See also

30.04.2025 08:31 AM

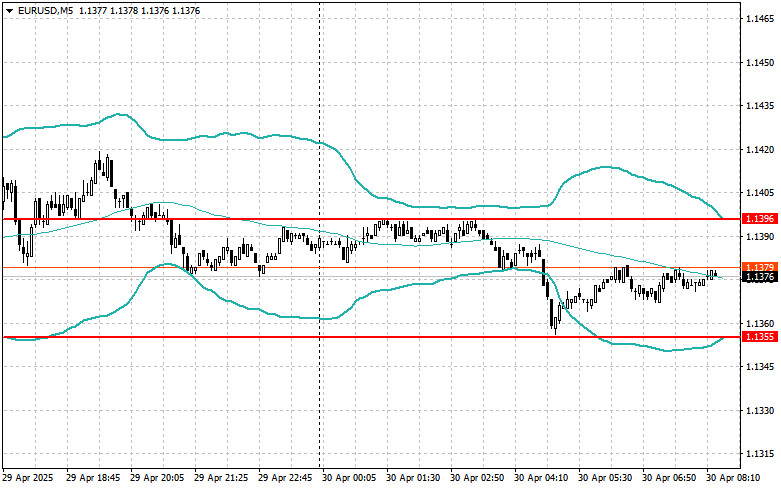

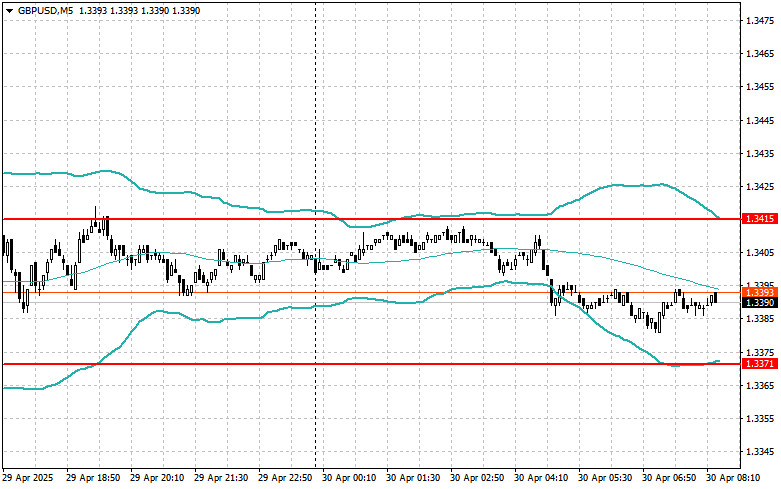

30.04.2025 08:31 AMThe rise of the euro and the pound has paused. Yesterday's weak U.S. consumer confidence data failed to seriously pressure the dollar, resulting in only a modest strengthening of the euro and the British pound. However, during today's Asian trading session, pressure on these instruments resumed.

The consumer confidence index came in significantly below economists' expectations, indicating growing concern among U.S. consumers about the state of the economy. This triggered a wave of dollar selling as traders revised their expectations regarding the Federal Reserve's future policy. The weakening of the dollar, in turn, created a favorable environment for risk assets to strengthen.

But more important are today's upcoming events. The economic calendar is packed. In the first half of the day, we expect data on the change in Eurozone GDP for Q1, as well as Germany's CPI, unemployment rate, and retail sales figures.

The Eurozone GDP data will help assess the extent of the economy's recovery after winter and provide insight into its future trajectory. Analysts are closely watching these indicators, as they are key measures of the Eurozone's economic health and directly influence European Central Bank decisions.

German data will be equally important. The German CPI will indicate inflationary pressure in the Eurozone's largest economy. The unemployment rate will reflect labor market conditions, while retail sales data will provide insight into consumer activity.

Together, these factors will paint a picture of the region's economic landscape, influencing trader sentiment and the euro's direction. No important data is expected from the UK today.

If the data aligns with economists' expectations, acting based on the Mean Reversion strategy is better. The Momentum strategy is recommended if the data significantly exceeds or falls short of expectations.

Buy on a breakout above 1.1395 could lead to a rise toward 1.1435 and 1.1490

Sell on a breakout below 1.1360 could lead to a drop toward 1.1320 and 1.1267

Buy on a breakout above 1.3410 could lead to a rise toward 1.3465 and 1.3510

Sell on a breakout below 1.3375 could lead to a drop toward 1.3333 and 1.3282

Buy on a breakout above 142.80 could lead to a rise toward 143.30 and 143.71

Sell on a breakout below 142.30 could lead to a decline toward 141.82 and 141.34

Look to sell after a failed breakout above 1.1396, on a return below this level

Look to buy after a failed breakout below 1.1355, on a return above this level

Look to sell after a failed breakout above 1.3415, on a return below this level

Look to buy after a failed breakout below 1.3371, on a return above this level

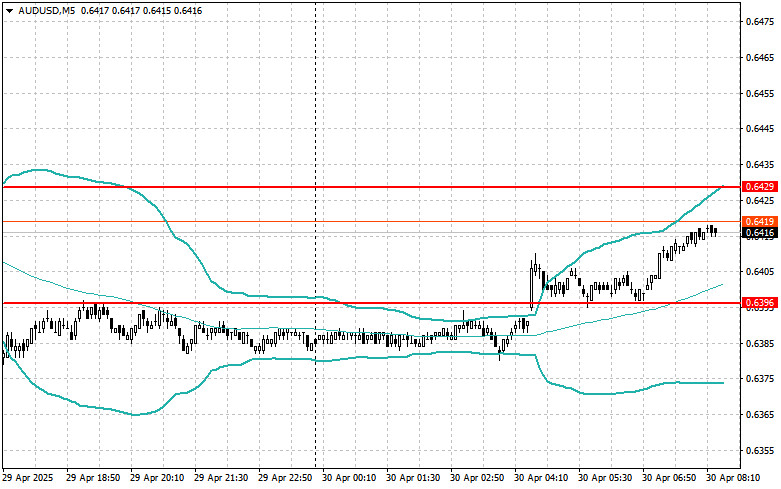

Look to sell after a failed breakout above 0.6429, on a return below this level

Look to buy after a failed breakout below 0.6396, on a return above this level

Look to sell after a failed breakout above 1.3853, on a return below this level

Look to buy after a failed breakout below 1.3813, on a return above this level

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 144.59 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upward potential. For this reason, I did not buy the dollar

The price test at 1.3461 in the second half of the day occurred when the MACD indicator had already significantly moved below the zero mark, which limited the pair's downside

The first test of the 1.1302 price level in the second half of the day occurred when the MACD indicator had already moved significantly below the zero line, which limited

The price test at 144.35 occurred when the MACD indicator began rising from the zero line, confirming a valid entry point for buying the dollar. However, considering that the pair

The price test at 1.3532 in the second half of the day occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside

The price test at 1.1359 in the second half of the day coincided with the MACD indicator just beginning to move upward from the zero line, confirming a correct entry

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.