See also

16.01.2025 08:18 AM

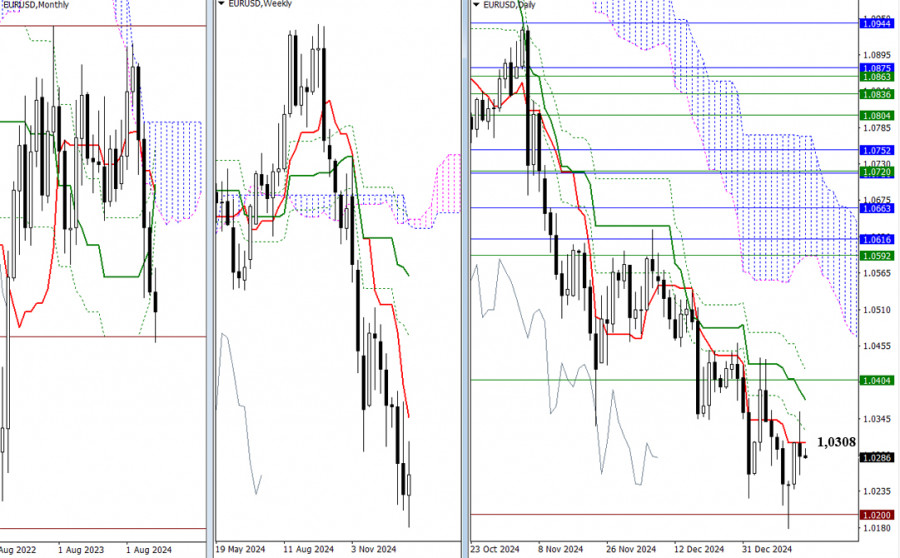

16.01.2025 08:18 AMYesterday, the pair formed a long upper shadow, testing the daily Fibonacci Kijun level at 1.0338. By the end of the day, the market chose to remain below the daily resistance levels of 1.0338 to 1.0308. There was no significant rebound, leaving multiple scenarios possible for today. For the bulls, the path is obstructed by the resistances of the daily Ichimoku bearish cross, ranging from 1.0308 to 1.0328, with additional resistance at 1.0374 and 1.0420, reinforced by the weekly short-term trend at 1.0404. For the bears, a break below the historical support level at 1.0200 and a continuation of the downward trend at 1.0179 are crucial.

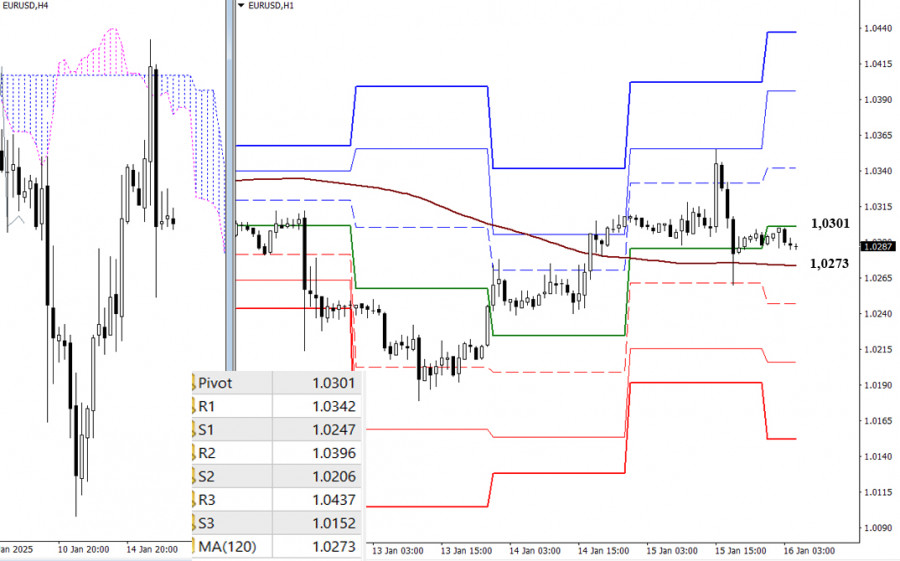

On the lower timeframes, the pair is currently testing support levels at 1.0301 (Central Pivot Point) and 1.0273 (Weekly Long-Term Trend). Staying above these levels maintains the advantage for the bulls. Conversely, a break below these levels and a trend reversal would give the bears the upper hand and open the door for further bearish developments. Additional reference points for intraday moves include resistance levels at 1.0342, 1.0396, and 1.0437, as well as support levels at 1.0247, 1.0206, and 1.0152 from the classic Pivot levels.

