See also

14.04.2025 09:45 AM

14.04.2025 09:45 AMGlobal markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff duties. Market participants remain mainly unresponsive to key economic data— especially from the U.S. — remaining instead under the strong influence of the chaos generated by the American president. And yet, that data signals significant changes in the national economy.

On Friday, a report on U.S. consumer inflation showed a notable slowdown in headline and core values. If this trend continues, it could become a strong signal for the Federal Reserve to proceed with interest rate cuts this year. However, amid this wave of positivity, one key factor must be considered — the turbulence surrounding Trump's tariff decisions. He softened his stance under domestic pressure by issuing a resolution to delay massive tariff plans for most trading partners by 90 days, settling on a 10% rate.

But this isn't a solution to the problem. It still looms. And while many begin to believe that Trump may yield under immense pressure, that may not happen, considering the personality traits of the 47th president. Also worth noting is that the U.S.'s largest trading partner, China, didn't bend to Washington's will and responded symmetrically.

In this environment of persistent uncertainty surrounding the future of the trade war, investors are trying to react locally. The market responded positively to the 90-day pause and the U.S. Consumer Price Index drop on Friday. Global stock indices gained solidly, and prices rose in the commodity markets. Meanwhile, the U.S. dollar, as expected, fell below the critical psychological level of 100.00 on the ICE index — and this decline continues this morning. The cryptocurrency market has slowed its upward movement, as the key factor of global economic uncertainty remains the primary constraint.

What can be expected in the markets today?

The positive reaction in the stock markets will likely fade against the backdrop of lingering uncertainty over the consequences of the trade wars launched by Donald Trump. The cryptocurrency market is expected to consolidate within a sideways range, as will prices in the commodity markets. However, the dollar is expected to continue declining, as falling inflation now adds to the negative pressure from the tariff narrative — and if inflation continues to fall, the Fed may be prompted to cut interest rates.

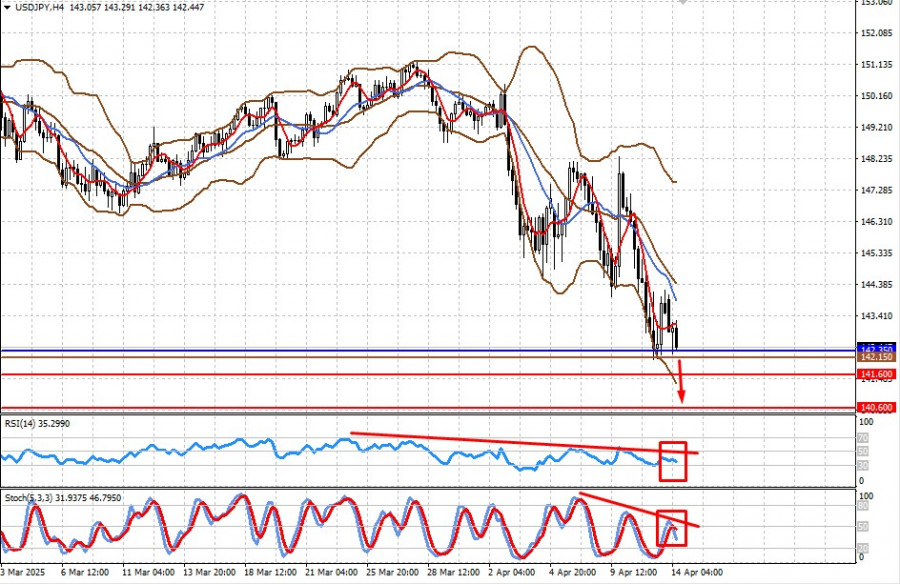

The pair remains under intense pressure amid the negativity surrounding the dollar. Most likely, after breaking below the 142.35 support level — which previously served as a target — the pair may fall first to 141.60 and then to 140.60. A potential entry point could be at 142.15.

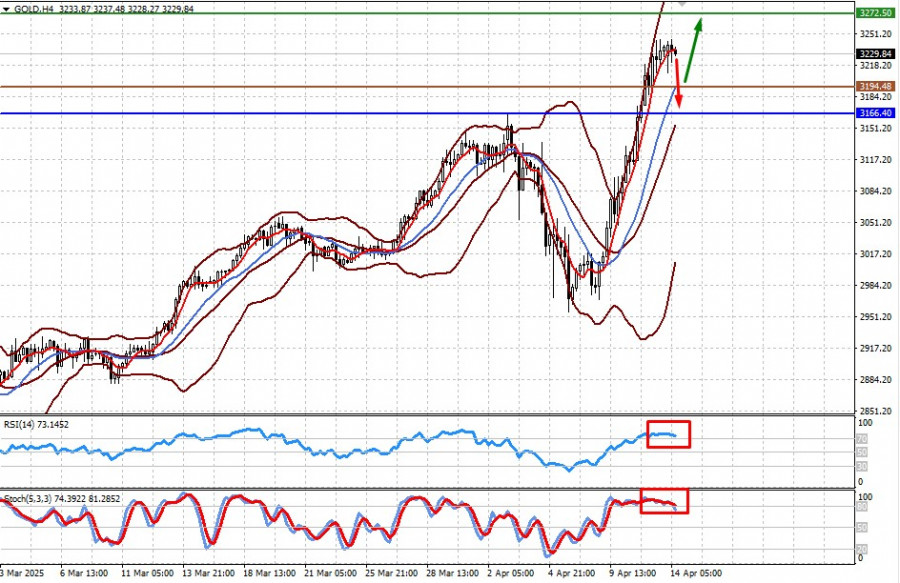

Gold prices resumed growth under the influence of uncertainty. However, a pullback toward 3166.40 is possible before the next upward movement due to local overbought conditions. The entry point could be around 3194.48, with a short-term target of 3272.50.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The beginning of actual negotiations could lead to a significant drop in gold prices in the near future. In previous articles, I suggested that the previously surging price of gold

The EUR/USD currency pair continued to trade calmly on Thursday, although volatility remained relatively high. This week, the US dollar showed some signs of recovery—something that could already be considered

A few macroeconomic events are scheduled for Friday, but this doesn't matter, as the market continues to ignore 90% of all publications. Among the more or less significant reports today

U.S. President Donald Trump once again commented on Federal Reserve Chairman Jerome Powell, openly expressing dissatisfaction with the pace of rate cuts. Another public expression of disapproval of the Fed's

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.