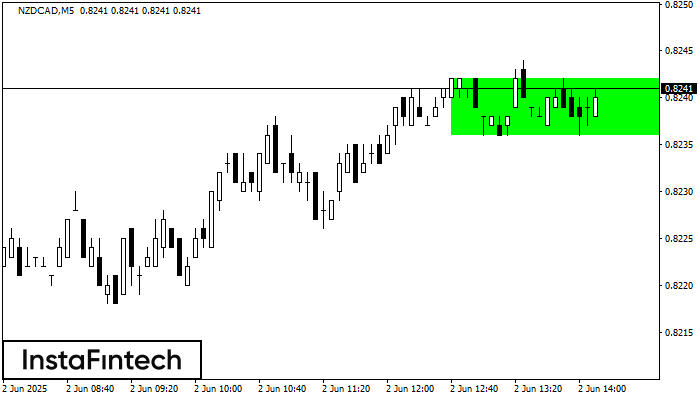

Bullish Rectangle

was formed on 02.06 at 13:16:37 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCAD formed the Bullish Rectangle. The pattern indicates a trend continuation. The upper border is 0.8242, the lower border is 0.8236. The signal means

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish Rectangle

was formed on 02.06 at 13:12:18 (UTC+0)

signal strength 1 of 5

According to the chart of M5, EURUSD formed the Bullish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 1.1437 and support 1.1412

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

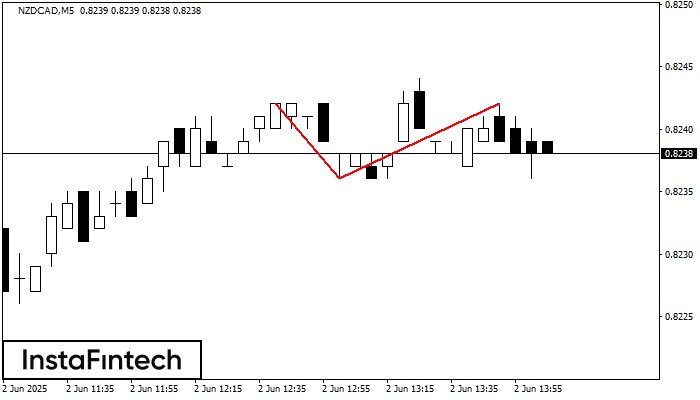

Double Top

was formed on 02.06 at 13:05:05 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on NZDCAD M5. Characteristics: the upper boundary 0.8242; the lower boundary 0.8236; the width of the pattern is 6 points. Sell trades

The M5 and M15 time frames may have more false entry points.

Open chart in a new window