See also

24.04.2025 05:50 AM

24.04.2025 05:50 AMOn Wednesday, the GBP/USD pair closely followed the movements of the EUR/USD pair, further confirming that the current situation hinges on the US dollar. The fate of the US dollar entirely depends on Donald Trump's will. Almost all market movements are, in one way or another, triggered by statements from the US President. It may seem like we constantly talk only about Trump, but what's the point in discussing other factors that do not influence price movements?

Yesterday, April's business activity indices in the services and manufacturing sectors were published in both the UK and the US. In the UK, the indices were frankly weak, but the British pound held up quite well during the European session and showed no desire to fall. Similarly, weak US business activity data did not prevent the dollar from rising during the US session.

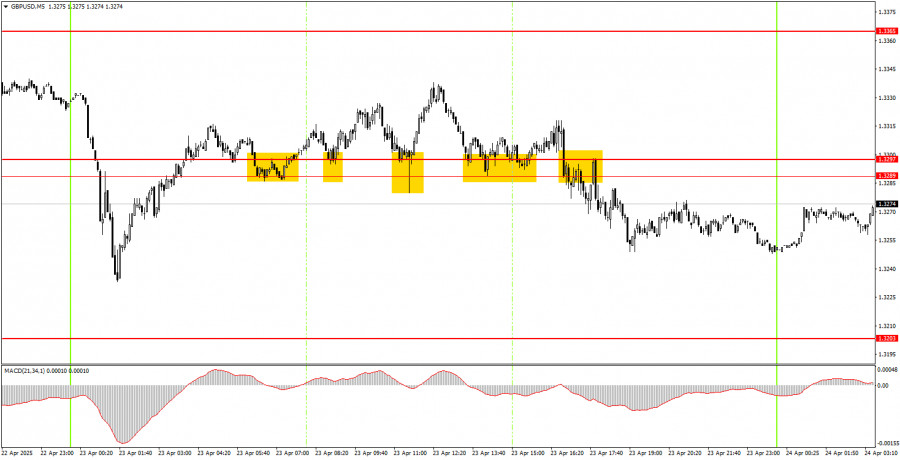

On Wednesday's 5-minute timeframe, several more or less accurate trading signals were formed, but profiting from them was extremely difficult as the price kept changing direction. As we previously warned, confusion and chaos persist in the market. The price rebounded four times from the 1.3289–1.3297 area but failed to resume the upward trend. After breaking through this area, we also didn't see a significant decline in the British pound, although this could continue today.

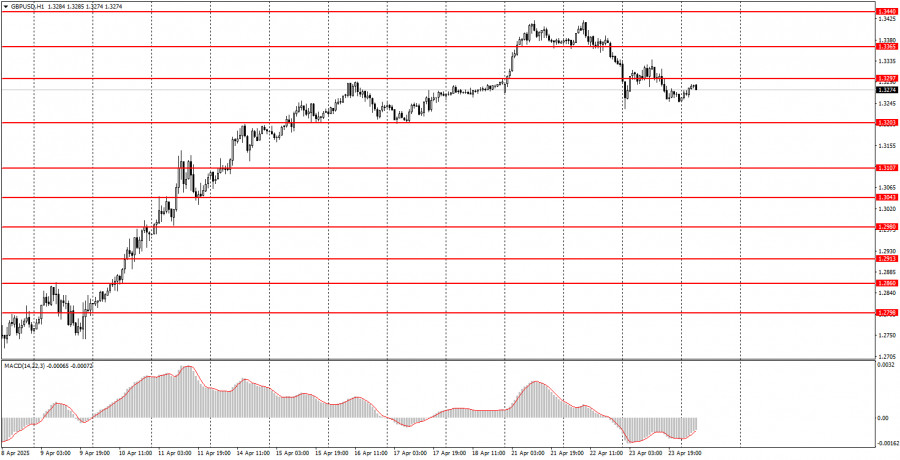

On the hourly timeframe, the GBP/USD pair could have started a downward trend long ago, but the market continues to focus solely on Trump, so the pound keeps creeping upward. One day of decline is not a sign of a new downtrend. Therefore, the future movements of the pair depend solely on the US president and his decisions and nothing else.

On Thursday, the GBP/USD pair may trade to the downside for a while as the first signs of easing tension in the global trade war have started to appear. However, for the dollar to show significant growth, there needs to be a continuous stream of news pointing to de-escalating the trade conflict.

Trading is currently possible using the 5-minute timeframe levels: 1.2848–1.2860, 1.2913, 1.2980–1.2993, 1.3043, 1.3102–1.3107, 1.3145–1.3167, 1.3203, 1.3289–1.3297, 1.3365, 1.3421–1.3440, 1.3488, 1.3537, 1.3580–1.3598. No major reports are scheduled in the UK on Thursday, while several interesting reports will be released in the US, which the market may ignore. Trump did not make any high-profile statements overnight, so the market may move more calmly for a while.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Friday Trade Review: 1H Chart of GBP/USD On Friday, the GBP/USD pair also showed a relatively strong upward movement, which was driven mainly by very weak US unemployment and labor

Friday Trade Review: 1H Chart of EUR/USD On Friday, the EUR/USD currency pair showed a strong upward move, which fully reflected the macroeconomic background. It was impossible to predict

On Friday, the EUR/USD currency pair showed strong growth for understandable reasons. The NonFarm Payrolls report disappointed for the fourth time in a row, and the US unemployment rate rose

Thursday Trade Review: 1H Chart of GBP/USD The GBP/USD pair traded in absolute flat conditions on Thursday. The day's total volatility was just 45 pips, despite the release of another

Thursday Trade Review: 1H Chart of EUR/USD The EUR/USD currency pair continued trading inside a sideways channel on Thursday. Nothing is helping so far—not fundamental events, nor macroeconomic data releases

The GBP/USD currency pair also traded very weakly on Thursday. After the British currency recovered on Wednesday, bulls were unable to break through the Ichimoku indicator lines, leading

Throughout Thursday, the EUR/USD currency pair was essentially in convulsions all day. Despite the publication of lots of important reports this week, the market is simply refusing to trade

Wednesday Trade Review: 1H Chart of GBP/USD On Wednesday, the GBP/USD pair traded higher. Recall that on Tuesday, British currency quotes plummeted sharply—a move many experts explained by the rise

Wednesday Trade Review: 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair recovered from Tuesday's decline, just as we had warned. There were no strong reasons for the euro's

On Wednesday, the EUR/USD currency pair easily and simply reversed upward around the 1.1604–1.1615 area, which can be considered the approximate lower boundary of the sideways channel the pair

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.