See also

03.04.2025 09:02 AM

03.04.2025 09:02 AMBitcoin and Ethereum rose even before Trump's decision and the announcement of trade tariffs, but pressure on risk assets increased significantly afterward. It's hard to say that the newly announced tariffs directly affect the cryptocurrency market—for instance, the forex market and its risk assets rose against the dollar. However, a sharp drop in U.S. stock indices also pulled cryptocurrencies down.

Another failed attempt by Bitcoin to hold above the $88,000 level led to a sell-off. It is now trading at around $83,200. Ethereum also faced setbacks: after reaching $1,950 during the U.S. session yesterday, it is now trading around $1,821.

On a positive note, Fidelity has announced the launch of a retirement plan that allows direct investments in cryptocurrency. This is undoubtedly a significant step, signaling the growing recognition of digital assets within traditional financial institutions. Ordinary households can now include Bitcoin and other cryptocurrencies in their retirement portfolios, opening new opportunities for diversification and potentially higher returns. However, it's important to remember that despite their appeal, cryptocurrencies carry substantial risks, as demonstrated by yesterday's developments surrounding Trump's trade policy.

Market volatility and unpredictable regulation may present challenges, making it unlikely that households will rush to invest in Bitcoin at the risk of their retirement savings.

I will continue to focus on significant pullbacks in Bitcoin and Ethereum for the crypto market, anticipating a continuation of the medium-term bull market, which remains intact.

For short-term trading, the strategy and conditions are outlined below.

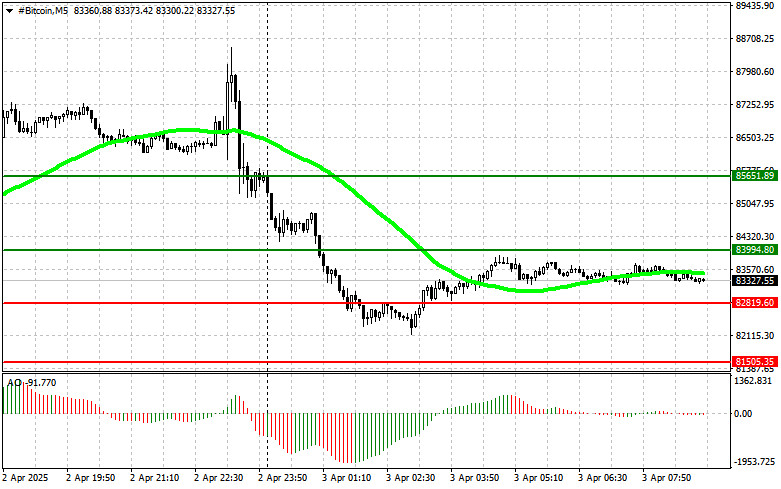

Scenario #1: Buy Bitcoin today at the entry point near $84,000 with a target of $85,600. I'll exit long positions around $85,600 and sell immediately on a bounce. Before a breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy from the lower boundary at $82,800 if there is no market reaction to a breakout, aiming for a rebound toward $84,000 and $85,600.

Scenario #1: Sell Bitcoin today at the entry point near $82,800 with a target of $81,500. Exit short positions at $81,500 and buy immediately on a bounce. Before a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell from the upper boundary at $84,000 if there is no market reaction to a breakout, aiming for a return toward $82,800 and $81,500.

Scenario #1: Buy Ethereum today at the entry point near $1,844 with a target of $1,893. Exit long positions at $1,893 and sell immediately on a bounce. Before a breakout buy, ensure the 50-day moving average is below the current price and the Awesome Oscillator is in positive territory.

Scenario #2: Buy from the lower boundary at $1,808 if there is no market reaction to a breakout, aiming for a rebound toward $1,844 and $1,893.

Scenario #1: Sell Ethereum today at the entry point near $1,808 with a target of $1,770. Exit short positions at $1,770 and buy immediately on a bounce. Before a breakout sell, ensure the 50-day moving average is above the current price and the Awesome Oscillator is in negative territory.

Scenario #2: Sell from the upper boundary at $1,844 if there is no market reaction to a breakout, aiming for a return toward $1,808 and $1,770.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has successfully pushed above $90,000, while Ethereum added more than 10% in just one day, rebounding to $1800. The main catalyst was Donald Trump's statement yesterday, clarifying that firing

Bitcoin and Ethereum, having spent the entire weekend moving sideways within a range, surged sharply during today's Asian session. The rally was triggered by rumors that U.S. Federal Reserve Chair

Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However

After successfully exiting the Ascending Broadening Wedge pattern on the 4-hour chart of the Litecoin cryptocurrency followed by the appearance of Divergence between the Litecoin price movement and the Stochastic

Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two markets

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.