See also

09.04.2025 08:09 AM

09.04.2025 08:09 AMThe euro and the pound held their ground under renewed selling pressure and even posted slight gains during today's Asian session.

Yesterday's weak data from the NFIB Small Business Optimism Index in the U.S. put some pressure on the dollar, but the larger impact came from another wave of sell-offs in the stock markets. Meanwhile, the European economy continues to show signs of slowing, while the resilience of the U.S. labor market and consumer spending will continue to support the dollar. However, with the new trade tariffs coming into effect today, it's difficult to say how things will develop. In the short term, volatility may persist due to the lack of important macroeconomic data, but further growth of EUR/USD will likely be limited. Market participants will probably focus on U.S. news to forecast the dollar's future dynamics.

In the near term, the key event for traders will be the release of the Federal Reserve meeting minutes, which we will discuss in more detail in the afternoon forecast. During the European session, it's best to focus on the EU's response to the U.S. and potential trade talks, including those from the UK. The summary and minutes of the Bank of England's Financial Policy Committee meeting will be the only noteworthy publication.

If the data meets economists' expectations, following the Mean Reversion strategy is best. The Momentum strategy is recommended if the data significantly exceeds or falls short of expectations.

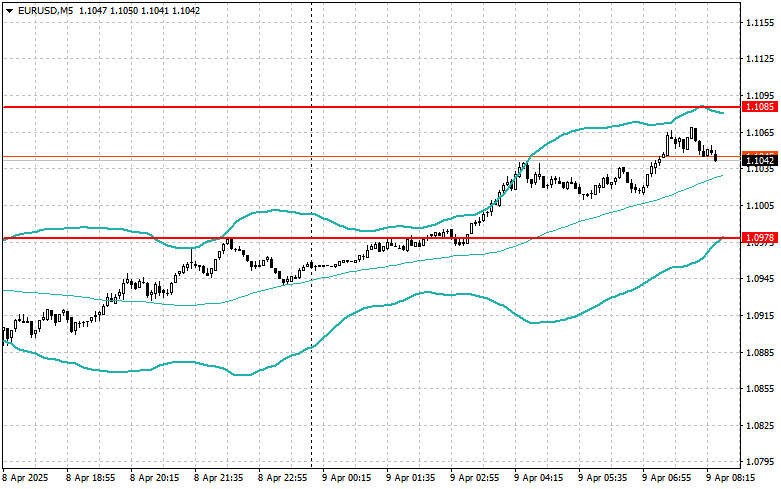

Buying on a breakout above 1.1050 may lead to a rise toward 1.1086 and 1.1143.

Selling on a breakout below 1.1020 may lead to a drop toward 1.0990 and 1.0942.

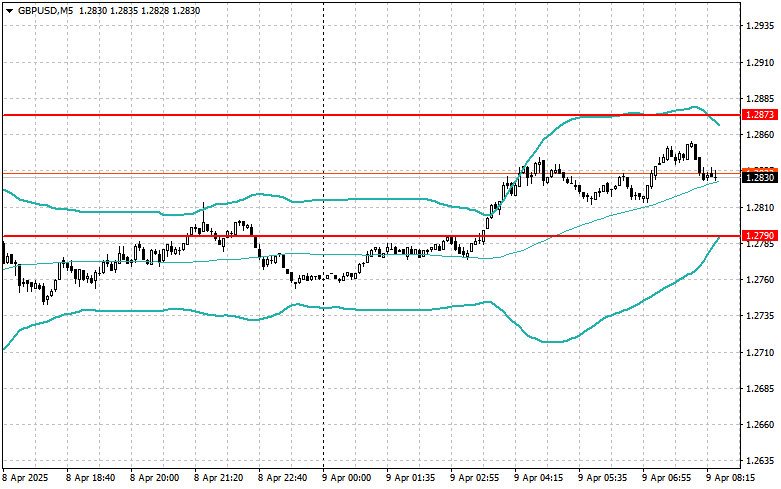

Buying on a breakout above 1.2850 may lead to a rise toward 1.2887 and 1.2929.

