See also

14.03.2025 04:53 AM

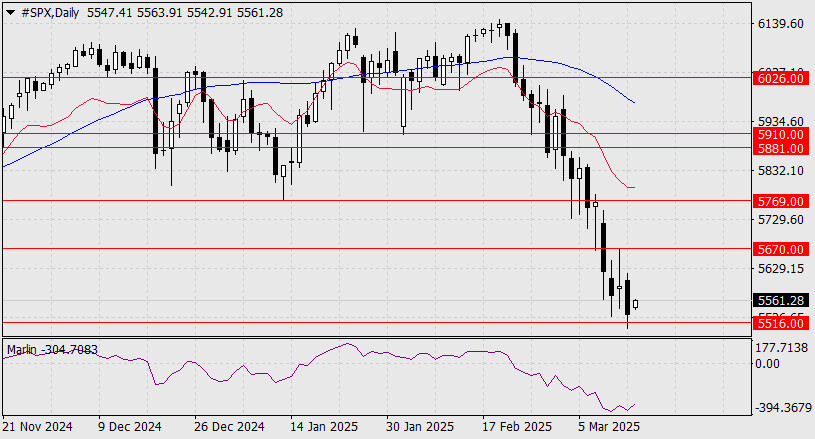

14.03.2025 04:53 AMYesterday, the S&P 500 index reached its target support level of 5516, which corresponds to the peak observed on June 20, 2024. This level also aligns with the 23.6% Fibonacci retracement from the growth experienced since October 2022. Additionally, the Marlin oscillator has shown an upward movement.

Even if we assume that the stock market is currently experiencing a crisis, a corrective rebound is still possible due to the lack of panic among investors. There has been buying activity from risk-takers who believe in ongoing growth and view current prices as attractive long-term entry points, as reported by various business media outlets. The nearest target for this correction is 5670. If this resistance level is breached, it would pave the way to 5769, which is the low from January 13. A move above the range of 5881–5910 would confirm the market's intent to establish new all-time highs.

On the H4 chart, a convergence has developed between the price and the Marlin oscillator. The oscillator's signal line is nearing positive territory. Consolidating above 5670, which would also mean breaking above the MACD line, could encourage further growth toward 5769.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.