See also

22.04.2025 11:26 AM

22.04.2025 11:26 AMThe US stock market closed lower in the most recent regular session. The S&P 500 fell by 2.36%, while the Nasdaq 100 lost 2.45%. The Dow Jones Industrial Average dropped by 2.38%.

The dollar weakened for a fourth straight day as stalled tariff negotiations and growing concerns about US economic growth prompted investors to reassess their expectations. Futures on equity indices saw a modest rebound today, while the US dollar index extended losses, hitting a 15-month low. The yen climbed above 140 per dollar for the first time since September, and gold surged to another record high amid safe-haven demand. Asian indices remained almost unchanged, while futures on European equities opened higher.

Investors are growing weary of the endless headlines surrounding trade talks after President Donald Trump escalated the trade war this month by imposing the highest tariffs in a century. Concerns that Trump might seek to remove Federal Reserve Chairman Jerome Powell have only added to market anxiety. Trump's rhetoric has forced a reassessment of the traditional pillars of US financial dominance. The dollar and Treasury bonds, long seen as safe havens in times of market stress, are becoming less attractive.

Traders are also weighing Trump's warning that the US economy could slow unless the Fed acts immediately to cut interest rates, a move the central bank has so far resisted.

Meanwhile, China has allowed the yuan to weaken against nearly all major currencies to support its economy as trade tensions with the US escalate. Chinese authorities have urged other countries not to bow to Trump's pressure or sign unfavorable trade deals. In a sign of efforts to defuse the US-China conflict, a high-level Japanese delegation is set to deliver a letter from Prime Minister Shigeru Ishiba to Chinese leader Xi Jinping this week. Earlier, Beijing warned countries against making deals with Washington that could harm Chinese interests.

Japanese Finance Minister Katsunobu Kato said his government is in contact with other countries to discuss how best to convey widespread concerns about the impact of tariffs during meetings in Washington this week. As Prime Minister Ishiba stated yesterday, Japan will not simply continue to give in to US demands for a tariff agreement, countering President Trump's claims that a deal with Japan is nearly finalized.

With equity indices falling, optimism appears to be waning as markets may be starting to price in a less favorable outcome in the ongoing tariff negotiations.

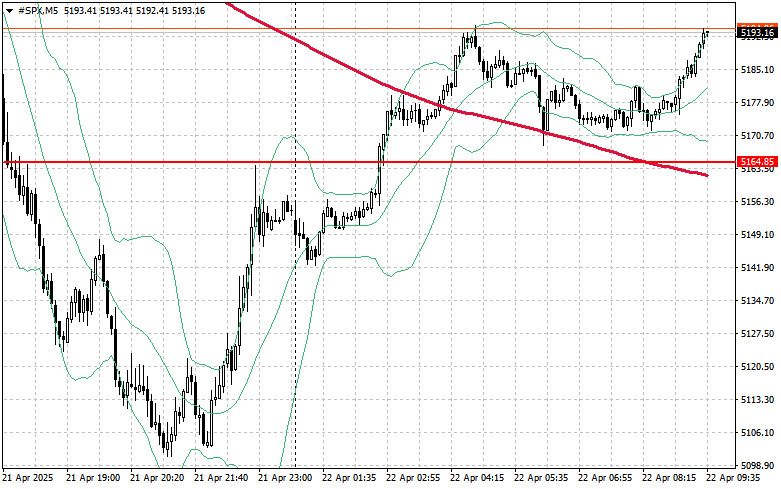

As for the technical analysis of the S&P 500 index, the primary task for buyers today will be to break through the immediate resistance level of $5,226. A move above this mark would confirm bullish momentum and open the door for a push towards the next target at $5,269. Maintaining control above $5,305 is equally important for bulls as it would reinforce their positioning. If risk appetite wanes and triggers a downward move, buyers will have to defend the $5,164 area. A break below this level could quickly send the benchmark back to $5,084 and potentially down to $5,004.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.