Selling on a breakout below 1.2810 may lead to a decline toward 1.2779 and 1.2711.

Buying on a breakout above 145.35 may lead to a rise toward 145.60 and 145.95.

Selling on a breakout below 144.95 may trigger a decline toward 144.50 and 144.00.

Look to sell after a failed breakout above 1.1085 on a return below this level.

Look to buy after a failed breakout below 1.0978 on a return above this level.

Look to sell after a failed breakout above 1.2873 on a return below this level.

Look to buy after a failed breakout below 1.2790 on a return above this level.

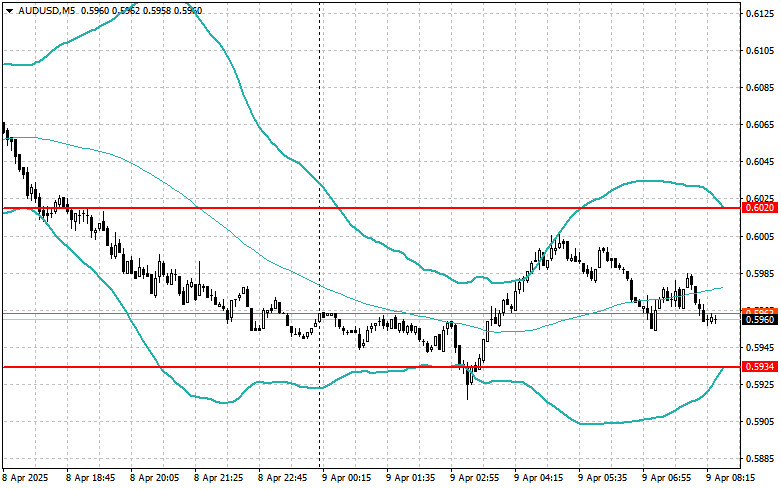

Look to sell after a failed breakout above 0.6020 on a return below this level.

Look to buy after a failed breakout below 0.5934 on a return above this level.

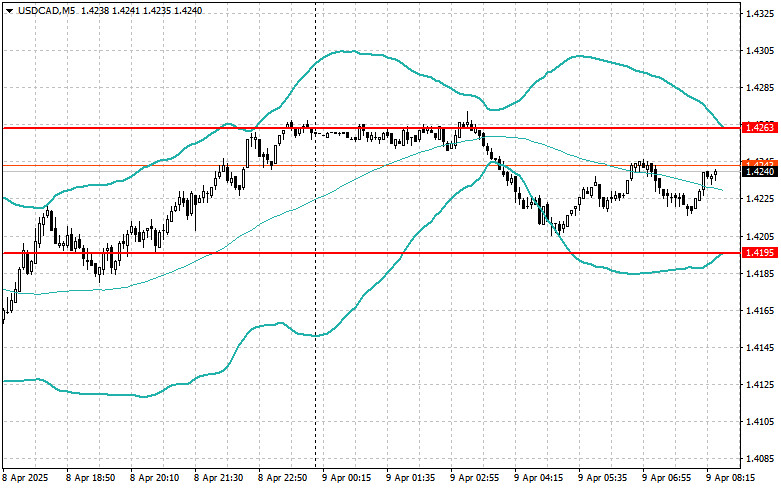

Look to sell after a failed breakout above 1.4263 on a return below this level.

Look to buy after a failed breakout below 1.4194 on a return above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The price test at 140.68 occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the pair's upside potential. For this reason

The test of the 1.3356 price level coincided with the moment when the MACD indicator had just started moving downward from the zero mark, confirming a correct entry point

The test of the 1.1460 price level in the second half of the day coincided with the MACD indicator starting to move downward from the zero line, confirming the correct

Graphical patterns

indicator.

Notices things

you never will!

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.