See also

21.04.2025 09:03 AM

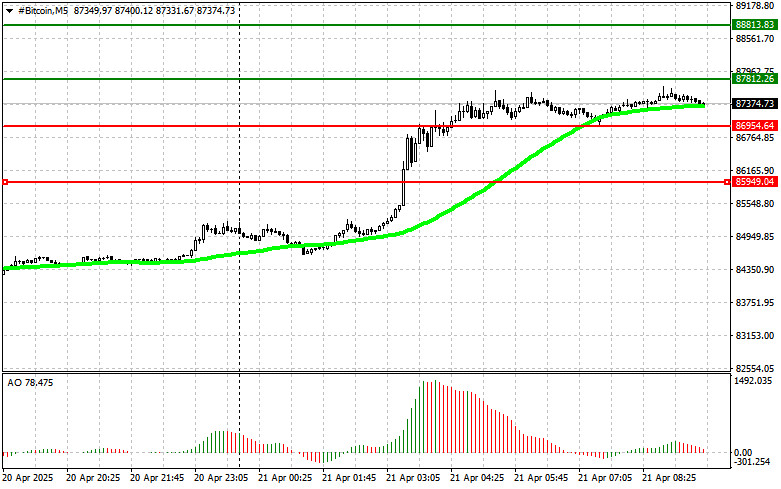

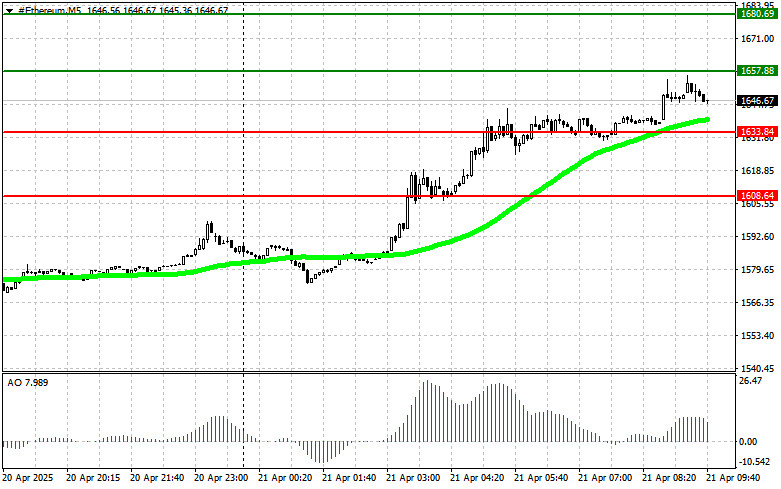

21.04.2025 09:03 AMBitcoin and Ethereum, having spent the entire weekend moving sideways within a range, surged sharply during today's Asian session.

The rally was triggered by rumors that U.S. Federal Reserve Chair Jerome Powell may be removed from office—an event that would further intensify the turmoil currently shaking the U.S. economy. This sparked a strong sell-off in the dollar, further undermining investor confidence in the greenback. And if even the U.S. dollar is falling, why not consider Bitcoin—often referred to as digital gold—as an alternative safe-haven asset?

According to recent data, active and key market participants—wallets holding between 10 and 10,000 BTC—continue to accumulate Bitcoin actively. The total BTC balance on these wallets has returned to record levels, signaling strong demand.

This trend also reflects large investors' confidence in Bitcoin's long-term potential. They view the current volatility as an opportunity to expand their positions rather than a signal to sell.

Accumulation of BTC by major players is traditionally considered a bullish signal, as it reduces the available supply on the market and creates upward price potential. Moreover, interest in Bitcoin isn't limited to retail investors—institutions are also getting involved. Many companies and funds add BTC to their investment portfolios to diversify and hedge against inflation. This signals the growing recognition of Bitcoin as a legitimate asset class.

As for the intraday strategy, I will focus on buying into major dips in Bitcoin and Ethereum in anticipation of continuing the medium-term bull market, which is still in play.

For short-term trading, the following scenarios apply:

Scenario #1: I will buy Bitcoin today if it reaches the entry point around $87,800, targeting a rise to $88,800. I will exit long positions at $88,800 and immediately sell on a pullback. Before buying a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buying is also possible from the lower boundary at $86,900 if there is no market reaction to a breakout below, with a rebound expected back toward $87,800 and $88,800.

Scenario #1: I will sell Bitcoin today if it reaches the entry point around $86,900, targeting a decline to $85,900. I will exit short positions at $85,900 and immediately buy on a pullback. Before breakout selling, ensure the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario #2: Selling is also possible from the upper boundary at $87,800 if there is no market reaction to a breakout above, with a move expected down to $86,900 and $85,900.

Scenario #1: I will buy Ethereum today if it reaches the entry point around $1657, targeting a rise to $1680. I will exit long positions at $1680 and sell immediately on a pullback. Before buying a breakout, ensure that the 50-day moving average is below the current price and that the Awesome Oscillator is above zero.

Scenario #2: Buying is also possible from the lower boundary at $1633 if there is no market reaction to a breakout below, with a rebound expected back toward $1657 and $1680.

Scenario #1: I will sell Ethereum today if it reaches the entry point around $1633, targeting a decline to $1606. I will exit short positions at $1606 and buy immediately on a pullback. Before breakout selling, ensure the 50-day moving average is above the current price, and the Awesome Oscillator is below zero.

Scenario #2: Selling is also possible from the upper boundary at $1657 if there is no market reaction to a breakout above, with a move expected down to $1633 and $1606.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin and Ethereum continued their corrections, falling significantly throughout yesterday. The decline extended into today's Asian session, with Bitcoin updating its price to $104,500 and Ethereum testing $2,560. Thus

Bitcoin has shown a fairly solid rebound, climbing back above the $108,000 mark and breaking through $109,000. The chart below highlights a morning breakout through the $108,100 level. Statistics confirm

Bitcoin is starting a correction, and Ethereum is showing signs of strength. Yesterday, Bitcoin dipped to around $107,000 before rebounding sharply — a sign that many traders are cautious about

The announcement that Cantor Fitzgerald, one of the largest U.S. primary dealers, is launching Bitcoin-backed lending has reshaped the crypto market. Managing $2 billion in capital for this venture

Yesterday, Bitcoin and Ethereum continued to attract demand from traders and investors, maintaining strong prospects for the continuation of the bullish market. Meanwhile, the International Monetary Fund (IMF) stated that

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.