See also

28.04.2025 06:49 AM

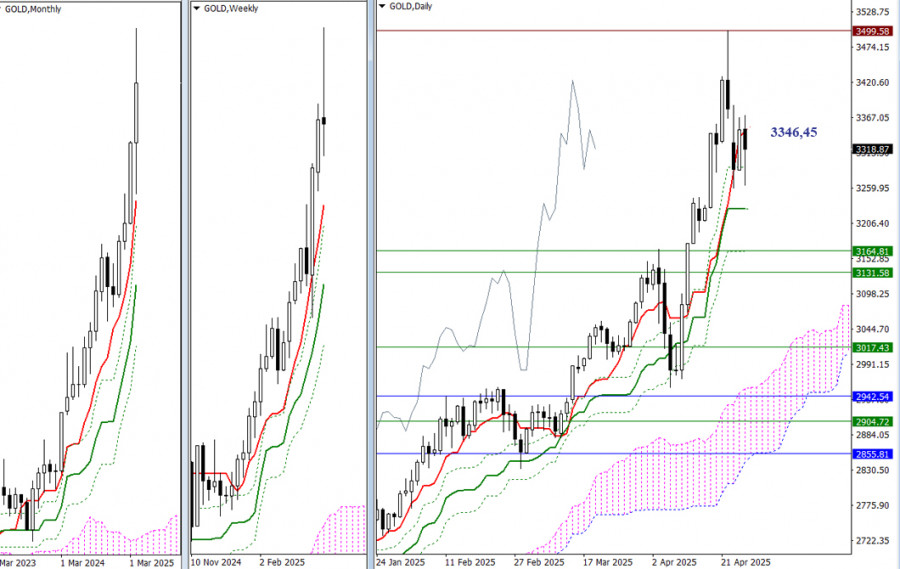

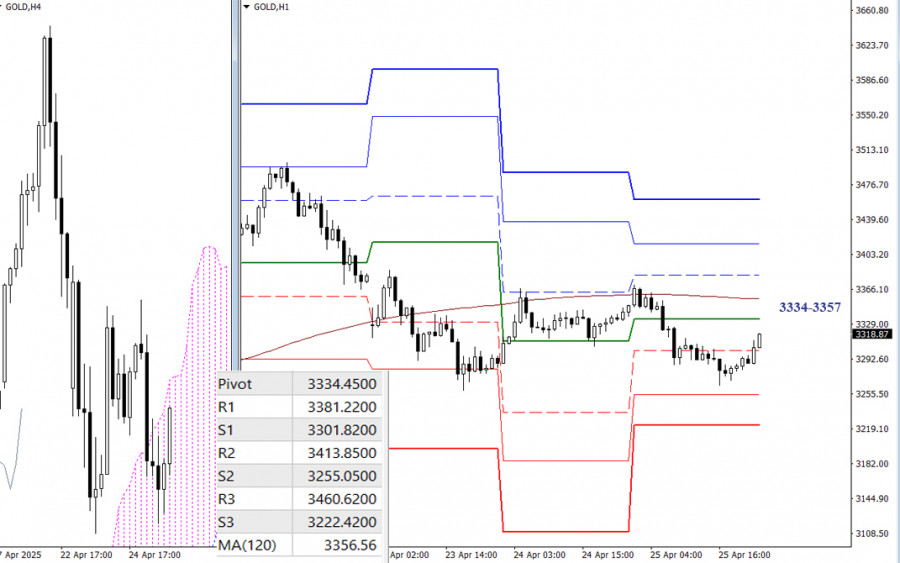

28.04.2025 06:49 AMOn the lower timeframes, the main advantage remains with the bears. The market is operating below the key levels, currently at 3334.45 (the daily central Pivot level) and 3356.56 (the weekly long-term trend). Consolidation above the trend line and its reversal could shift the current balance of forces in favor of further bullish recovery. Resistance levels will be important for the bulls if the market starts developing directed movements, and support levels will be important for the bears according to the classic pivot points. Pivot levels are updated daily, and new actual data will appear at the opening of trading.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin is trading around 109,369, bouncing back after reaching the key level of 107,500, which represents strong support for Bitcoin. If it consolidates above 108,700 (21SMA) in the coming hours

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.