See also

Yesterday, U.S. President Donald Trump announced that both broad mutual tariffs and certain sector-specific additional tariffs will come into effect on April 2, posing a serious risk to the global economy. However, we've seen repeatedly how Trump's policies can generate waves of uncertainty that then quickly fade as markets await responses from other countries.

In terms of individual stocks, FedEx Corp., often seen as a barometer of the U.S. economy, declined after the company cut its profit forecast due to rising costs and signs of weakened demand. Nike Inc. also cited tariffs and geopolitical tensions as factors that could affect its earnings. Now, investors are turning their attention to upcoming earnings reports from major Chinese companies, including Xiaomi Corp., Tencent Holdings Ltd., and e-commerce giant Meituan.

As for central bank signals, this week officials from the Federal Reserve, the Bank of Japan, and the Bank of England all stated that tariffs are making it harder to forecast economic outcomes and complicating future policy guidance. Meanwhile, the European Union has postponed retaliatory tariffs on American whiskey, stating that they are open to dialogue with Trump before taking further action.

Oil prices rose after the U.S. imposed sanctions on a Chinese refinery, a move seen as a significant escalation in efforts to restrict Iranian oil exports. Gold, on the other hand, pulled back after nearing a record high.

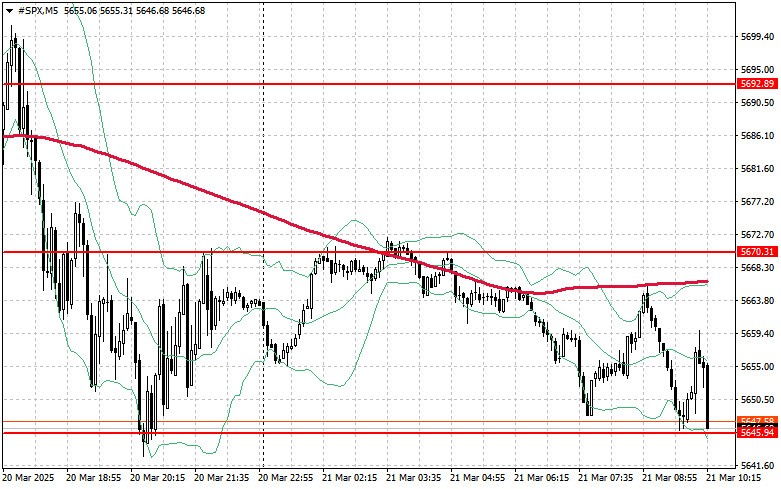

The decline continues. The main task for buyers today is to break through the nearest resistance at $5670. This would help resume the uptrend and open the path toward $5692. An equally important objective for bulls is to gain control over $5726, which would further strengthen buyer positions.

In case of downward movement amid waning risk appetite, buyers must defend the $5645 level. A break below this support would quickly push the index back to $5617 and could open the way to $5585.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.