See also

30.04.2025 01:09 PM

30.04.2025 01:09 PMRetail sales in Canada fell by 0.4% month-over-month in February but rebounded in March with a strong increase of 0.7%. On a year-over-year basis, retail sales declined to 4.7% in February, down from a revised 5.3% in January.

Retail sales in Canada fell by 0.4% month-over-month in February but rebounded in March with a strong increase of 0.7%. On a year-over-year basis, retail sales declined to 4.7% in February, down from a revised 5.3% in January. One of the drivers of increased spending was concern over new U.S. tariffs, which prompted consumers to stock up in advance—therefore, spending is likely to show a decline going forward.

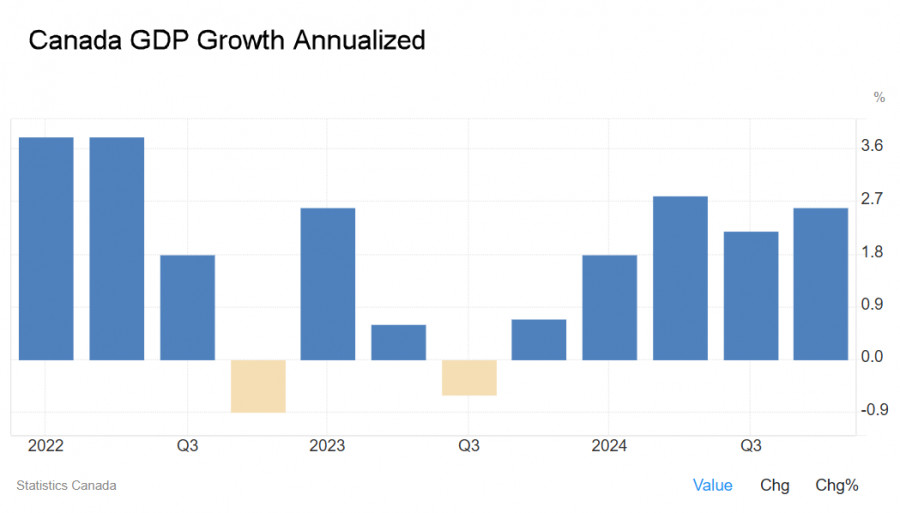

Today, GDP data for Canada covering February and March will be published, though it is unlikely to have a significant market impact. Instead, the market will be watching the release of the initial U.S. GDP estimate with much greater interest, followed by the U.S. jobs report on Friday. Canada's GDP showed steady growth throughout 2024, but the uncertainty that emerged after the onset of trade wars could erase all the gains.

Even a slight slowdown in Canadian GDP growth may turn out to be inconsequential, as the first estimate of U.S. Q1 GDP—due today—could show a much worse result. If pessimistic expectations are confirmed, a spike in volatility is inevitable and will likely lead to another wave of U.S. dollar selling.

Canada has held its federal elections, with Liberal leader Mark Carney winning by a narrow margin, as expected. Carney previously served as Governor of both the Bank of England and the Bank of Canada. He is considered a political heavyweight, and his main task is believed to be helping Canada withstand pressure from U.S. President Donald Trump. "America wants our land, our resources, our water, our country," Carney said in his victory speech. "These are not empty threats. President Trump is trying to break us so that America can own us. That will never, ever happen."

The loonie barely reacted to the election results but is expected to respond to Carney's subsequent actions. Since he won by a narrow margin, he will be forced to form a minority government, which is likely to put some pressure on the CAD. However, a large-scale sell-off of the Canadian dollar seems unlikely at this stage.

The Bank of Canada will hold its next meeting on June 4, which leaves ample time to assess both Carney's initial steps and the overall state of the economy. At its last meeting, the BoC kept the rate unchanged at 2.75%, and if incoming data proves weak, further rate cuts may follow, putting additional pressure on the Canadian dollar.

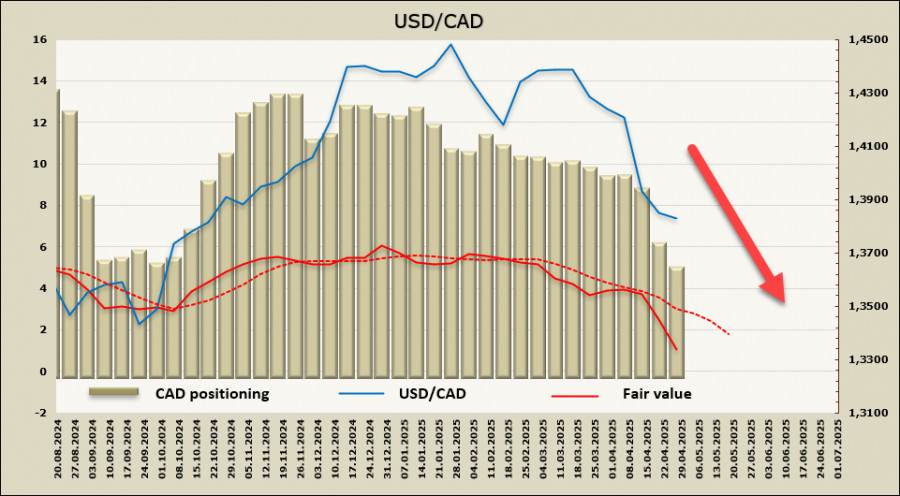

The net short position on the CAD dropped by a notable $1.15 billion over the reporting week, to –$4.86 billion. The reduction has been particularly pronounced over the past two weeks, and while speculative positioning still favors the U.S. dollar, the fair value has finally diverged from the long-term average with a clear intention to move lower.

We expect USD/CAD to move lower from current levels toward the 1.3410–1.3430 range. The pair spent the past week in consolidation, but a likely upward correction following a fairly strong decline never occurred, meaning the risk of a corrective bounce remains. The strong resistance zone at 1.4130–1.4160 is unlikely to be reached—resuming the downtrend would require a strong catalyst, which could arrive today following the release of a broad set of U.S. economic statistics.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets continue to act blindly amid the chaotic actions of Donald Trump, who is trying to pull the U.S. out of a deep, all-encompassing crisis like Baron Munchausen pulling himself

Very few macroeconomic reports are scheduled for Friday. Only two are noteworthy: the final estimate of Germany's Q1 GDP and April's UK retail sales data. The German GDP report

InstaTrade video

analytics

Daily analytical reviews

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.