See also

04.02.2025 12:09 PM

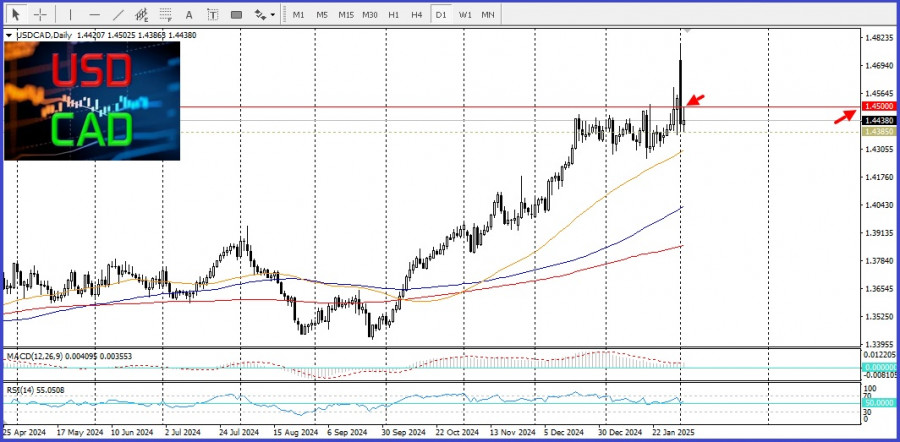

04.02.2025 12:09 PMCrude oil prices are falling for the second consecutive day, hitting a more-than-one-month low, undermining the commodity-linked Canadian dollar. This provides a tailwind for the USD/CAD pair amidst rising demand for the U.S. dollar.

U.S. President Donald Trump's decision to postpone the recently imposed tariffs on imports from Canada and Mexico has eased concerns over potential supply disruptions from these two major oil suppliers to the U.S.

Additionally, the outlook for reduced fuel demand, particularly due to the expected ripple effects of Trump's trade policies, is exerting further pressure on oil prices. Expectations that Trump's policies could push inflation higher and reduce the need for the Federal Reserve to cut interest rates have also contributed to a modest rebound in the U.S. Treasury yields. This, in turn, offers additional support to the USD/CAD pair. Moreover, the dovish outlook from the Bank of Canada suggests that the path of least resistance for the USD/CAD pair remains upward.

From a technical perspective, oscillators on the daily chart remain in positive territory, indicating that the pair is not yet ready for a significant decline. This setup suggests the potential for further gains in the near term, with the psychological 1.4500 level acting as the next target for bulls.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The beginning of actual negotiations could lead to a significant drop in gold prices in the near future. In previous articles, I suggested that the previously surging price of gold

The EUR/USD currency pair continued to trade calmly on Thursday, although volatility remained relatively high. This week, the US dollar showed some signs of recovery—something that could already be considered

A few macroeconomic events are scheduled for Friday, but this doesn't matter, as the market continues to ignore 90% of all publications. Among the more or less significant reports today

U.S. President Donald Trump once again commented on Federal Reserve Chairman Jerome Powell, openly expressing dissatisfaction with the pace of rate cuts. Another public expression of disapproval of the Fed's

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.