See also

27.01.2025 09:31 AM

27.01.2025 09:31 AMThe upcoming week will be filled with important events and the release of significant economic data, which will undoubtedly have a noticeable impact on global market dynamics.

Let's begin by discussing the main political and geopolitical events of the past week. Since taking office, President Donald Trump has made numerous statements and taken actions that directly affect market conditions. A primary concern has been the issue of tariffs and duties on imports, which, coupled with geopolitical tensions, has created anxiety among investors. On Friday, while speaking online at the forum in Davos, the president emphasized the need to continue lowering interest rates. This statement led to an increase in demand for company shares. However, with the Federal Reserve meeting approaching and a wealth of important economic data as well as earnings reports from several major American companies on the horizon, investors are choosing to reduce the number of previously opened positions.

The ongoing discussions around tariff plans and immigration control are negatively impacting U.S. equities while simultaneously bolstering the dollar as a safe-haven currency. However, the market's response to the upcoming FOMC meeting and recent economic reports remains uncertain.

According to data from federal funds futures, there is a 99.5% probability that interest rates will stay unchanged within the 4.25%-4.50% range. The main focus will be on Fed Chair Jerome Powell's statement regarding the outlook for future rate cuts. Many investors believe that a rate cut is unlikely before summer. Therefore, if the FOMC statement and Powell's comments do not provide new insights, the market reaction to the meeting results is expected to be muted.

Economic reports will be crucial, particularly the Personal Consumption Expenditures (PCE) Price Index and its core reading, along with data on personal income and spending. An increase in these indicators would indicate ongoing inflationary pressures, making it less likely for the Fed to ease monetary policy before spring.

Investors will closely examine the Q4 GDP report, which is expected to indicate a slowdown in growth from 3.1% to 2.7%.

Overall, the upcoming FOMC meeting, potentially weaker GDP data, and rising PCE, combined with tariff concerns, may lead to further corrections in U.S. equities. During this time, the dollar is likely to find support.

Furthermore, anticipated rate cuts from the European Central Bank and the Bank of Canada could put pressure on the euro and the Canadian dollar against the U.S. dollar.

What could reverse the negative trends in U.S. equities, cryptocurrencies, and the strengthening of the dollar?

A series of optimistic announcements from Trump could serve as a catalyst. For example, implementing his plans to reduce the corporate tax burden would significantly boost demand in the stock market. Additionally, positive earnings reports from major companies expected this week could provide an upward momentum for equities.

Given Trump's ambitious plans to revive the U.S. economy, any correction in the stock market is likely to be short-lived. Local declines may prompt renewed buying, allowing major stock indices to resume an upward trajectory.

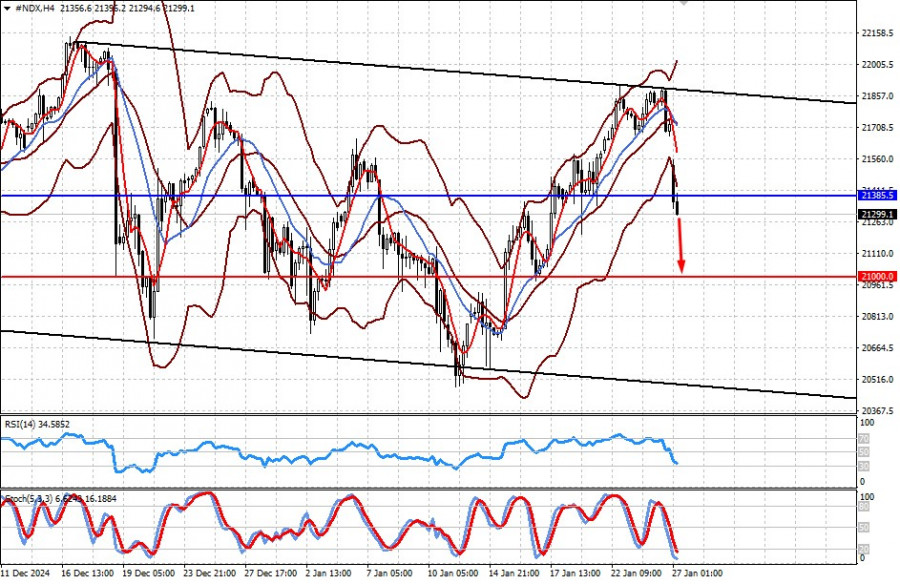

The NASDAQ CFD is declining amid expectations of the FOMC meeting results and critical U.S. economic data released this week. Persistently negative market sentiment could push the CFD down to 21,000.00.

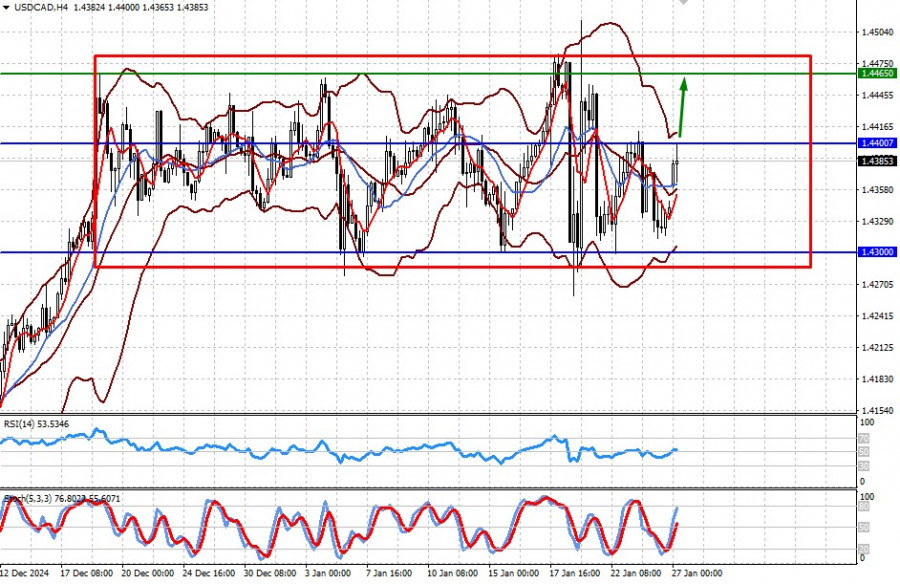

The pair remains in a sideways range of 1.4300–1.4465. A potential rate cut by the Bank of Canada, coupled with the Fed maintaining its rates and overall market negativity, could drive the pair toward the upper boundary of this range at 1.4465.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are very few macroeconomic reports scheduled for Thursday. Only two secondary reports from the UK and the US are all traders will get today. The construction sector activity report

The GBP/USD currency pair traded rather calmly on Wednesday, as there were few important events and reports during the day. As we expected, the business activity indices (excluding ISM)

After a sharp, almost catastrophic drop in March and April, the major U.S. stock indices recovered in May, fully offsetting the decline. Confidence is growing among market participants that this

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.