See also

22.04.2025 09:00 AM

22.04.2025 09:00 AMOn Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic to another.

Donald Trump once again intensified his criticism of Federal Reserve Chairman Jerome Powell, raising concerns about the central bank's independence and shocking investors. On his social network Truth Social, he called Powell a "lagging gentleman and a big loser," urging him to cut interest rates immediately. This unprecedented pressure for the U.S. came just days after Trump suggested he might consider removing Powell from his post. The growing pressure on the Fed triggered a plunge in U.S. equities and further weakened the dollar in the Forex market.

Markets are already under constant stress due to uncertainty over global trade, particularly with China. This added strain on the Fed appears to be seriously undermining investor confidence. Negotiations between Washington and Beijing show little progress and are increasingly marked by rising tensions.

Why is Trump pressuring the Fed, and what is he aiming to achieve?

I touched on this topic in yesterday's article and will now briefly summarize it again. Trump believes that the revival of the real U.S. economy cannot happen amid a strong dollar relative to other currencies. Since he cannot lower wages, he targets the dollar's value. A weaker dollar gives U.S. goods a competitive edge in global markets. That's one reason. The second is that lower interest rates open the door for faster economic growth, albeit at the risk of higher inflation. Trump is prioritizing economic growth—by any means necessary. Hence, there is pressure on the Fed, with the potential to replace Powell with someone more compliant.

In light of recent events, the dollar is under the most intense pressure in years. On Monday, the dollar index fell below the 98.00 mark—the lowest level since February 2022. With trust in the Fed eroding, demand for U.S. assets—dollars and Treasuries—is increasingly viewed as less reliable and less of a safe haven due to mounting uncertainty over the Trump administration's policies.

The yield on 10-year Treasuries at the time of writing stood at 4.429%. While not at the local high of 4.800% seen on January 13, 2025, it still worries market participants, forcing them to dump government bonds. Another major concern is China's high likelihood of large-scale Treasury sales amid the ongoing trade war, which could crash the U.S. government bond market and plunge U.S. finances into chaos.

What can we expect from the markets today?

It seems the previously initiated negative trend will persist. It may continue to pressure the dollar in Forex and the U.S. equity market while supporting the cryptocurrency market and gold prices locally. At the same time, a further deterioration in the situation may force Trump to "blink" and begin adjusting his geopolitical and economic stance, fearing a collapse of the national economy due to what his opponents see as excessively drastic reforms and radical policy shifts.

Forecast of the Day:

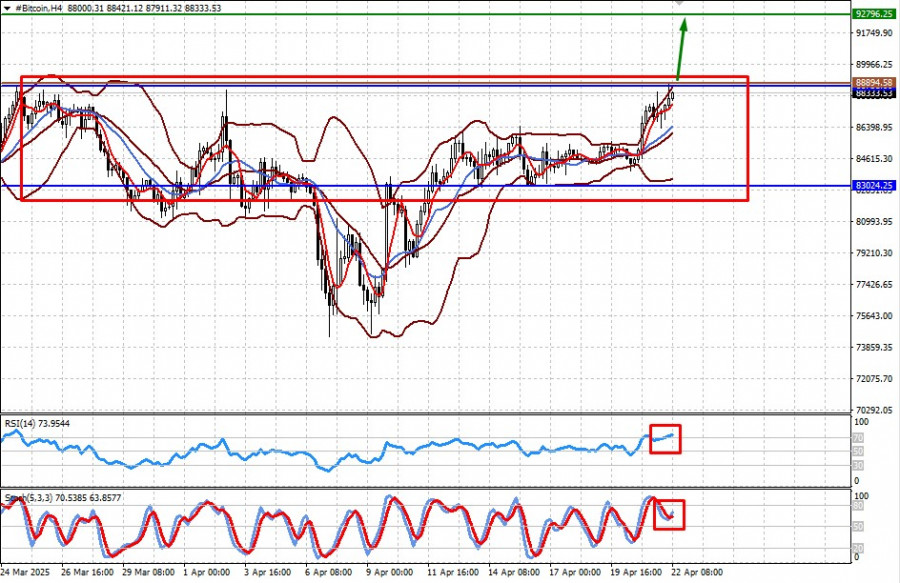

The cryptocurrency is gaining support from two factors: the significant weakening of the dollar in Forex, the avoidance of dollar-denominated assets, and the transfer of some capital into crypto. Bitcoin may continue rising to 92,796.25 if it breaks above 88,731.00, escaping the wide range of 83,024.25–88,731.00. A buying point could be the level of 88,894.58.

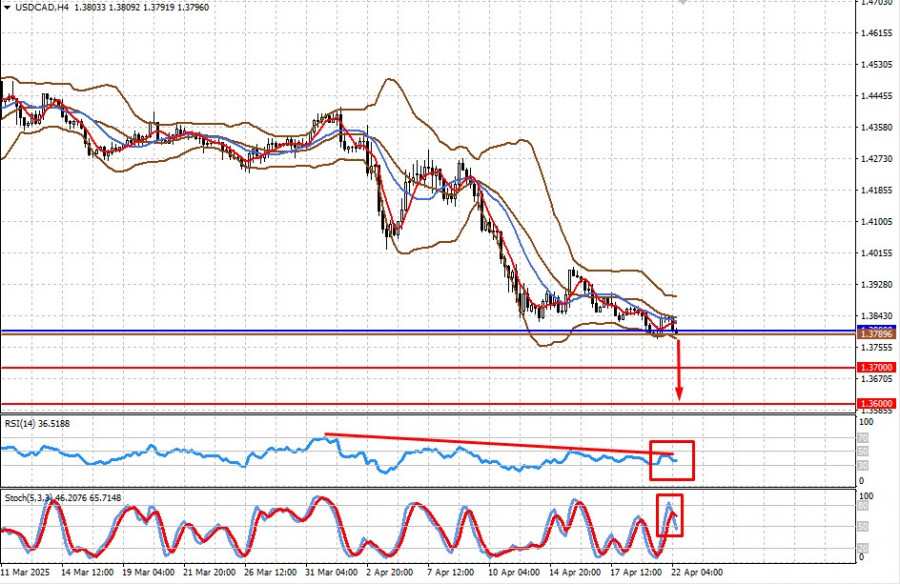

The pair is trading near the 1.3800 level amid overall dollar weakness and relative stabilization in crude oil prices. If it drops below this mark, it could continue falling toward 1.3700 and 1.3600. A suitable entry point for selling the pair could be 1.3789.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Global markets are significantly influenced by events occurring in the United States, where both political and economic spheres continue to swing like a pendulum. Earlier this week, after the U.S

Several macroeconomic reports are set to be released on Friday, but none are deemed particularly significant. In Germany, the inflation report for May will be released, with expectations

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.