See also

03.01.2025 05:38 PM

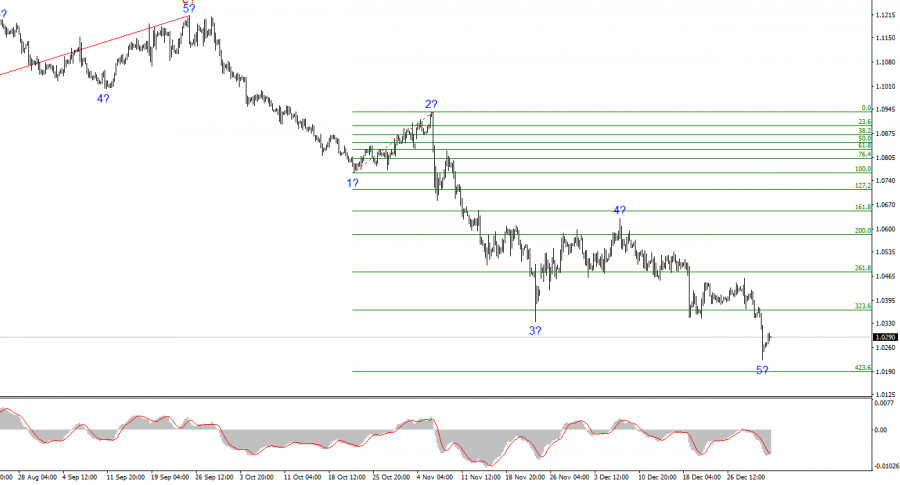

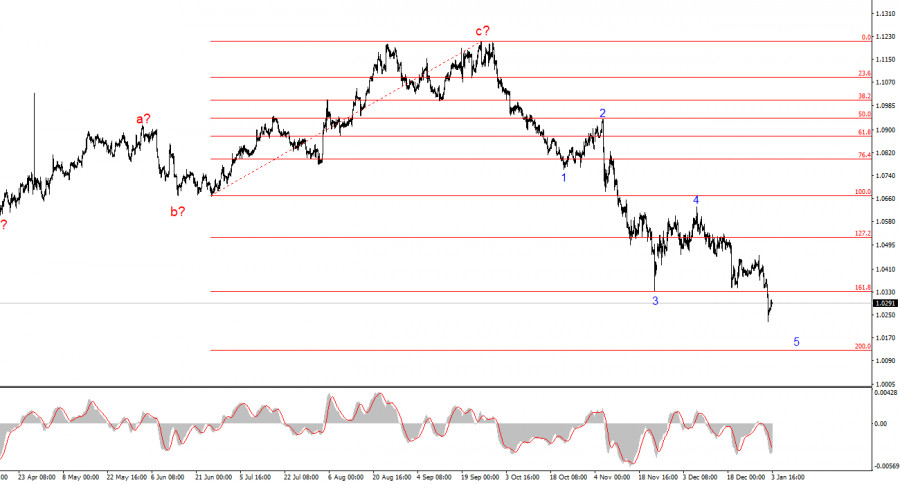

03.01.2025 05:38 PMThe wave structure of the 4-hour chart for EUR/USD is becoming increasingly clear and interesting. Since January 2024, I can identify only two three-wave patterns (a-b-c) with a turning point on April 16. After completing the upward wave structure, a new downward structure began forming, which has the potential to become impulsive. If this proves to be the case, a more convincing fifth wave is expected to form, after which the pair could transition to constructing a prolonged and complex corrective structure.

Overall, the current wave analysis seems straightforward and clear. I would like to remind you that market fundamentals can be misleading for one, two, or even three months, but not indefinitely. Recent US reports showed that the economy is not facing severe issues. There is no recession, and it is unlikely to occur. The economy may slow down, but its current growth rates allow it to navigate this period without significant losses. The Federal Reserve is expected to ease policy slower and less aggressively than the market anticipated at the beginning of the year. Conversely, the ECB sees no reason to stop easing and will likely continue.

On Friday, the EUR/USD pair gained 30 basis points. This rise is negligible compared to yesterday's drop in the euro, marking another decline in recent months. I believe the new fall in the euro was predictable, given the overwhelming factors weighing on the EU currency, which are hard to ignore. I still think the recent market movements reflect a reaction to unmet expectations. In 2024, the market anticipated 6–7 rounds of Federal Reserve monetary easing but only got three. In 2025, expectations were clearly higher than the two 25-basis-point cuts that have been announced. Thus, a "dovish" scenario was priced into the dollar, and now the market seems to be recalibrating.

No news yesterday provided strong support for the dollar, nor were there reports today that would fail to support the US currency. German unemployment data released today showed neutral results, with unemployment levels unchanged and figures aligning with market expectations. Later today, the ISM Manufacturing PMI for the US will be released, providing the final piece of data for the first week of 2025. Significant market fluctuations are possible during the final trading hours of the week. However, these fluctuations will not negate the fact that demand for the dollar has been growing for over three months—a fully justified market reaction.

Based on the EUR/USD analysis, I conclude that the pair continues to build a new downward trend segment. The unsuccessful attempt to break the 1.1184 level signaled the beginning of a series of downward waves. Three failed attempts to break the 200.0% Fibonacci level indicated readiness for the fifth wave, targeting as low as the 1.02 range. Yesterday, the pair entered the 1.02 range, and the fifth wave could conclude at any moment.

At a higher wave scale, it is evident that the wave structure is evolving into a more complex formation, primarily consisting of corrective waves. A new set of downward waves is likely, but its length and structure remain challenging to predict at this stage.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

GBP/USD Analysis: The British pound continues its downward movement, which began a month ago. After breaking a strong intermediate support level last week, the pair rebounded, forming a correction along

EUR/USD Analysis:The upward trend in the main euro pair, which began in February this year, has brought the quotes to the lower boundary of a broad potential reversal zone

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Training video

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.