See also

28.04.2025 03:51 AM

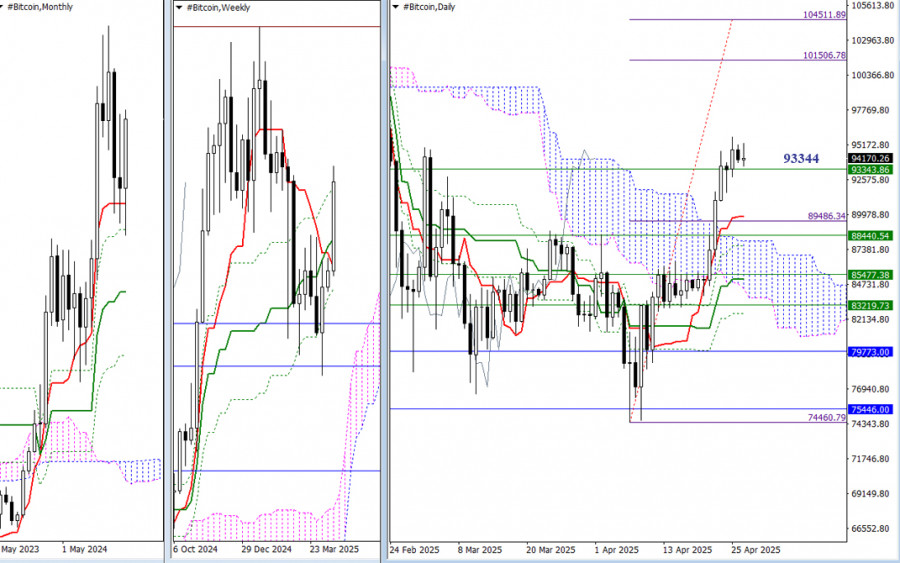

28.04.2025 03:51 AMCurrently, bullish players are attempting to change the situation and achieve bullish optimism for April. Last week, resistance at the final level of the weekly Ichimoku cross (93344) was tested, and on the daily timeframe, the price managed to consolidate above this level, closing the week higher. The elimination of the weekly "dead cross" will open up new prospects, which in the current situation can be noted at the levels of 101507–104512 (daily target for a cloud breakout) and 109986 (the last historical all-time high).

Failure by the bulls and a rebound from the encountered resistance (93344) will return the market to the zone of attraction and influence of the weekly and daily Ichimoku crosses, as well as the daily cloud. All these levels are currently concentrated around 89827–88441–85477–83220. This support zone is further reinforced by monthly levels 79774 (monthly short-term trend) and 75446 (monthly Fibonacci Kijun).

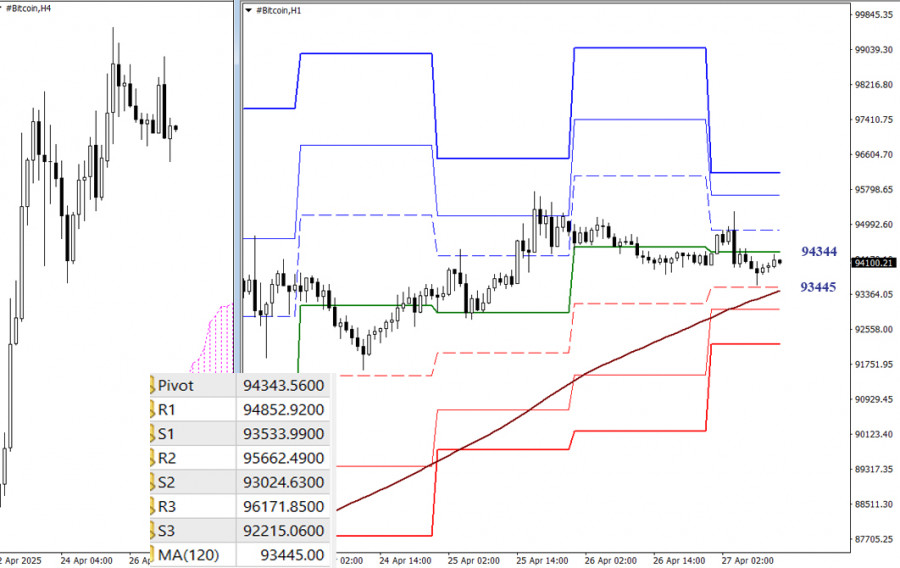

On the lower timeframes, the advantage still belongs to bullish players, but they are currently within a downward corrective zone and close to testing the weekly long-term trend (93445). A breakout and reversal of the trend could change the current balance of power. Classic Pivot levels provide additional intraday reference points. Bullish players will focus on resistances, while bearish players will monitor the classic Pivot supports.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has shown a fairly solid rebound, climbing back above the $108,000 mark and breaking through $109,000. The chart below highlights a morning breakout through the $108,100 level. Statistics confirm

Bitcoin is starting a correction, and Ethereum is showing signs of strength. Yesterday, Bitcoin dipped to around $107,000 before rebounding sharply — a sign that many traders are cautious about

The announcement that Cantor Fitzgerald, one of the largest U.S. primary dealers, is launching Bitcoin-backed lending has reshaped the crypto market. Managing $2 billion in capital for this venture

Yesterday, Bitcoin and Ethereum continued to attract demand from traders and investors, maintaining strong prospects for the continuation of the bullish market. Meanwhile, the International Monetary Fund (IMF) stated that

On the 4-hour chart of the Bitcoin cryptocurrency, there appears to be a Divergence between the Bitcoin price movement and the Stochastic Oscillator indicator, which indicates that in the near

Bitcoin reached $110,000 but failed to sustain the rally throughout the day, continuing its consolidation. Yet this lull is by no means a sign of exhaustion. Behind the scenes, activity

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.