See also

26.03.2025 08:00 AM

26.03.2025 08:00 AMDonald Trump has dealt such a heavy blow to globalization that conditions and outlooks for the future have changed—now divided along territorial lines. While European banks believe the S&P 500's decline will continue, their American counterparts argue that the time to sell the rally is over. In both cases, tariffs play a central role.

JP Morgan sees the risk of a renewed correction in the broad stock index as low, while Morgan Stanley considers the S&P 500 rally to be gaining momentum, expecting clarity on the White House's tariffs after April 2. The idea is that markets mostly feared the approach of import duties. Once that materializes, there'll be nothing left to fear. "The anticipation of death is worse than death itself." Time to buy U.S. stocks! Increasing the likelihood of consolidation.

In contrast, Swiss bank UBS and UK-based HSBC remain in the bearish camp. UBS cut its S&P 500 forecast to 5,300, citing warning signs in the latest U.S. macro data, which they argue justify selling the index. HSBC claims the chances of uncertainty disappearing after April 2 are slim. Ongoing tariff noise will affect American business and the economy, leading to further stock declines.

The Wall Street consensus expects a 13% rise from current levels to 6,539. Oppenheimer's John Stoltzfus target is the most bullish, at 7,100, while Stifel's Barry Bannister's target is the most bearish, at 5,500.

Overall, it must be acknowledged that markets have absorbed the negative impact of Donald Trump's policies without the upside. We're talking about a cooling U.S. economy, fading hopes for additional fiscal stimulus from Washington, an unstable tariff strategy, and an unexpectedly strong response from Europe. All this has led to capital outflows from the New World to the Old, contributing to the S&P 500's decline. Is the rough patch for the broad index over?

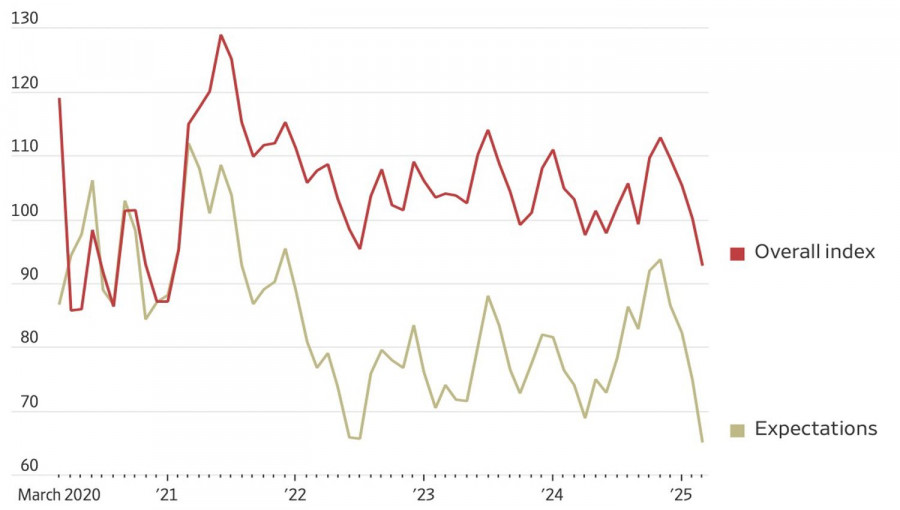

Markets had been climbing on rumors of less severe White House tariffs than previously feared. Trump mentioned potential exemptions but then stated he doesn't like granting them. Combined with the consumer confidence index dropping to a four-year low, this clipped the wings of S&P 500 buyers.

Until the import tariff situation is clearer, the chance of the broad index consolidating remains high. Few investors are willing to jump into the fire ahead of such a key event, making choppy, directionless fluctuations more probable.

Technically, the bulls' counterattack continues on the S&P 500 daily chart. Traders who opened long positions from 5,670 are "sitting pretty." However, if the index bounces off resistance levels — the pivot zones at 5,815, 5,835, and 5,885 — it may trigger a reversal and shift toward selling.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets have fully priced in the outcome of the U.S.–China talks, which resulted in a 90-day trade truce. Weaker-than-expected U.S. economic data offset the early-week optimism. The recent rally lost

Few macroeconomic events are scheduled for Friday, and they are not more significant than the reports released on Thursday, which did not provoke any market reaction. In essence, the only

The EUR/USD currency pair moved in both directions on Thursday but ultimately remained below the moving average line. Its position beneath the moving average allows us to expect further strengthening

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.