See also

25.04.2025 07:06 AM

25.04.2025 07:06 AMThe GBP/USD pair continued to trade upward on Thursday despite the absence of any objective reasons for such movement. There were no significant events or news in the UK, Donald Trump made no statements regarding the trade war, and U.S. macroeconomic data supported the dollar. The pair began to decline slightly during the night, but any downward movement should be approached cautiously. We do not see any fundamental reasons that would allow the dollar to reverse the trend. To be more precise, many data points and factors support the U.S. currency, yet the market ignores them, entirely focused on the topic of trade wars. Therefore, we believe that the dollar has little to rely on until Trump moves toward de-escalating the global trade war. One might say the first signs of softer demands toward China have already emerged, but at the same time, China itself stated it is not engaged in any negotiations with the United States.

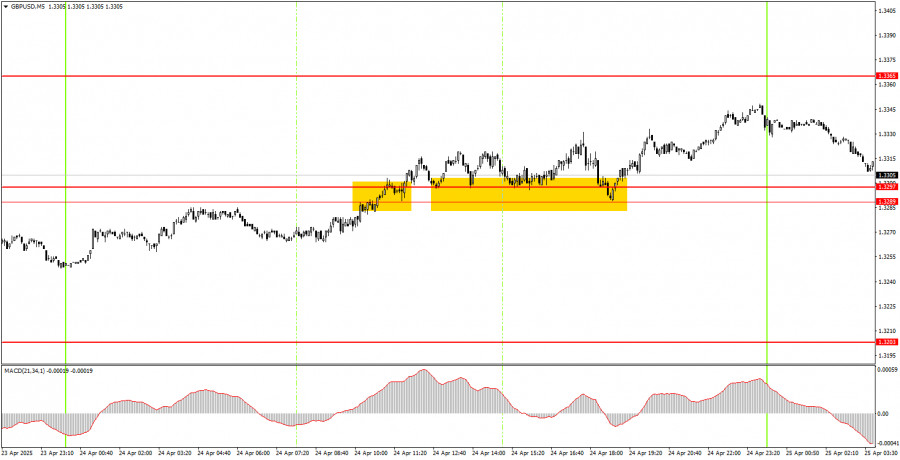

On Thursday's 5-minute timeframe, several trading signals were formed. Initially, the pair broke through the 1.3289–1.3297 zone and then bounced off it from above four times. Only by the end of the day did the price move about 30 pips upward from the buying signal zone. Thursday's movements were weak, and the British pound has generally not shown intense volatility lately.

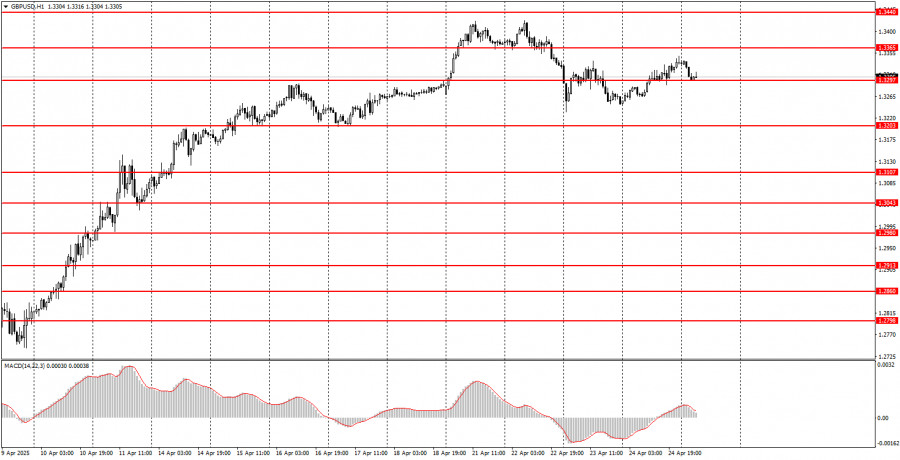

In the hourly timeframe, the GBP/USD pair could have started a downward trend long ago, but the market continues to focus solely on Trump. As a result, the pound continues to climb steadily. A single day of decline does not indicate the beginning of a bearish trend. Therefore, future movements of the pair still depend exclusively on the U.S. President and his decisions—nothing else.

On Friday, the GBP/USD pair may trade south for a while as the first signs of easing global trade tensions appear. However, a steady flow of de-escalation news is required for the dollar to grow significantly.

On the 5-minute timeframe, current trading levels are 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3203, 1.3289–1.3297, 1.3365, 1.3421–1.3440, 1.3488, 1.3537, 1.3580–1.3598. On Friday, the UK is scheduled to publish a retail sales report, and in the U.S., the University of Michigan Consumer Sentiment Index will be released. The market could easily ignore both of these reports.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Note for Beginner Forex Traders: Not every trade can be profitable. Developing a clear strategy and sound money management is key to long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair didn't even attempt a correction on Thursday. While the euro faced bearish pressure from weak business activity indices

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair corrected to the nearest support level on the hourly timeframe, which was at 1.1267. Multiple factors

The GBP/USD currency pair broke out of its sideways channel through the upper boundary, but it is in no hurry to continue rising. Traders appear to be gathering momentum

On Thursday, the EUR/USD currency pair traded lower, which can be considered an exception to the general trend. Nearly all macroeconomic reports during the day were unfavorable for the euro

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair maintained its upward trend on Wednesday, a movement that has developed over the past two weeks. Recall that

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair continued its upward movement calmly and steadily. The price broke through the 1.1267 level, which

The GBP/USD currency pair also resumed its upward movement on Wednesday. The rise of the British pound, which in reality still reflects the fall of the US dollar, began overnight

The EUR/USD currency pair resumed its upward movement on Wednesday, and it is now safe to say that the uptrend is present not only in the hourly timeframe but also

Analysis of Tuesday's Trades 1H Chart of GBP/USD The GBP/USD pair mainly traded sideways on Tuesday, but early Wednesday morning it surged upward. On the 4-hour timeframe, it's clear that

Analysis of Tuesday's Trades 1H Chart of EUR/USD On Tuesday, the EUR/USD currency pair traded sideways, but it resumed its upward movement early Wednesday morning. This indicates that the ongoing

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.