See also

20.01.2025 09:32 AM

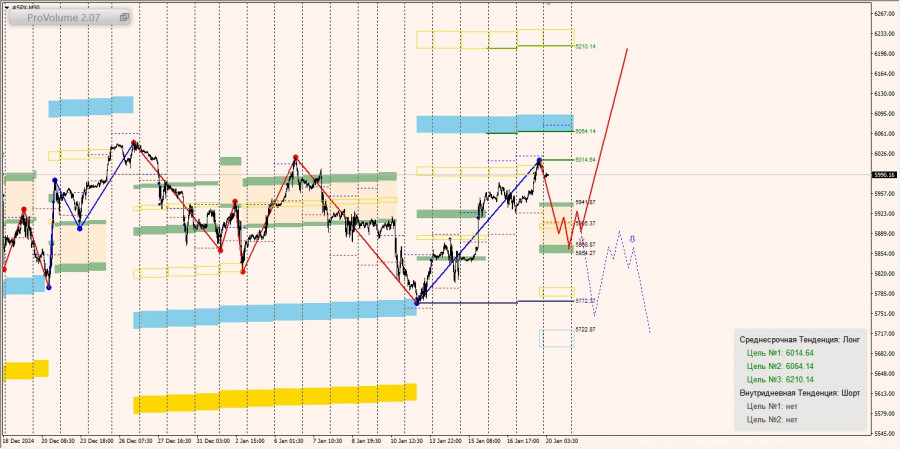

20.01.2025 09:32 AMLong-Term Trend: Temporary uncertainty.

Medium-Term Margin Trend: Long.

Key levels:

Medium-Term Technical Target: Break above the January 17, 2025 high of 6014.64.Medium-Term Margin Target: Test of the lower boundary of the KMCZ (Key Margin Control Zone) at 6210.14.

Investment Outlook:

Buy upon pattern formation.

Alternative Scenario:If S&P 500 prices consolidate below the 1/2 zone (5854.27) during pullbacks, look for sell opportunities according to the pattern within the new favorable price range. Targets:

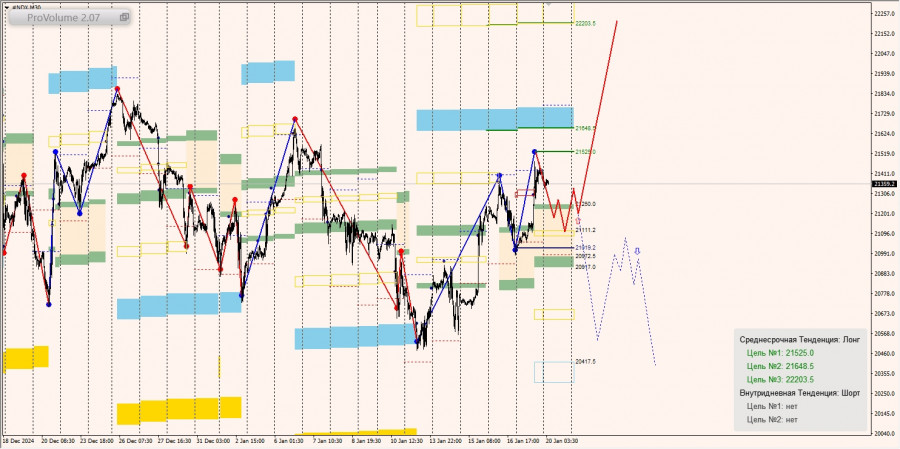

Long-Term Trend: Long.

Medium-Term Margin Trend: Long.

Key levels:

Medium-Term Technical Target: Break above the January 17, 2025 high of 21525.0.Medium-Term Margin Target: Test of the lower boundary of the KMCZ at 22203.5.

Investment Outlook:Buy within the favorable price range upon forming a reversal pattern.

Alternative Scenario:If NASDAQ prices consolidate below the 1/2 zone (20917.0), look for sell opportunities on pullbacks within the new favorable price range. Targets:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In my morning forecast, I highlighted the 1.1374 level and planned to make trading decisions based on it. Let's look at the 5-minute chart to analyze what happened. A decline

The GBP/USD currency pair also traded higher on Monday, although it pulled back slightly during the day. This retreat followed the announcement that the increase in tariffs for the European

On Monday, the EUR/USD currency pair initially rose following Trump's announcement that tariffs on EU goods would increase to 50% starting June 1. However, the pair subsequently fell after Trump

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed a confident upward movement on Friday, driven by the overall uptrend observed over the past two weeks

Analysis of Friday's Trades 1H Chart of EUR/USD On Friday, the EUR/USD currency pair continued its upward movement after bouncing from the 1.1267 level during a brief correction. The uptrend

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.