See also

25.04.2025 07:57 AM

25.04.2025 07:57 AMThe GBP/USD currency pair traded higher on Thursday, remaining near its 3-year highs. Despite the British pound's strong rally in recent months, corrections are still rare in the forex market. We still can't fully explain the sharp rise of the U.S. dollar between April 3–7. However, since April 7, the dollar has declined—who can say it's unjustified?

The U.S. dollar still has no cards to play against the euro and the pound. And it's not like the euro or the pound have any aces—it's more that the dollar holds a hand of twos. If this were poker, we could say that the euro and the pound are playing sixes and sevens, and they're still soundly beating the dollar's twos and threes. Trump tried to bluff his way through the game, but it's not going well so far. Major trade partners aren't rushing to the White House to beg Trump for deals, so now he's being forced to soften his rhetoric.

Meanwhile, the market closely watches the Federal Reserve's next moves in 2025. At the start of the year, the consensus was for two rate cuts. But that was before Trump's tariff policies came into play. Now, expert forecasts range from maximum rate cuts to possible policy tightening. The problem is that no one can say whether the Fed will try to save the economy or keep fighting inflation. If it's the former, we'll see rate cuts; if it's the latter, rates will at least remain unchanged.

The Fed has already begun expressing concern that Trump's tariffs may significantly impact the economy more than expected. Some FOMC members noted that tariff levels have exceeded earlier projections, meaning the economic slowdown and inflation could worsen. The Fed maintains that they need to better understand the full impact of the tariffs before making any decisions regarding monetary policy adjustments. Therefore, we're holding our view: there will be no rate cuts in the near term.

However, for the dollar, this is neither here nor there. The Fed hasn't eased policy even once in 2025, but the dollar has collapsed for two months. Why? Because the market is reacting solely to Donald Trump and his decisions. As a result, whatever the Fed, the European Central Bank, or the Bank of England do, it doesn't matter. The ECB cut rates for the seventh time in a row at its last meeting, yet the euro continues to appreciate against the dollar.

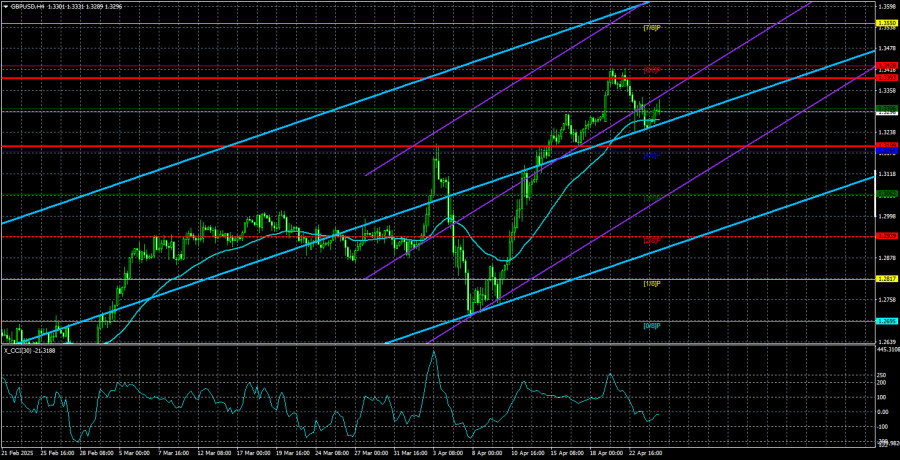

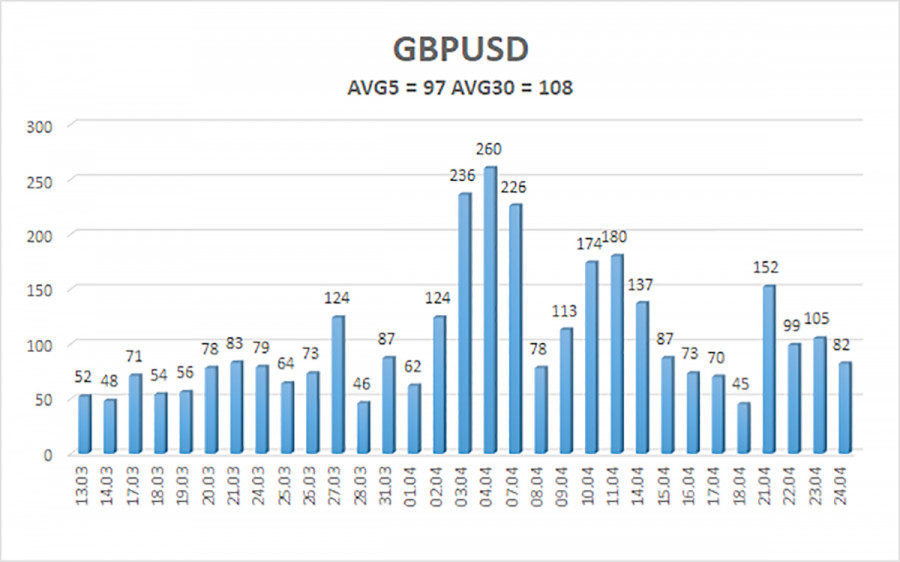

The average volatility of GBP/USD over the last 5 trading days is 97 pips, which is considered "average" for the pair. Therefore, on Friday, April 25, we expect movement within a range of 1.3199 to 1.3393. The long-term regression channel is pointing upward, indicating a clear uptrend. The CCI indicator has once again entered overbought territory, but in a strong bullish trend, this generally signals only short-term corrections.

S1: 1.3184

S2: 1.3062

S3: 1.2939

R1: 1.3306

R2: 1.3428

R3: 1.3550

The GBP/USD pair continues its steady uptrend. We still believe that this upward movement is a correction on the daily timeframe, which has taken on an illogical character. However, if you are trading based purely on technicals or reacting to Trump's actions, long positions remain valid with targets at 1.3393 and 1.3428, as the price is above the moving average. Short orders remain attractive, but the market isn't even considering buying the U.S. dollar right now, especially as Donald Trump regularly triggers fresh selloffs.

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Buyers of EUR/USD started the trading week vigorously, testing the resistance level at 1.1450 (the upper line of the Bollinger Bands indicator on the daily chart) and updating a six-week

Although the market has largely stopped reacting to incoming economic data—especially from the U.S.—and is more focused on the geopolitical and economic moves of Donald Trump, who is steering

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.