See also

25.04.2025 12:59 AM

25.04.2025 12:59 AMLast week, the Bank of Canada kept its interest rate unchanged at 2.75%, as expected. The accompanying statement was neutral in tone, emphasizing ongoing uncertainty. Confidence is hard to maintain when U.S. President Donald Trump once again made disparaging comments about Canada. He suggested that auto tariffs might be increased, supported by the bizarre claim that the U.S. subsidizes Canada by 200 billion dollars a year.

Nevertheless, the markets reacted little to the statement, and the Canadian dollar has remained steady despite expectations. There is still a chance that the Bank of Canada will be forced to cut the rate at its next meeting in June, but forecasts will inevitably be revised after the April 28 elections. The frontrunner is former Bank of England Governor Mark Carney, appointed by the monarch to stand up to Trump—so a serious showdown over tariffs and broader trade relations appears likely, and the outcome is far from certain.

Last week, Carney published his "Plan to Defend Against Trump" and called it his campaign platform. At the top of the agenda is raising defense spending to 2% of GDP, including to counter China and Russia in the Arctic. The economic portion of the plan remains vague, suggesting it's still being negotiated. Accordingly, everything is subject to change—and could change quickly—making forecasts for the CAD's future trajectory unstable.

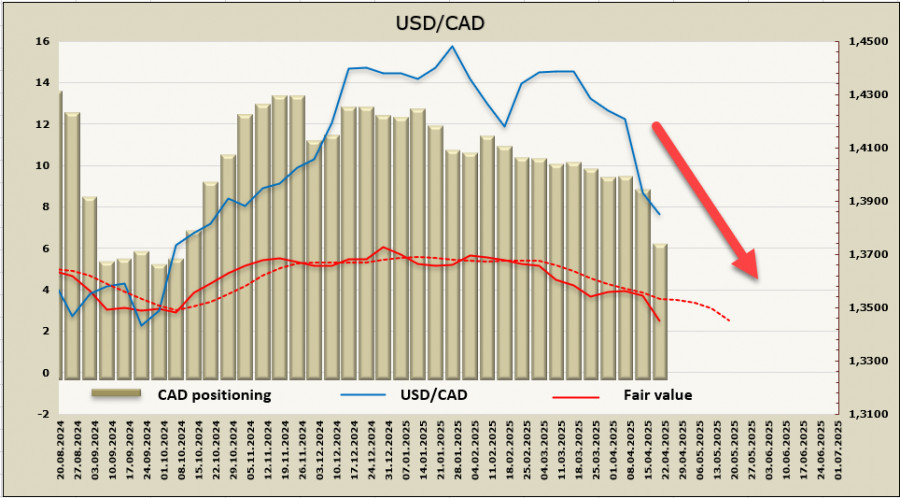

The speculative short position on the CAD dropped significantly—by 2.35 billion to -6.0 billion—allowing the estimated fair value to dip below its long-term average.

The Loonie is consolidating just above the support zone at 1.3680/3700. Last week, we suggested that trading would enter a sideways range after forming a base. However, recent trends have increased the likelihood of further declines. We expect an attempt to break below this support zone toward the 1.3410/30 area, which would have seemed far-fetched recently, especially considering Canada was the first country targeted by the U.S.'s new trade policy. Yet, market reaction suggests that investors see a strong chance that Canada will defend its position. If there's a pullback toward the nearest resistance zone at 1.4010/20, we anticipate a resumption of selling.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Global markets are significantly influenced by events occurring in the United States, where both political and economic spheres continue to swing like a pendulum. Earlier this week, after the U.S

Several macroeconomic reports are set to be released on Friday, but none are deemed particularly significant. In Germany, the inflation report for May will be released, with expectations

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.