See also

08.04.2025 10:57 AM

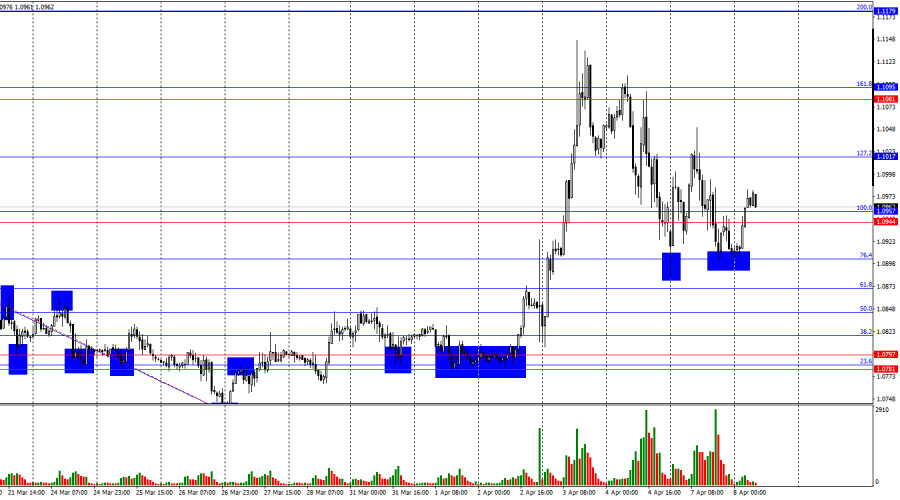

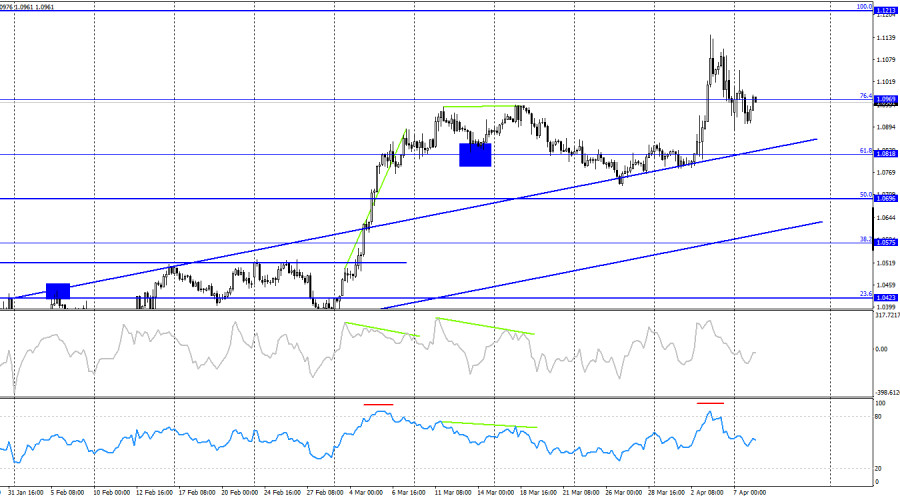

08.04.2025 10:57 AMOn Monday, the EUR/USD pair made two rebounds from the 76.4% retracement level, turned in favor of the euro, and consolidated above the 1.0944–1.0957 zone. As a result, the upward movement may continue toward the next Fibonacci level at 127.2% – 1.1017. A consolidation below the support zone of 1.0944–1.0957 will once again favor the US dollar and signal a potential resumption of the downtrend.

The wave structure on the hourly chart has shifted. The last completed downward wave broke the previous low, but the most recent upward wave broke the previous high. This suggests a potential reversal of the trend to a bullish direction. Donald Trump continues to impose new import tariffs, and the markets remain in a state of panic and chaos. Bulls re-emerged last week, but it's currently hard to say who is in control.