***

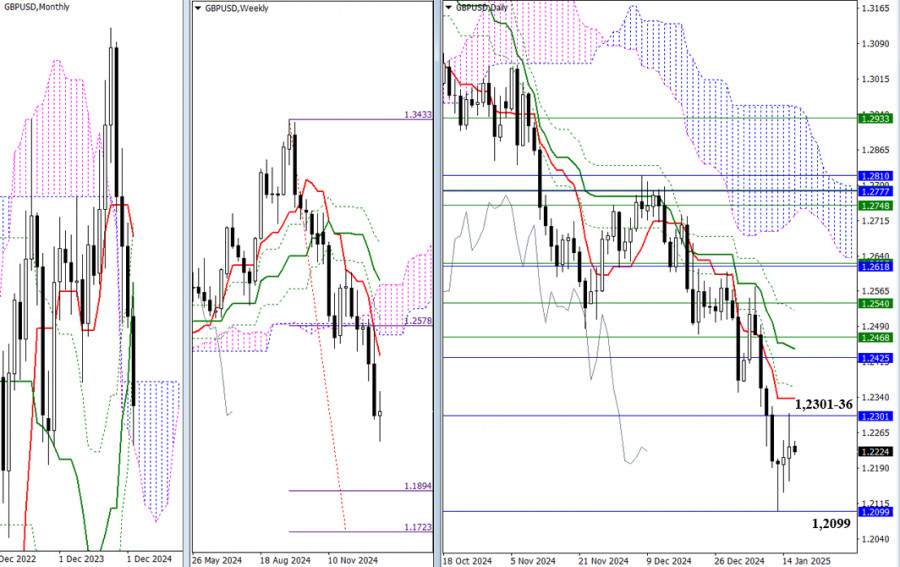

Yesterday, bulls managed to reach and test the upper boundary of the monthly cloud at 1.2301. However, the pair still lacks clear direction, as the previous days formed candles with small bodies and long wicks in both upward and downward directions. Bulls are targeting the nearest resistance levels at 1.2301–1.2336 (the upper boundary of the monthly cloud and the daily short-term trend), while bears aim to break out of the monthly cloud at 1.2099, potentially entering bearish territory to resume the downward trend.

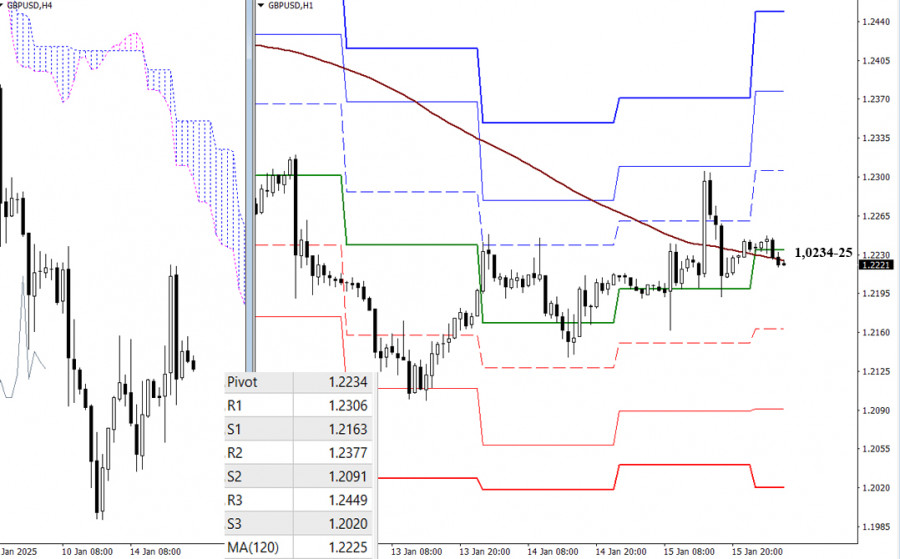

On the lower timeframes, bulls are currently battling for control over key levels at 1.2234–1.2225 (the Central Pivot Point and the Weekly Long-Term Trend). Maintaining these levels would help them retain their advantage. Classic Pivot levels serve as reference points for the development of directional movements throughout the day. For the bulls, the path to success lies through resistance levels at 1.2306, 1.2377, and 1.2449. Conversely, for bearish sentiment to develop, they will focus on the support levels at 1.2161, 1.2091, and 1.2020 within the classic Pivot levels.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin is trading around 109,369, bouncing back after reaching the key level of 107,500, which represents strong support for Bitcoin. If it consolidates above 108,700 (21SMA) in the coming hours

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.