See also

03.04.2025 07:26 AM

03.04.2025 07:26 AMOn Thursday, several macroeconomic events are scheduled, with the U.S. ISM Services PMI being the most significant. At this moment, we believe there is little value in analyzing the macroeconomic context. In recent weeks, market participants have frequently ignored macroeconomic data, shifting their focus to Trump's trade tariffs. We had assumed that the hype surrounding this topic was gradually fading and that the market was starting to grow accustomed once again to Trump's ambition to "Make America Great Again." However, as practice has shown, Trump still has many methods and decisions that can plunge all markets into complete chaos.

There is no point in discussing anything other than Trump's trade tariffs. The dollar's decline may continue for several more days, and we recommend that traders pay close attention to statements from leaders of major countries and alliances regarding retaliatory tariffs. Trump has stated that any response to his efforts to "eliminate injustice" will be met with harsh new sanctions and tariffs. So, anyone who thought yesterday's tariffs were final and the rates were set is sorely mistaken. Now, lengthy and complex negotiations begin with all the sanctioned countries that cannot afford to accept Trump's tariffs. Retaliatory measures from major players—such as the European Union, China, Japan, South Korea, Canada, and others—are on the way.

On the penultimate trading day of the week, both currency pairs may continue to rise, as Trump has once again done everything he can to push the dollar lower. This is likely far from the last market shock of 2025. The global trading system is being reshaped, and we can expect significant shifts in trade flows. Many companies and countries will look for new markets, redirect exports, and form new trade alliances and agreements. This will result in a significant redistribution of capital and trade flows.

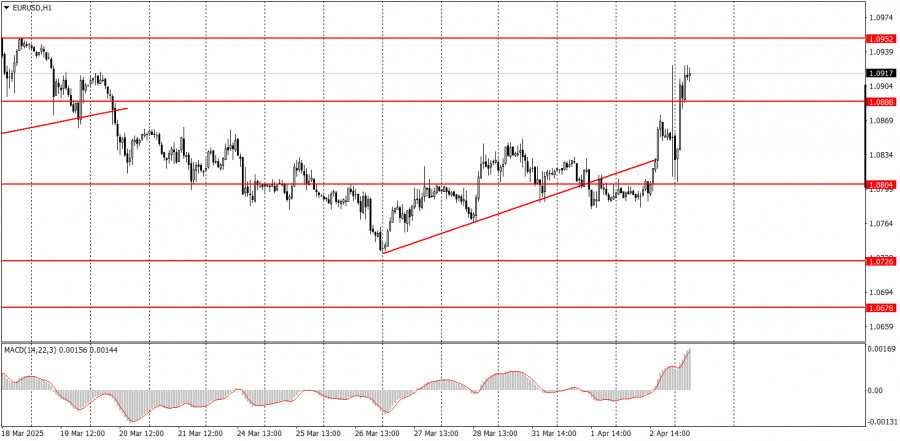

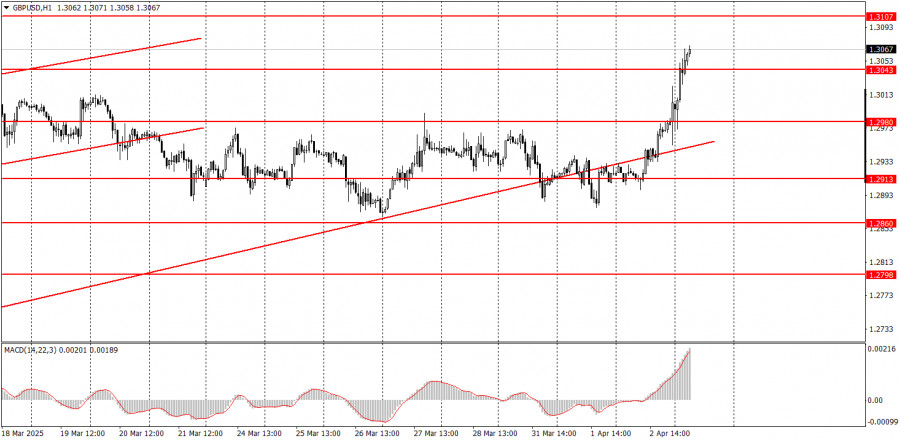

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Global markets are significantly influenced by events occurring in the United States, where both political and economic spheres continue to swing like a pendulum. Earlier this week, after the U.S

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.