See also

04.02.2025 07:46 AM

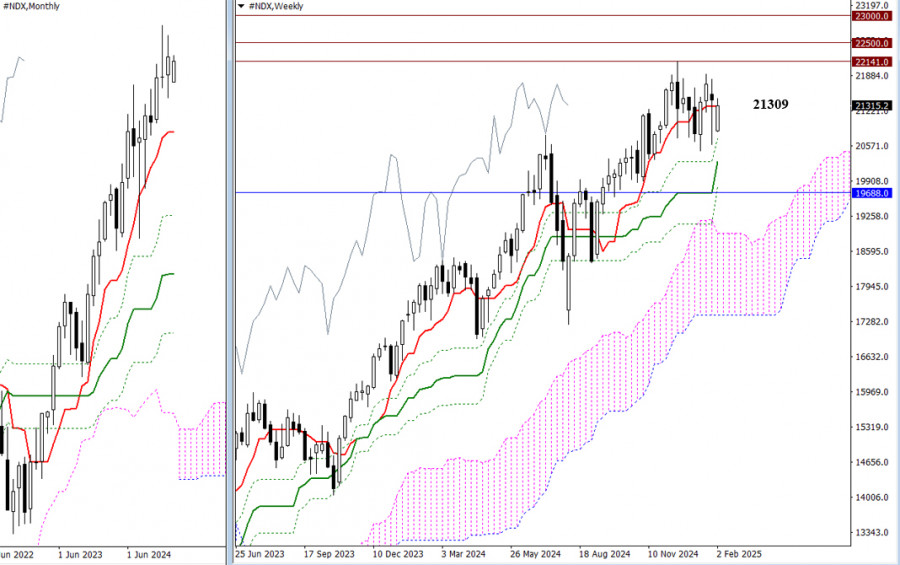

04.02.2025 07:46 AMAt the end of last year, the index reached a new all-time high of 22,141. Following that peak, the upward momentum stalled, leading to a correction and consolidation phase. Currently, the key focus is the weekly short-term trend level at 21,309. Even yesterday, despite a significant downward gap, prices managed to rebound back to the 21,309 area. Given the current conditions, we can identify the nearest benchmarks for potential market movement. If bullish activity continues, a breakout above the all-time high of 22,141 could pave the way for further gains, targeting the psychological levels of 22,500 and 23,000. On the other hand, if the consolidation phase ends with bearish momentum, the primary targets would involve breaking the Ichimoku weekly cross and a corrective decline towards the monthly short-term trend level at 19,688.

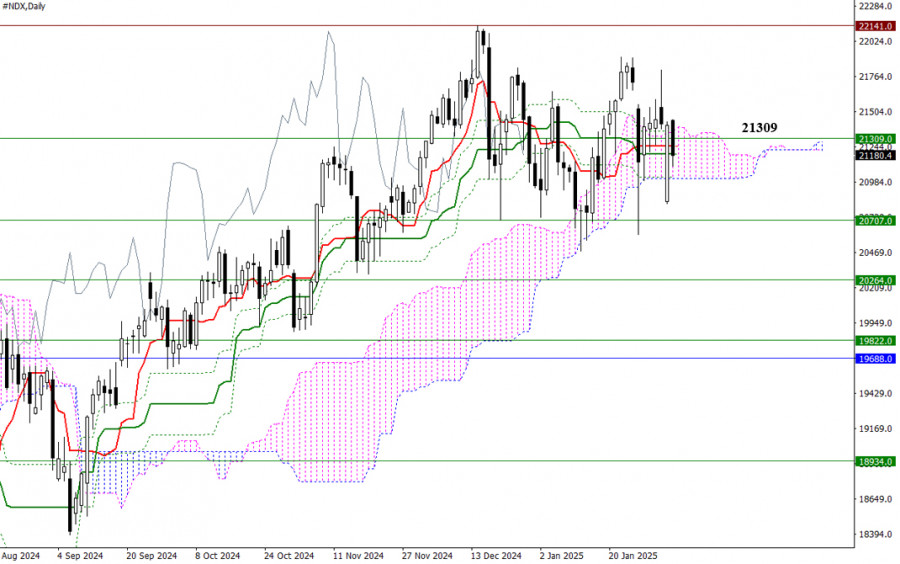

For two consecutive weeks, the market has opened with a significant downward gap, followed by rapid attempts to recover and close that gap. A clear struggle is occurring: one side is trying to push the index much lower, while the other side is working hard to maintain current levels. At present, the bulls have a clear path toward the all-time high of 22,141. The daily Ichimoku setup supports this scenario, featuring a daily cross and daily cloud, along with additional support from the weekly short-term trend at 21,309. If the market breaks below the daily cloud at 21,014, it would trigger a bearish target with further declines potentially reaching the monthly short-term trend at 19,688. Additional support along this trajectory may come from weekly levels at 20,707, 20,264, and 19,822.

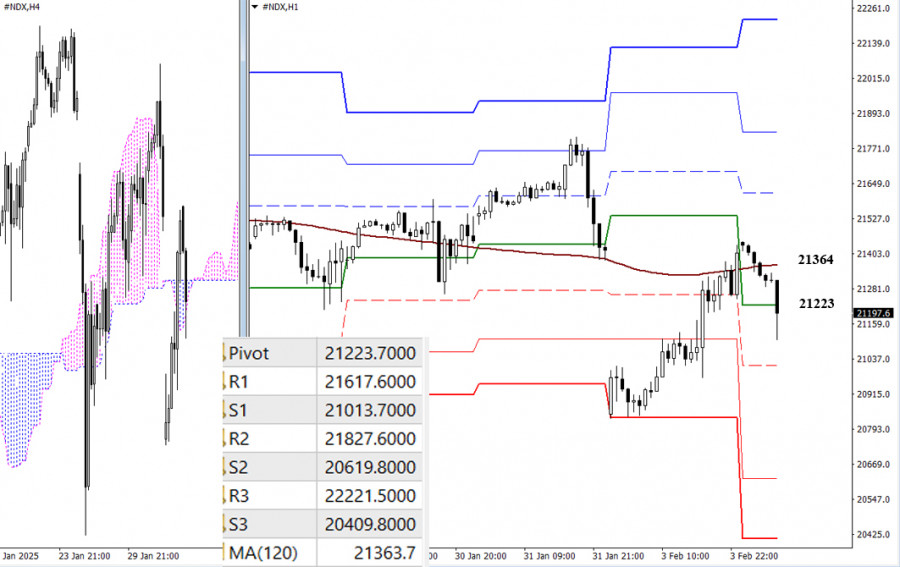

On lower timeframes, the bulls have managed to push the price back to the area of the weekly long-term trend, which is currently positioned at 21,364. The slope and position of this trend contribute to the prevailing uncertainty in the market. We may continue to see consolidation; however, if there are attempts to establish a directional move during the day, classic Pivot levels will serve as key reference points. For the bears, it will be crucial to break through support levels at 21,014, 20,620, and 20,410. Meanwhile, the bulls will be targeting resistance levels at 21,618, 21,828, and 22,222.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

EUR/USD is trading around 1.1437, below the Murray 6/8 level and within the uptrend channel formed on May 9. The instrument has an area where buyers have found it easier

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Currently on the 4-hour chart, the EUR/USD main currency pair appears to be moving above the WMA (21) which also has a slope that is going upwards and the condition

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.