See also

10.04.2025 08:05 AM

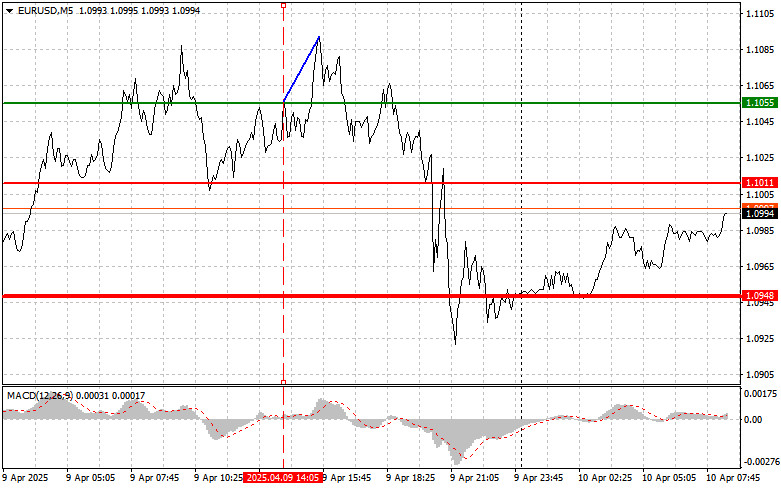

10.04.2025 08:05 AMThe price test at 1.1055 occurred just as the MACD indicator began moving upward from the zero line, confirming a valid entry point for buying the euro and resulting in a 30-pip rise in the pair.

Yesterday's decision by Donald Trump to suspend tariffs for 90 days prompted an immediate reaction: the U.S. dollar surged while the euro weakened. This step was aimed at stabilizing the economy amid growing global instability. However, if more long-term and fundamental measures aren't implemented, the effect of this pause may be short-lived. Investors wary of trade conflicts saw this as a chance to ease tensions, but this move is unlikely to have a lasting impact. A retreat by the U.S. on tariffs might be perceived more as a sign of weakness than strength, something key trade partners have long feared.

Meanwhile, analysts and investors remain closely monitoring the economic situation in the eurozone. Today's industrial production figures from Italy may show mixed dynamics. A consistent decline has yet to be replaced by significant growth, indicating that stabilization in the sector remains elusive. Conversely, the Bundesbank's monthly report could reflect more optimistic trends in the German economy. Despite ongoing issues in global supply chains, the German industry is showing signs of modest growth, supported by both domestic and foreign demand.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario #1:

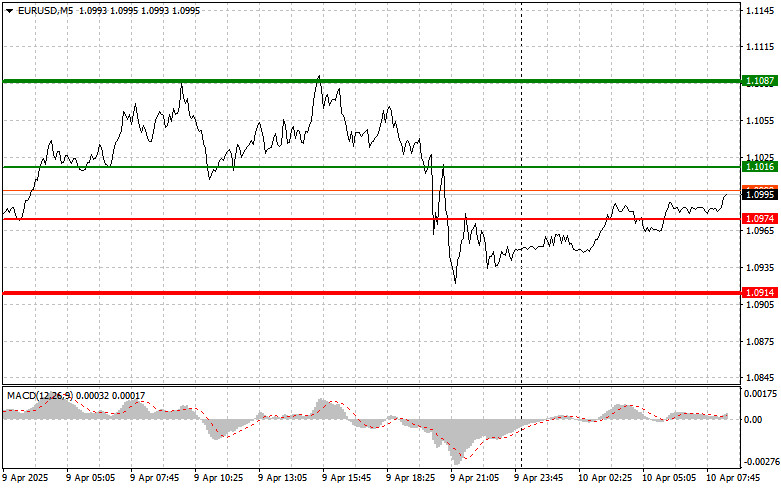

Today, I plan to buy the euro at 1.1016 (green line on the chart), targeting a rise to 1.1087. At 1.1087, I will exit the market and open short positions, expecting a pullback of 30–35 pips. A rise in the euro in the first half of the day can only be expected if economic data is strong.

Important! Before entering a long trade, ensure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2:

I also plan to buy the euro if there are two consecutive tests of the 1.0974 level while the MACD is in oversold territory. This would limit downside potential and trigger an upward reversal. A rise toward 1.1016 and 1.1087 can be expected.

Scenario #1:

I plan to sell the euro after it reaches 1.0974 (red line on the chart), targeting 1.0914, where I will exit the short and open a long position (expecting a 20–25 pip reversal from that level). Selling pressure could return quickly today.

Important! Before entering a short trade, ensure the MACD indicator is below the zero line and beginning to decline.

Scenario #2:

I also plan to sell the euro if there are two consecutive tests of the 1.1016 level while the MACD is in overbought territory. This would limit the pair's upside potential and lead to a downward reversal. A decline toward 1.0974 and 1.0914 can be expected.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Trade Analysis and Strategy Tips for the Japanese Yen The first test of the 142.66 level occurred when the MACD indicator had already dropped significantly below the zero line, which

The test of the 142.32 level occurred when the MACD indicator had already moved significantly above the zero mark, which, in my view, limited the pair's upside potential. For this

The price test at 1.1382 in the second half of the day coincided with the MACD indicator beginning a downward move from the zero line, confirming a correct entry point

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.