The news background on Monday caused traders considerable anxiety. All the news revolved around trade tariffs, and traders changed their trading direction several times throughout the day. It was reported that China is preparing retaliatory tariffs against the US, while the European Union has proposed a 25% import tariff on US goods. Just hours later, news emerged that the EU is considering abandoning US payment systems such as Visa and PayPal, and that Trump plans to raise tariffs on China to an unprecedented 104%. As a result, the dollar continued to be thrown back and forth. What will happen today is unknown and unclear. Every day is now a potential storm on the market. No one knows what tariffs will be introduced today or what decisions Trump will make—he is known for catching everyone off guard. Chart patterns cannot currently serve as a basis for trading. Economic reports will not influence trader sentiment.

On the 4-hour chart, the pair reversed in favor of the US dollar, but the future direction will depend entirely on how global events unfold. The trade war, in the full sense of the word, has only just begun. Therefore, I cannot predict growth or decline based on existing information. Movements will be determined solely by the news background that develops throughout the day.

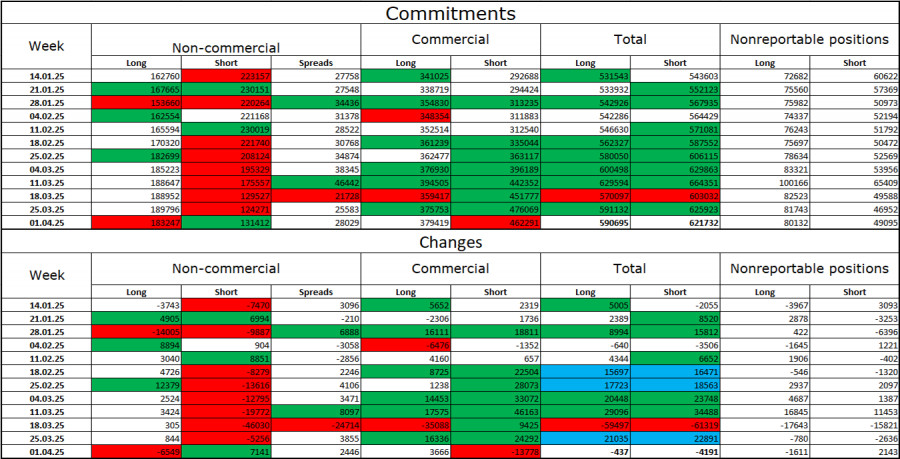

Commitments of Traders (COT) Report:

In the latest reporting week, professional traders closed 6,549 long positions and opened 7,141 short positions. The sentiment of the "Non-commercial" group has recently turned bullish again—thanks to Donald Trump. The total number of long positions held by speculators now stands at 183,000, while short positions total 131,000.

For twenty consecutive weeks, large players were shedding euros, but for the past eight weeks, they have been reducing short positions and increasing long positions. The difference in monetary policy approaches between the ECB and the Fed still leans in favor of the US dollar due to widening interest rate differentials. However, Donald Trump's policies are a more significant factor for traders, as they could have a dovish impact on FOMC policy and even trigger a recession in the US economy.

News calendar for the US and the EU:

On April 8, the economic calendar contains no notable entries. The influence of the classic news flow on market sentiment on Tuesday will be minimal. However, I remind you that tariff-related news is currently the most important and is not reflected in the standard calendar. Any country on "Trump's list" can announce retaliatory tariffs at any moment. China, the European Union, Japan, and South Korea are already prepared to do so. And after retaliatory measures, new tariffs from the White House may follow.

EUR/USD Forecast and Trading Advice:

Selling or buying the pair today should only be considered if there are clear signals near any key levels on the hourly chart. However, I must emphasize once again that movements will largely depend on the news background, not on the chart setup.

Fibonacci retracement grids are plotted from 1.0957 to 1.0733 on the hourly chart and from 1.1214 to 1.0179 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

By looking at the 4-hour chart of the EUR/JPY cross currency pair, it appears that in the near future EUR/JPY has the potential to strengthen, which is confirmed

Early in the American session, the EUR/USD pair is trading around 1.1378 within the downtrend channel formed on April 17 and showing signs of exhaustion of bullish strength. A technical

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.