See also

13.03.2025 09:28 AM

13.03.2025 09:28 AMFutures for the S&P 500 and NASDAQ indices declined again following yesterday's unexpected U.S. inflation data, which revealed a slowdown in price pressures that contradicted economists' forecasts. Asian stocks also fell, continuing a trend of heightened volatility over the past two weeks that has resulted in hedge fund losses and prompted Wall Street strategists to lower their forecasts for U.S. stocks.

Today, U.S. and European futures dropped by 0.5%, while NASDAQ 100 contracts fell by 0.9%, interrupting Wednesday's rally. In contrast, Treasury bonds rose, and the yen strengthened after Bank of Japan Governor Kazuo Ueda expressed expectations for improvements in real wages and consumer spending.

The fluctuations in the stock market illustrate the uncertainty affecting investors amid an aggressive sell-off over the last two weeks. This volatility has been driven by higher unemployment rates and federal job cuts, which have increased the likelihood of slower U.S. economic growth. Additionally, the escalation of former President Donald Trump's trade war and geopolitical developments related to Ukraine have raised concerns among investors, some of whom are considering moving their capital out of the U.S.

Recently, analysts have become more cautious in their outlook on the U.S. market. Goldman Sachs Group Inc. is the latest to raise alarms, following similar actions by Citigroup Inc. and HSBC Holdings Plc. Earlier this week, Citi downgraded its rating on U.S. stocks from "overweight" to "neutral," while upgrading China's rating to "overweight."

The renewed market volatility arises from the recent realization that a single soft Consumer Price Index (CPI) report may not change the Federal Reserve's trajectory. Expectations that the Fed will maintain elevated interest rates have dampened demand, leading to another sell-off of risk assets.

Yesterday, Senate Majority Leader Chuck Schumer announced that his party would block the Republicans' spending bill to prevent a government shutdown on Saturday. He urged the GOP to approve the Democrats' funding plan, which is proposed to extend through April 11. This situation suggests that the recent market bottom may not be the true bottom.

On the tariffs front, former President Trump announced that the U.S. would respond to the European Union's countermeasures against his new 25% tariffs on steel and aluminum, increasing the risk of escalating trade tensions. Additionally, Canada has imposed 25% tariffs on American-made products valued at approximately $20.8 billion, including steel and aluminum, in response to the Trump administration's global tariffs on these materials.

In commodities, gold prices rose and were trading around $2,940 per ounce. Meanwhile, oil prices fell on Thursday after experiencing their largest two-week rally.

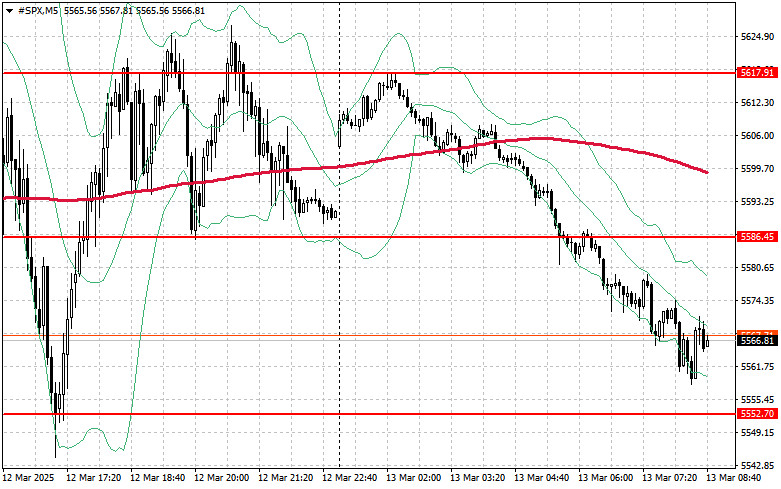

Technical Outlook for S&P 500

The decline continues. Buyers' main task today is to overcome the nearest resistance at $5,586. This will help sustain the upward movement and open the way for a push to a new level of $5,617. An equally important goal for bulls is maintaining control over $5,645, which would strengthen their position.

If the index moves downward amid reduced risk appetite, buyers must show strength around $5,552. A breakout below this level will quickly push the index back to $5,520 and open the path toward $5,483.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.