See also

20.03.2025 10:05 AM

20.03.2025 10:05 AMThe Fed is not throwing a lifeline to the S&P 500, but does it need one? Lifelines are for those drowning, while the market is merely spooked by a fleeting recession scare. Powell's tone at the post-FOMC press conference was bot just conciliatory—it was calming. The head of the Fed signaled control, and that was enough to lift the broad stock index.

Recession risks may be higher, but they are not alarmingly so. Inflation remains sticky, but there is no reason to panic. The impact of tariffs is transitory. The White House's protectionist stance brings uncertainty, but the Fed has time to wait. The stock market, which had lost about $5 trillion in market capitalization, was desperate for good news. Powell's calm gave traders the confidence to add long positions in the S&P 500 index.

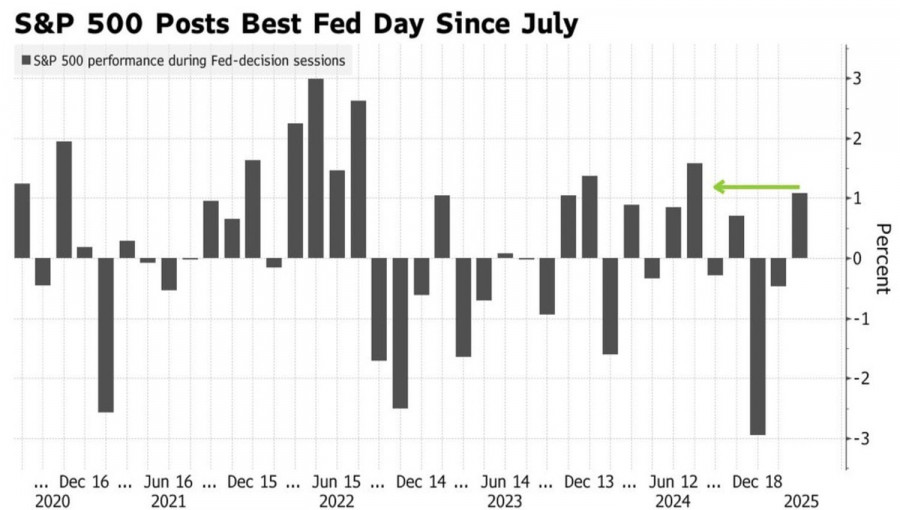

The broad stock index logged its strongest post-FOMC reaction since July, as policymakers' reluctance to radically adjust the federal funds rate forecast was exactly what markets wanted to hear. Investors stopped fretting over recession risks—and what more could a battered S&P 500 ask for?

The Fed slightly raised its inflation forecast from 2.5% to 2.7%, while lowering its GDP growth projection for 2025 from 2.1% to 1.7%. In effect, this reduced the chances of a soft landing and edged the economy closer to stagflation—an environment that equity markets do not favor.

According to Bloomberg estimates, the probability of a soft landing has shrunk to 10%, while the likelihood of stagflation has climbed to 40%. The chance of a recession now stands at 35%, while the risk of a hard downturn is estimated at 15%. This means that the odds of an unfavorable scenario for the S&P 500 are hovering around 90%, hardly an environment conducive to a sustained rally.

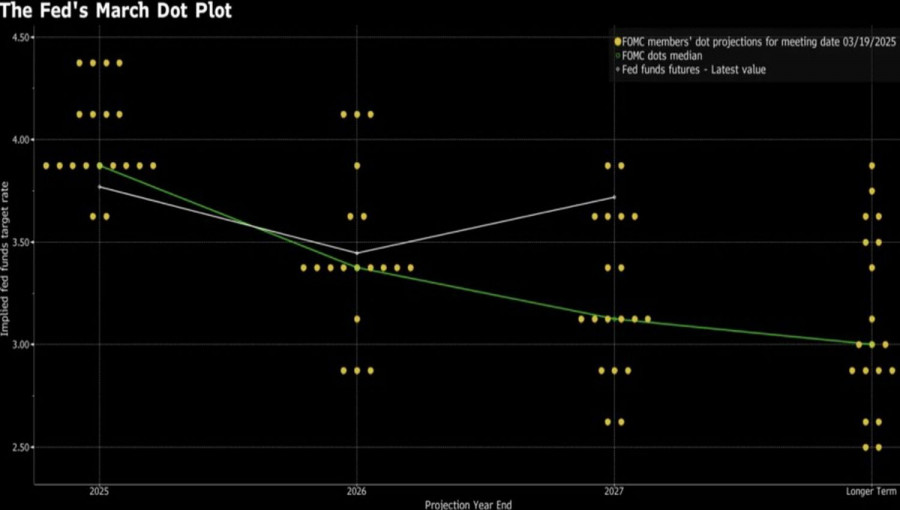

The Devil is in the details. While the Fed's median rate projection remained unchanged—still pointing to two rate cuts—the details tell a different story. In December, 15 Fed officials backed this outlook. By March, that number had dropped to 11. Meanwhile, eight Fed policymakers now expect only one rate cut or even less in 2025. That is bad news for the S&P 500.

Adding to market jitters, Donald Trump's call for the Fed to accelerate rate cuts—declaring April 2 as "America's Liberation Day"—only fuels uncertainty. The White House's tariffs are just around the corner, and there is reason to believe they will be substantial. As that moment approaches, fear will creep back into the markets, bringing with it another wave of S&P 500 sell-offs.

From a technical standpoint, the daily chart shows that S&P 500 bulls have launched a counterattack, attempting to regain control. However, the bearish momentum remains dominant. A pullback from the resistance levels of 5,750 and 5,815, or a break below the pivot level of 5,670 and the fair value of 5,620 should be seen as selling opportunities.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Recent events—including victorious declarations from Washington about agreements on customs tariffs with Japan and the EU—continue to support demand for risk assets. At least for now, investors are not concerned

A considerable number of macroeconomic reports are scheduled for Wednesday. Germany, the Eurozone, and the United States will all release Q2 GDP reports. It is worth noting that while

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.