See also

16.04.2025 12:22 PM

16.04.2025 12:22 PMFollowing the previous regular session, US stock indices closed slightly lower. The S&P 500 slipped by 0.17%, the Nasdaq 100 edged down 0.05%, and the Dow Jones Industrial Average dropped 0.18%.

More notably, the sell-off intensified in the futures market after the close, leading to heavier losses. Tech stocks led the decline after the Trump administration imposed new export restrictions on Nvidia Corp.'s chips to China, citing national security concerns. The restrictions target high-performance GPUs used in data centers and AI systems. As a market leader in this segment, Nvidia now faces the need to revise its export strategy and identify alternative markets. The move marks another escalation in the US-China tech standoff, with experts forecasting heightened competition and further fragmentation of the global tech ecosystem.

In Europe, the Stoxx 600 index declined as ASML Holding NV fell over 7% due to weaker-than-expected orders, reflecting softness in the chip sector. The Nasdaq 100 futures dropped over 2.3%, and Nvidia slid 7% in premarket trading. The US dollar fell to a six-month low as mounting trade war fears boosted safe-haven demand. Gold hit a new all-time high, while the Swiss franc also strengthened.

Clearly, the brief consolidation in equities after last week's turbulence is breaking down as traders confront fresh headlines about tariffs announced by President Trump. On Monday, the US administration launched a new investigation and signaled potential tariffs on critical minerals. Investor reaction has been risk-off, driven by the unpredictable nature of Washington's political moves and the tit-for-tat trade measures between the world's two largest economies.

Later today, investor focus will shift to remarks from Federal Reserve Chair Jerome Powell on the economy. His speech is expected to shed light on the Fed's current stance on inflation, interest rates, and growth outlook. Given recent market volatility and persistent uncertainty in the US economy, Powell's comments could significantly sway market sentiment and direction. Traders will be attuned to any hints about shifts in monetary policy. Gradual disinflation is easing pressure on the Fed to maintain tight monetary conditions. Powell will need to strike a careful tone, reassuring markets while reinforcing the Fed's commitment to price stability. His assessment of labor market strength will also be closely watched, as a resilient job market is seen as a double-edged sword: supportive of growth but potentially inflationary.

In commodities, oil prices continued to fall amid expectations of oversupply driven by escalating trade tensions between the US and China. Meanwhile, gold rose by 2.2%, surpassing $3,300 per ounce for the first time.

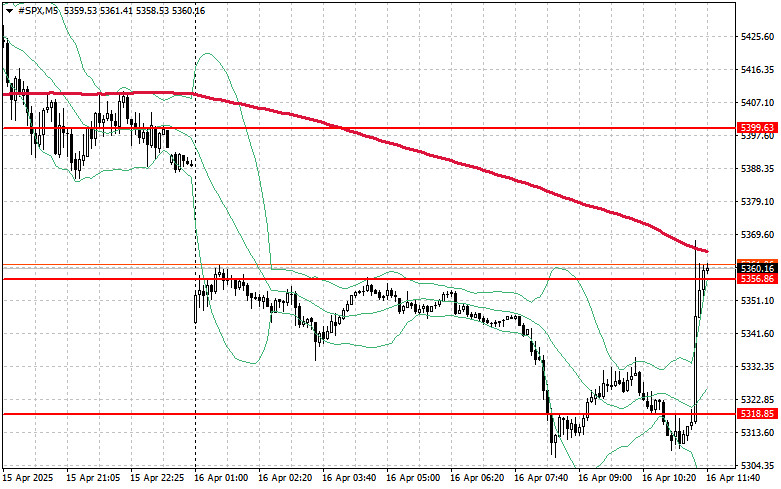

The S&P 500 index declined. Today, buyers will need to reclaim immediate resistance at $5,356 to sustain upward momentum and unlock a potential move toward $5,399. Another critical task for bulls is regaining control above $5,443, which would strengthen their position. On the downside, if risk appetite continues to fade, buyers must show up near $5,317. A break below that could send the instrument down to $5,282, opening the door to $5,226.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Buy Recommendation: Freeport-McMoRan Copper & Gold (#FCX)Freeport-McMoRan is one of the world's largest producers of non-ferrous metals. On the daily chart, the correction has been completed, with the price consolidating

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.