See also

24.04.2025 12:59 AM

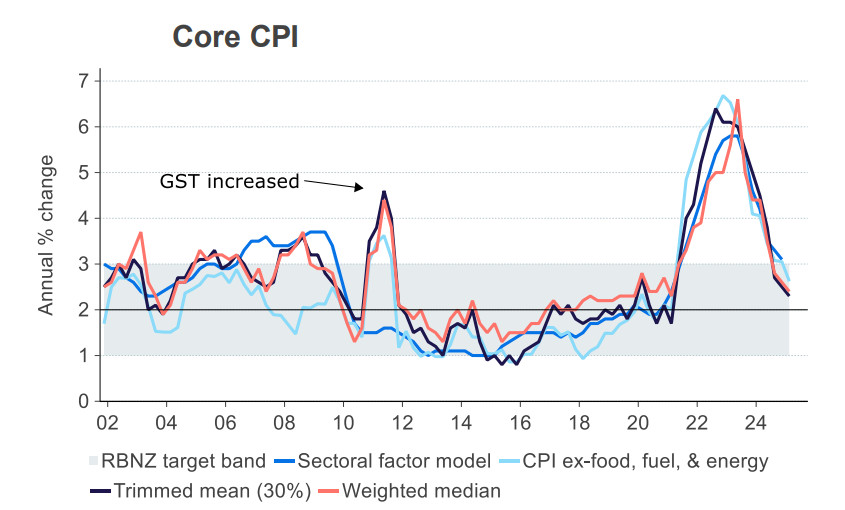

24.04.2025 12:59 AMInflation in New Zealand in Q1 came in slightly above expectations, rising from 2.2% to 2.5% year-over-year. This was mainly due to the goods sector, while core inflation is slowing in line with forecasts. Meanwhile, the factors driving the overall disinflationary process remain stable.

Economic indicators are not particularly encouraging either. Activity in the services sector remains below the expansion threshold, and optimism in the manufacturing sector has weakened. Spending on durable goods has declined for the third consecutive month, and consumer activity remains subdued, contributing to further inflation slowdown.

The combination of decelerating inflation, weak economic growth, and external uncertainty suggests that the Reserve Bank of New Zealand may lean toward cutting interest rates more quickly than expected. Notably, ANZ Bank now forecasts two additional rate cuts compared to earlier projections, with a minimum rate expectation of 2.5% instead of 3.0%. This is a more dovish outlook than before, and if ANZ is correct, the Kiwi is unlikely to develop sustained growth against the U.S. dollar and may complete its correction at some level before turning downward again.

That is unless the U.S. falls into a deep recession and the dollar loses some of its advantages as the world's primary reserve currency. So far, the Trump administration's actions lead in that direction—though the intended outcome was likely quite different.

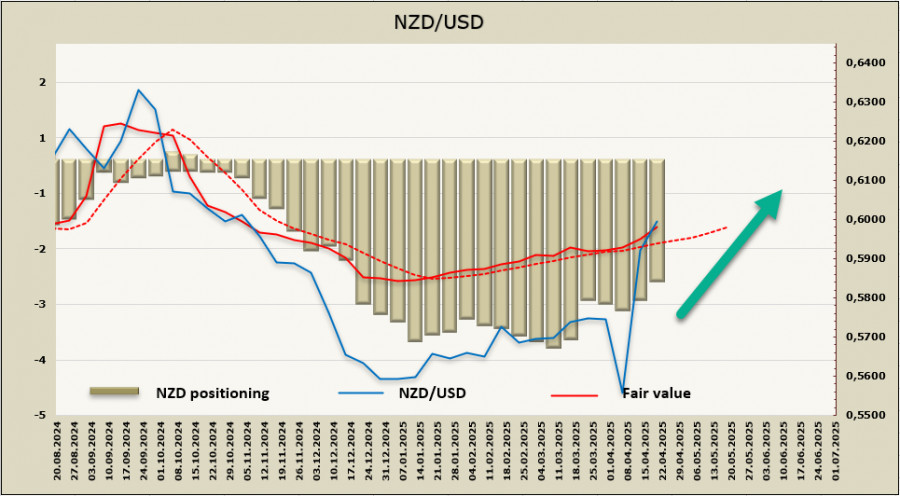

The net short position on the NZD has decreased again, this time by $215 million to -$1.95 billion. Speculative positioning remains bearish, but the fair value remains above the long-term average with no signs of a reversal.

Fair value showed a trend shift in mid-January and continues to confirm it. The sharp drop on April 4 had no fundamental basis and was a reaction to a political event. Fundamentally, the Kiwi remains a favorite in the NZD/USD pair.

NZD/USD has reached strong resistance at 0.6030. From here, there may either be an attempt to move higher on the current momentum or a brief consolidation and correction followed by another upward push. The likelihood of a decline is considered low. A break and hold above 0.6030 seems more realistic, but for sustained growth to continue, there is still little foundation, especially given the high level of uncertainty and the commodity-linked nature of the New Zealand dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Global markets are significantly influenced by events occurring in the United States, where both political and economic spheres continue to swing like a pendulum. Earlier this week, after the U.S

Several macroeconomic reports are set to be released on Friday, but none are deemed particularly significant. In Germany, the inflation report for May will be released, with expectations

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.