See also

31.03.2025 10:58 AM

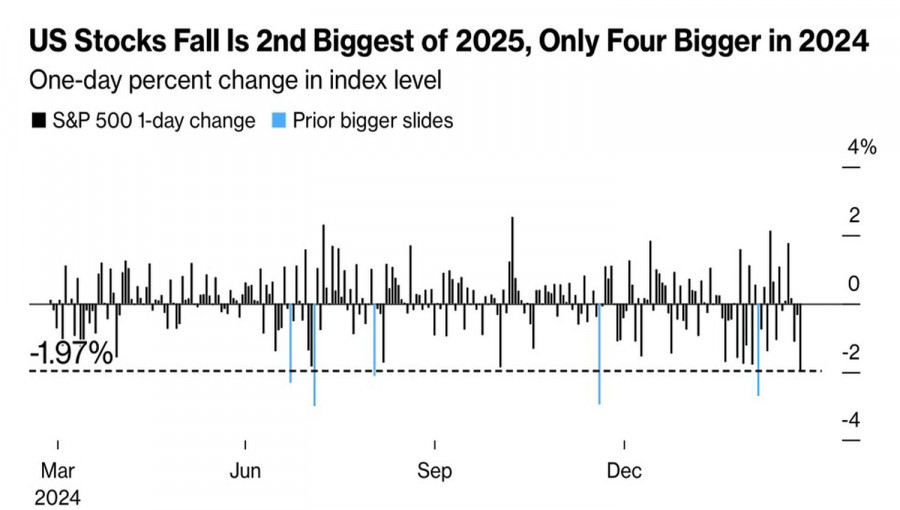

31.03.2025 10:58 AMRumors about mutual tariffs and another blow to consumer confidence triggered the second-worst sell-off of the S&P 500 this year. Investors are still holding piles of US stocks, but the threat of a recession due to the White House's tariff policy is forcing them to sell toxic assets. This could lead to a significant correction in the broad stock index.

Daily dynamics of the S&P 500

US stock markets entered 2025 with a high level of optimism. However, the first quarter turned out to be the worst for the S&P 500 compared to European equities since 2015. It's no joke to say that investors in Europe have already lost 13% from the fall in the broad stock index and the weakening of the US dollar against the euro!

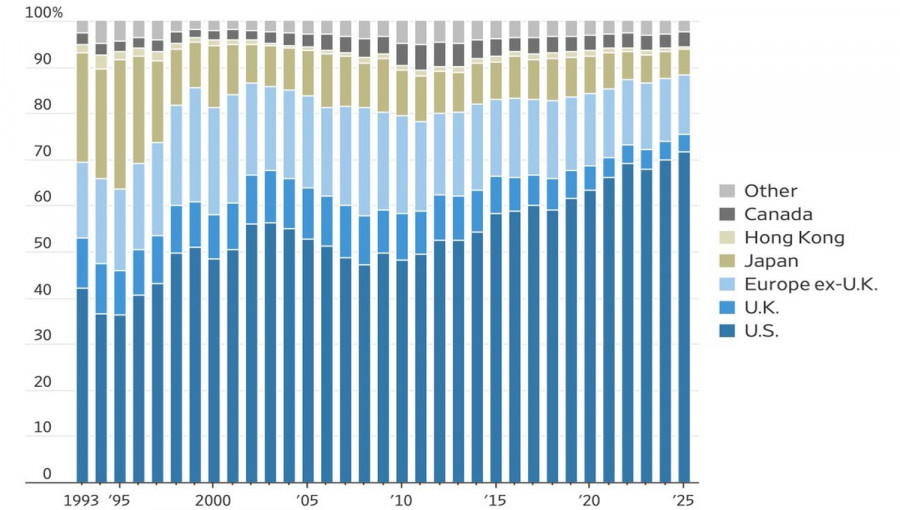

They have only themselves to blame. By the end of 2024, the share of US stocks owned by non-residents reached 20%, compared to 7% at the start of the century. The proportion of US-issued equities in global stock indices surged from 47% in 2008 to 72%! The retribution for excessive enthusiasm about American exceptionalism was inevitable.

The share of US stocks in global stock indices

The reason for the love of US stocks was the anemic growth of stock indices abroad, the rapid expansion of the US economy, and corporate profit growth driven by artificial intelligence technologies. Even with the latest sell-off, the S&P 500 has jumped 170% over the last decade. In comparison, the UK's FTSE 100 has only gained 30%. The US simply had no competitors.

They appeared in 2025. First and foremost, this refers to Europe. For the first time in years, the rationale for purchasing stocks issued in the Old World is not only their cheapness in terms of P/E. Germany's fiscal stimulus raises hopes for an economic boost. Besides, the belief in the imminent end of the armed conflict in Ukraine could release the region from geopolitical risks.

However, the EuroStoxx 600 will fall along with the S&P 500 by the end of March due to fears about import tariffs. According to sources from the Wall Street Journal, Donald Trump's mood has shifted again. One moment, he announces less severe mutual tariffs than investors had expected. Shortly after, he returns to the idea of universal tariffs and speculates about what the rates should be. The latter type of tariffs risks collapsing international trade and the global economy much faster than the mutual ones. Should we be surprised by sell-offs in stock markets worldwide?

Another drop in US consumer expectations to their lowest level since 2022, along with a rise in expected inflation, paints a stagflationary scenario for the US economy.

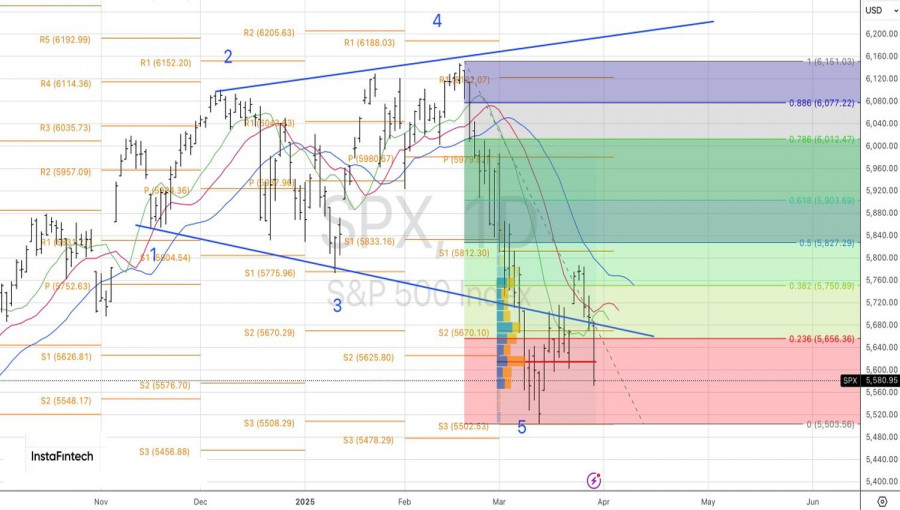

Technically, on the daily chart of the S&P 500, the success of the "bear" attack increases the risks of a further downtrend, rather than the previously forecasted consolidation in the range of 5,500 to 5,790. It would be wise to hold short positions opened during the rise to the upper border and then added from 5,670.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are very few macroeconomic reports scheduled for Thursday. Only two secondary reports from the UK and the US are all traders will get today. The construction sector activity report

The GBP/USD currency pair traded rather calmly on Wednesday, as there were few important events and reports during the day. As we expected, the business activity indices (excluding ISM)

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.