See also

10.04.2025 07:44 AM

10.04.2025 07:44 AMThe Euro and Pound managed to withstand renewed pressure from sellers and even slightly recovered their positions during today's Asian trading session.

Yesterday, Donald Trump announced a 90-day tariff pause, which led to a sharp strengthening of the U.S. dollar and a decline in several risk assets on the currency market. This move appears to be an attempt to stabilize the global economy and the U.S. stock market amid rising uncertainty. However, the effect of this decision may be temporary unless more long-term and structural measures follow it. The market reacted immediately, with a surge of optimism, as investors, exhausted by the ongoing trade wars, saw a glimmer of hope for de-escalation.

Nonetheless, many experts warn that 90 days is insufficient to fully restore trust or resolve the structural issues in global trade. Negotiations and comprehensive trade agreements are needed to ensure sustainable economic growth in the long term. The tariff pause is merely a first, albeit important, step in this direction.

Yesterday's FOMC meeting minutes had little impact on the markets, as traders found nothing fundamentally new in the document. Market participants already priced in expectations for continued interest rate holds and internal discussions on the future inflation outlook.

This morning, the only notable data includes Italy's industrial production figures and the Bundesbank's monthly report. These indicators typically don't move the markets significantly, but they will be watched closely in the current environment of heightened volatility and economic instability. Investors' nervousness may amplify their influence, with many looking for signs of a slowdown in the U.S. and European economies. Positive figures could temporarily support the euro, while disappointing results may weigh on it.

If the data meets economists' expectations, following the Mean Reversion strategy is best. The Momentum strategy is recommended if the data significantly exceeds or falls short of expectations.

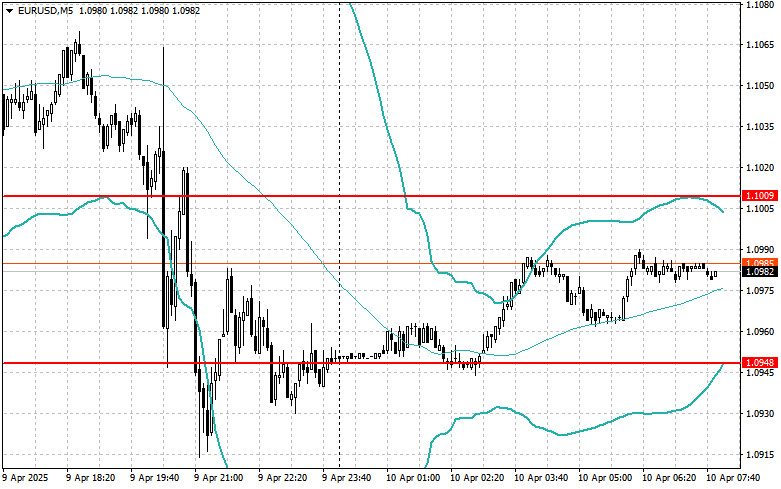

Buy on a breakout above 1.1019, targeting 1.1093 and 1.1143.

Sell on a breakout below 1.0946, targeting 1.0894 and 1.0845.

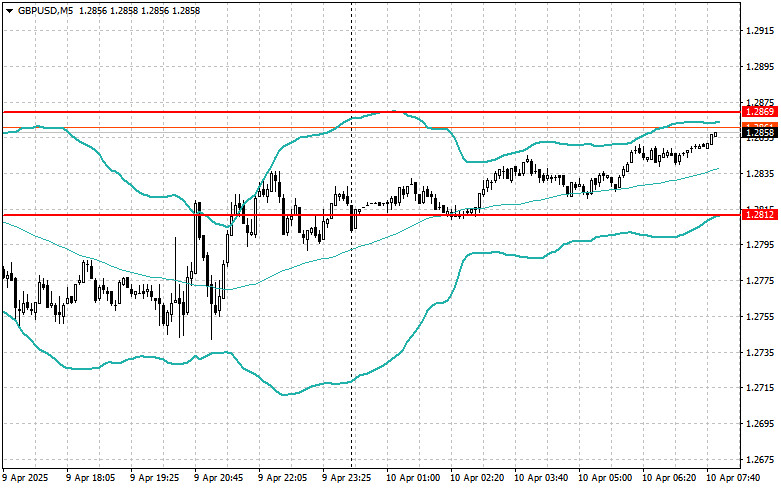

Buy on a breakout above 1.2871, targeting 1.2929 and 1.2986.

Sell on a breakout below 1.2806, targeting 1.2744 and 1.2695.

Buy on a breakout above 146.78, targeting 147.18 and 147.52.

Sell on a breakout below 146.49, targeting 146.22 and 145.93.

Look for shorts after a failed breakout above 1.1009, returning below that level.

Look for longs after a failed breakout below 1.0948, returning above that level.

Look for shorts after a failed breakout above 1.2869, returning below.

Look for longs after a failed breakout below 1.2812, returning above.

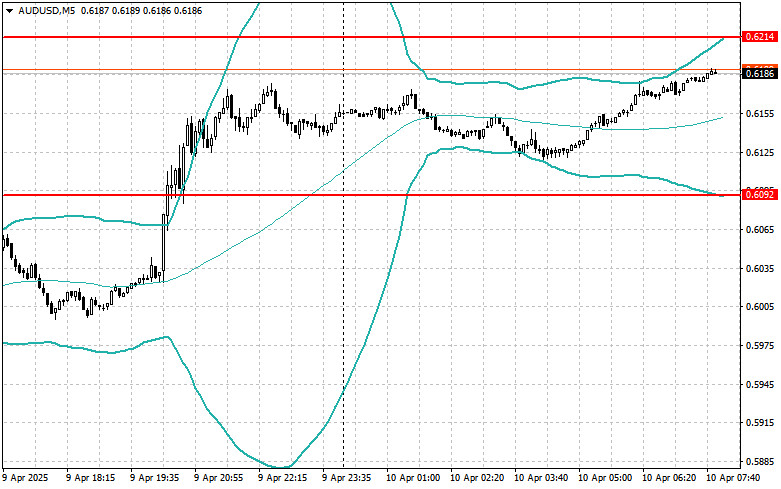

Look for shorts after a failed breakout above 0.6214, returning below.

Look for longs after a failed breakout below 0.6092, returning above.

Look for shorts after a failed breakout above 1.4129, returning below.

Look for longs after a failed breakout below 1.4056, returning above.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 140.68 occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the pair's upside potential. For this reason

The test of the 1.3356 price level coincided with the moment when the MACD indicator had just started moving downward from the zero mark, confirming a correct entry point

The test of the 1.1460 price level in the second half of the day coincided with the MACD indicator starting to move downward from the zero line, confirming the correct

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.