See also

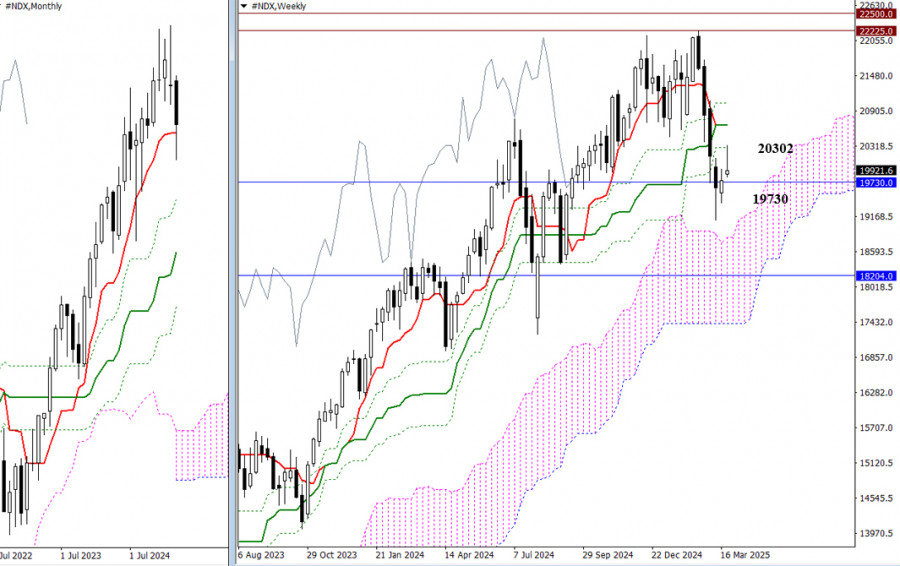

A stall at the monthly short-term trend level (19730) prompted an effort by bulls to reclaim their positions. As a result, a bullish gap formed at the start of the new trading week, with a test of the weekly resistance level at 20302. If this level is breached, the market will face two additional weekly resistance zones slightly above (20669 – 21036). However, if bulls lose momentum during a retest, the opposing side could swiftly return the market to the gravitational zone around the monthly Tenkan (19730), aiming to break the recent low (19113) and intensify bearish sentiment.

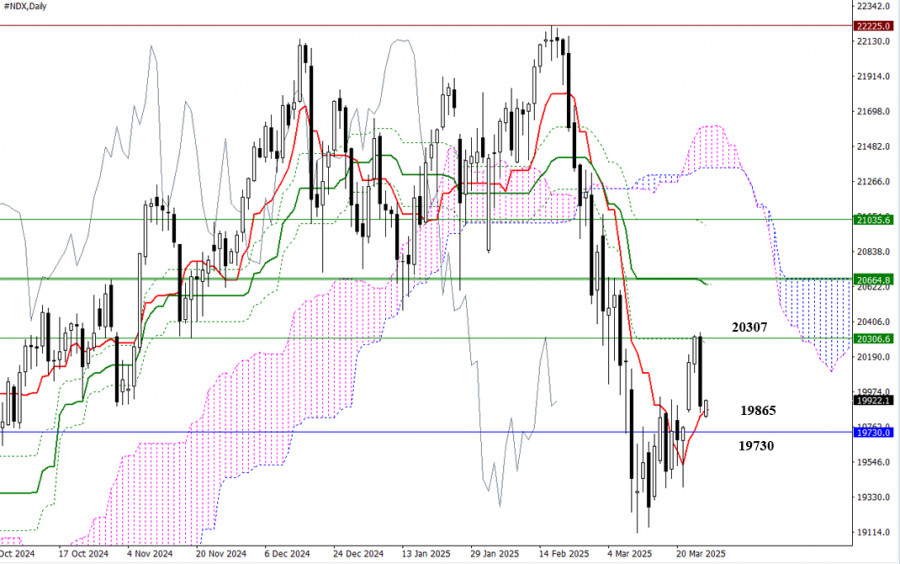

Yesterday's test of the Kijun Fibonacci levels (daily and weekly at 20302) resulted in a daily rebound. By the end of the session, the market had corrected downward to the daily short-term trend level (19865). The daily short-term trend supports (19865) and monthly supports (19730) will try to defend bullish interests. Failure to hold, breaking these supports, and moving out of the current attraction zone will shift market attention toward bearish targets—specifically, a new low at 19113 and a possible resumption of the broader downtrend.

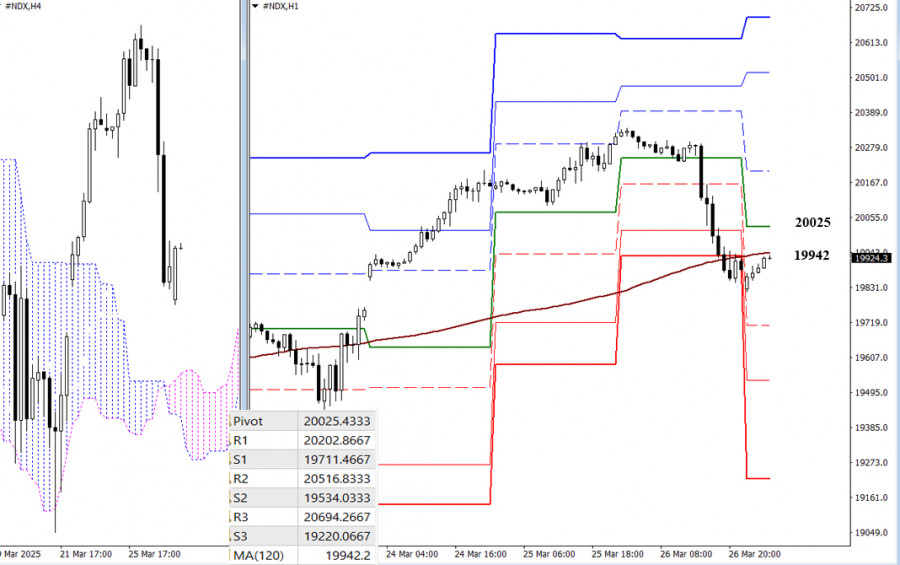

In the lower timeframes, the market now interacts with a key level determining the primary advantage: the weekly long-term trend in 19942. Whichever side holds this level will likely gain further momentum. Additional intraday bearish targets include the support levels of the classic Pivot Points (19712 – 19534 – 19220). Resistance levels at the classic Pivot Points (20025 – 20203 – 20517 – 20694) may serve as useful guides for bulls aiming to recover.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.