See also

03.02.2025 12:15 AM

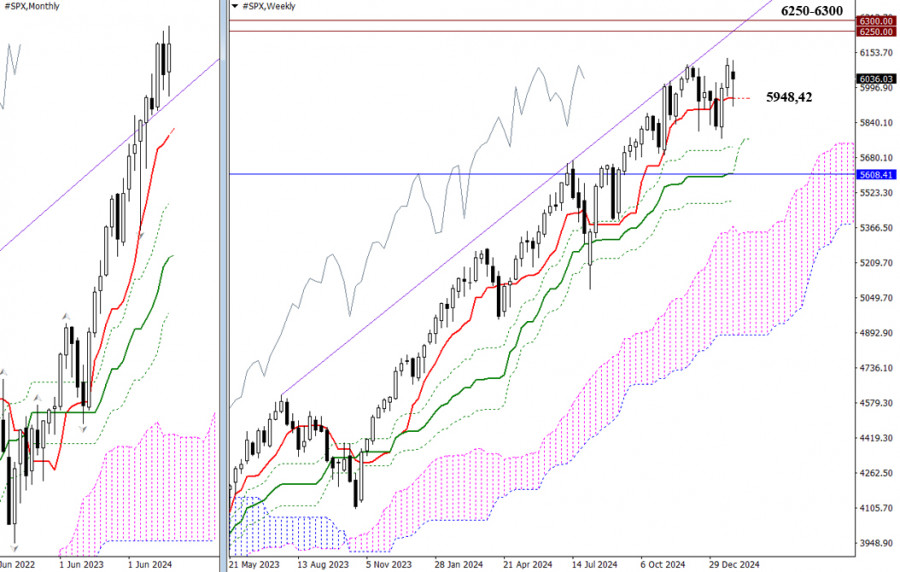

03.02.2025 12:15 AMJanuary ended with a bullish candle, establishing a new all-time high at 6127.41. However, the index only reached this high with an upper shadow, failing to close above previous levels. It's worth noting that bears also updated last month's low, and the weekly close before the weekend reflected a dominance of uncertainty. These circumstances open the door for the market to break below the current support at 5948.42 (weekly short-term trend) and initiate a downward correction. If bullish activity resumes, the resistance zone near the psychological levels of 6250 – 6300 remains the primary target.

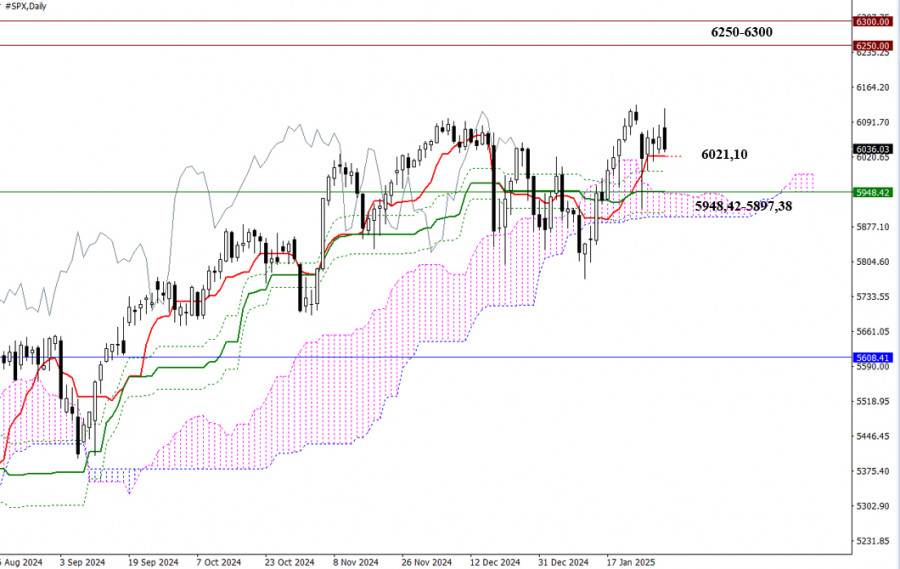

Last week, the index opened with a deep downward gap, which could not be fully closed by the daily candle's body, leaving only a shadow. If the daily short-term trend at 6021.10 ceases to act as support within this consolidation, the next critical levels for bears are 5948.42 (daily medium-term trend + weekly short-term trend) and the daily Ichimoku cloud support between 5943.52 and 5897.38. A break below these levels would create new opportunities for downward movement.

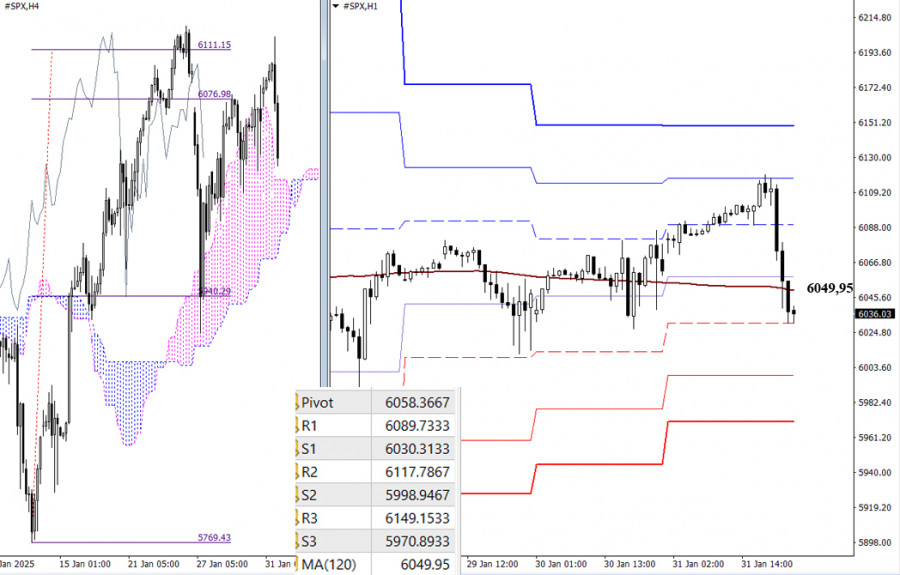

In the H4 timeframe, the bullish target of breaking above the H4 Ichimoku cloud at 6111.15 was achieved by the end of last week. As anticipated, the bulls took a pause afterward. This completed H4 target established a solid basis for a shift in sentiment. The bulls were unable to return to previous highs or continue their upward movement. Currently, the index is trading in a zone of equilibrium near the weekly long-term trend line at 6049.95, which has been moving horizontally for some time, indicating market indecision.

Trading above this trend line would favor a strengthening of bullish sentiment, while trading below it could create opportunities for bearish momentum to develop. The intraday movement will be guided by the classic pivot support and resistance levels, which are updated daily at market open.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the 4-hour chart, the USD/CAD commodity currency pair can be seen moving below the EMA (100) and the appearance of a Bearish 123 pattern and the position

With the Stochastic Oscillator condition heading towards the Oversold level (20) on the 4-hour chart of the AUD/JPY cross currency pair, in the near future AUD/JPY has the potential

Early in the American session, gold is trading around 3,220, showing signs of exhaustion. A further technical correction toward the 21SMA is likely in the coming hours

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.