See also

18.04.2025 09:00 AM

18.04.2025 09:00 AMBitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However, any new wave of selling would require strong justification, which is currently absent from the market.

Meanwhile, in a recent speech, Federal Reserve Chair Jerome Powell hinted that U.S. banking regulators may soften cryptocurrency restrictions. This is undoubtedly good news for the digital asset industry. Powell acknowledged the wave of failures and frauds over the years but also recognized the sector's growing popularity. Given the Fed's previously conservative stance, this kind of statement—regarding new recommendations and rules that banks will be expected to follow—could lay the groundwork for developing cryptocurrency legislation and attracting new investors and major players. However, Powell emphasized that any policy changes to encourage innovation must not compromise consumer protection and must support the banking system's stability.

It's worth noting that during Trump's presidency, federal agencies such as the FDIC and OCC had already started reversing previously imposed restrictions on crypto-related operations for banks. Powell also voiced support for the ongoing congressional efforts to regulate stablecoins.

I will continue to base my actions on any significant pullbacks in Bitcoin and Ethereum, anticipating the continuation of the intact medium-term bullish trend.

For short-term trading, the strategy and conditions are outlined below.

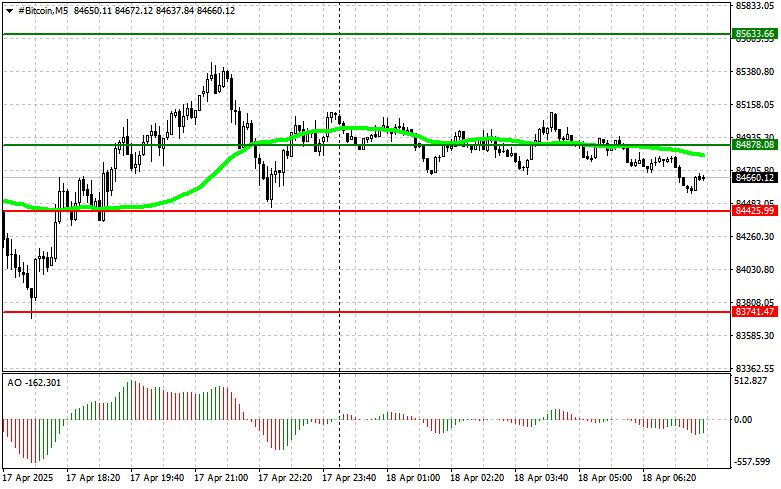

Scenario #1: I will buy Bitcoin today at the entry point near $84,900 with a target at $85,600. I will exit long positions at $85,600 and immediately sell on the pullback. Before entering a breakout trade, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: If the market does not react to a breakout, buying is also possible from the lower boundary at $84,400, aiming for $84,900 and $85,600.

Scenario #1: I will sell Bitcoin today at the entry point near $84,400 with a target at $83,700. I will exit short positions at $83,700 and immediately buy on the pullback. Before selling on a breakout, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $84,800 if there is no market reaction to a breakout. Aim for $84,400 and $83,700.

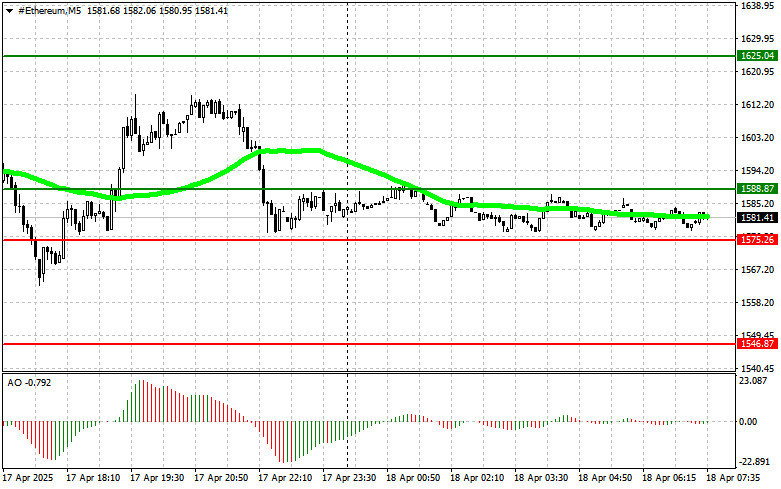

Scenario #1: I will buy Ethereum today at the entry point near $1,588, with a target at $1,625. I will exit long positions at $1,625 and immediately sell on the pullback. Before entering a breakout trade, make sure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buying is also possible from the lower boundary at $1,575, if there is no market reaction to a breakout, aiming for $1,588 and $1,625.

Scenario #1: I will sell Ethereum today at the entry point near $1,575 with a target of $1,546. I will exit short positions at $1,546 and immediately buy on the pullback. Before selling on a breakout, make sure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Selling is also possible from the upper boundary at $1,588, if there is no market reaction to a breakout, aiming for $1,575 and $1,546.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has shown a fairly solid rebound, climbing back above the $108,000 mark and breaking through $109,000. The chart below highlights a morning breakout through the $108,100 level. Statistics confirm

Bitcoin is starting a correction, and Ethereum is showing signs of strength. Yesterday, Bitcoin dipped to around $107,000 before rebounding sharply — a sign that many traders are cautious about

The announcement that Cantor Fitzgerald, one of the largest U.S. primary dealers, is launching Bitcoin-backed lending has reshaped the crypto market. Managing $2 billion in capital for this venture

Yesterday, Bitcoin and Ethereum continued to attract demand from traders and investors, maintaining strong prospects for the continuation of the bullish market. Meanwhile, the International Monetary Fund (IMF) stated that

On the 4-hour chart of the Bitcoin cryptocurrency, there appears to be a Divergence between the Bitcoin price movement and the Stochastic Oscillator indicator, which indicates that in the near

Bitcoin reached $110,000 but failed to sustain the rally throughout the day, continuing its consolidation. Yet this lull is by no means a sign of exhaustion. Behind the scenes, activity

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.