See also

01.04.2025 03:58 PM

01.04.2025 03:58 PMThe bottom shows no strength, the top has no desire. Even the so-called "smart money" is not rushing to buy Bitcoin, citing a confluence of negative factors. Tepid trading activity, a tense macroeconomic backdrop, and a lack of upside momentum have created what the market calls a "bull trap". If big players are holding back, what can we expect from smaller market participants?

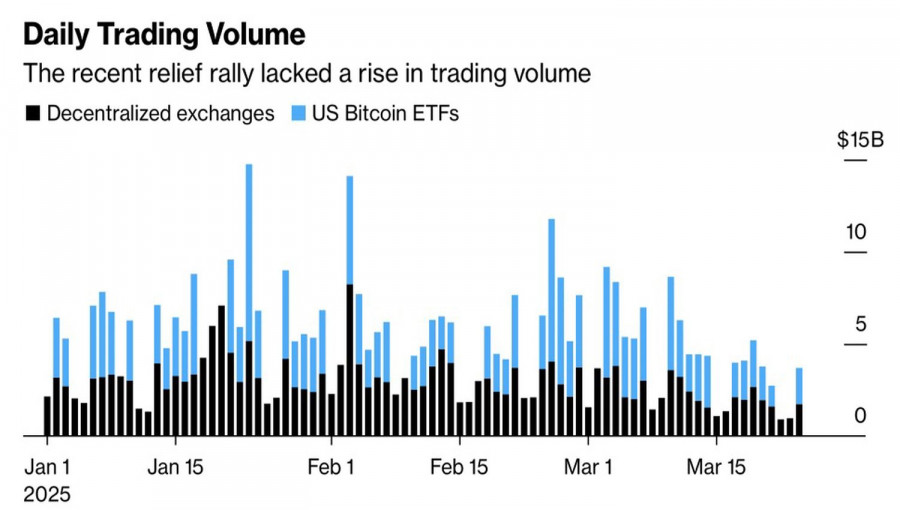

Crypto market volume trends

In the fourth quarter, Bitcoin lost around 10% of its value — not a terrible performance compared to broader crypto assets. Ethereum plunged 45%, and Coinbase shares fell 31%. This marked the worst performance since 2022, when the FTX collapse sent shockwaves through the entire digital asset industry.

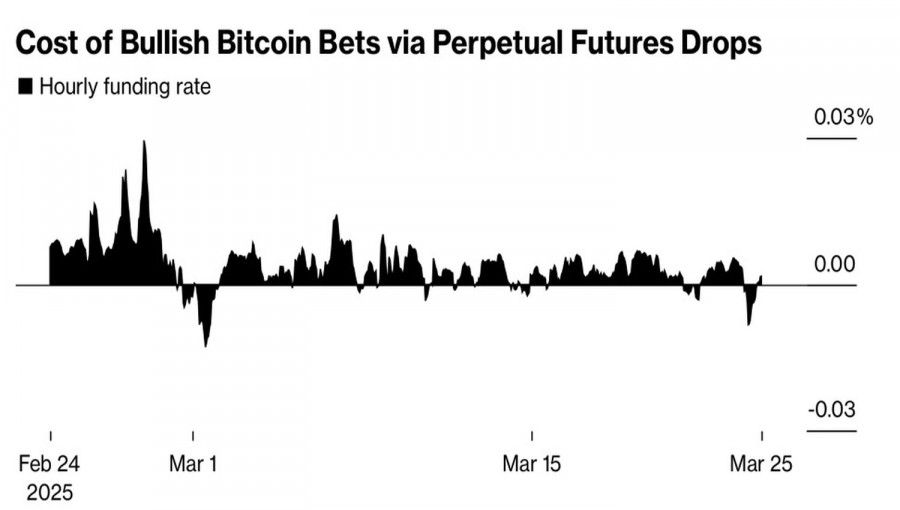

Bitcoin has outperformed Ethereum and other competitors largely due to increased attention from the White House. Donald Trump has announced the creation of a strategic reserve, and his family is launching mining ventures. They are clearly betting on a BTC/USD rally, but it is too early to call. In the futures market, hedging is ramping up to protect against a drop below the psychologically crucial $80,000 level. Meanwhile, the spread between spot and derivatives has dipped into negative territory, signaling a bearish market tone.

BTC futures vs spot market premium

Persistent geopolitical instability, looming risks of a US stagflation or recession, and the potential escalation of trade tariffs are casting a shadow over BTC/USD. Bitcoin remains mired in consolidation, and even if it manages to break out, there is no guarantee that it will be to the upside.

Much depends on how equity markets respond to "America's Liberation Day," as Trump has dubbed April 2. Two scenarios are in play: either the White House enacts universal 20% tariffs, or it goes with so-called reciprocal tariffs on selected imports. The former could shock markets and trigger a sell-off in riskier assets. The latter could extend the S&P 500's recent rally and throw Bitcoin bulls a much-needed lifeline.

In short, the fate of Bitcoin — and that of other assets — remains in the hands of Donald Trump. How aggressive will he be with protectionism? Will he offer exemptions, sparing some countries from the tariff blacklist? The answers are just days away. "Liberation Day" is approaching.

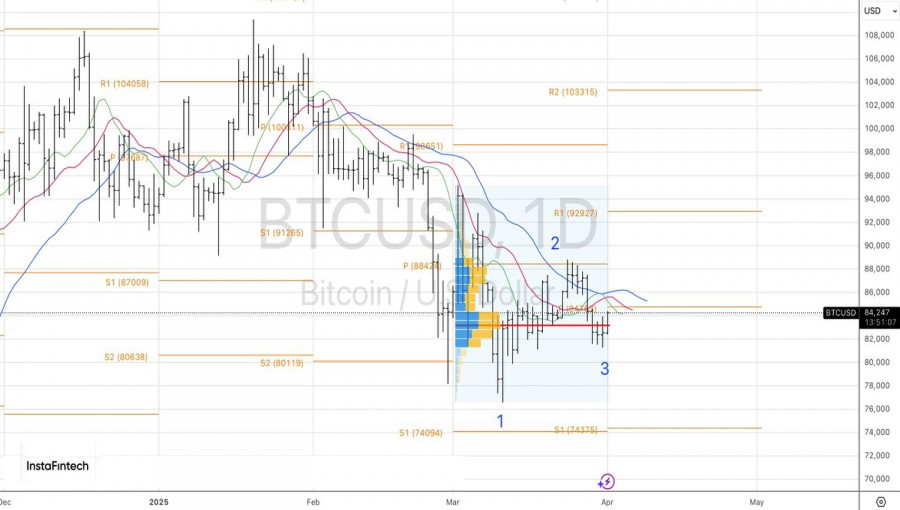

Technically, on the daily BTC/USD chart, bulls are trying to form and activate a combination of reversal patterns — Anti-Turtles and 1-2-3. A successful test of the $84,800 resistance level would strengthen the bullish case and open the door to building long Bitcoin positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are very few macroeconomic reports scheduled for Thursday. Only two secondary reports from the UK and the US are all traders will get today. The construction sector activity report

The GBP/USD currency pair traded rather calmly on Wednesday, as there were few important events and reports during the day. As we expected, the business activity indices (excluding ISM)

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.