See also

17.04.2025 11:02 AM

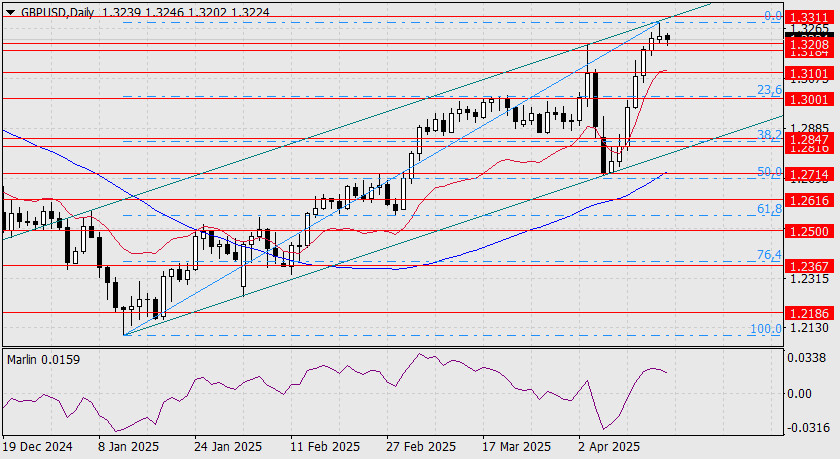

17.04.2025 11:02 AMYesterday, the UK released inflation data for March. Core CPI declined from 3.0% y/y to 2.8% y/y, and headline CPI dropped from 2.8% y/y to 2.6% y/y, below the forecast of 2.7% y/y. The attempt by the pound to rise toward the target level of 1.3311 was halted — the day ended with a gain of only 11 points, and this morning, the price is already moving into the 1.3184–1.3208 range.

However, the daily chart shows that the price has precisely tested the upper boundary of the upward price channel. This test occurred a day earlier than our projection, but the bulls have done their job, and everything is now set for a reversal.

The growth from January 13 to April 16 is perfectly described by the Fibonacci grid. The 23.6% retracement level coincides with our support at 1.3101, and the 38.2% level aligns with the target range of 1.2816/47. The Kruzenshtern line is also heading toward that zone. A break below this support could pave the way for a long-term decline in the pound.

On the four-hour chart, the price is attempting to enter the 1.3184–1.3208 support range as the Marlin oscillator reaches the boundary of the downward trend territory. A simultaneous breakout below support by both the price and the oscillator will strengthen the bearish momentum. The first target is 1.3101.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

EUR/USD is trading around 1.1287 after attempting to break the top of the downtrend channel. The instrument is now consolidating around the 21 SMA, which suggests it could continue

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

With the appearance of Divergence between the Nasdaq 100 index price movement which formed a Double Top with the Stochastic Oscillator indicator plus confirmation with its price movement which moved

As we can see on the 4-hour chart of USD/CHF main currency pair, some interesting information appears, namely first the appearance of Divergence between the price movement of USD/CHF with

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.