See also

22.02.2024 09:53 AM

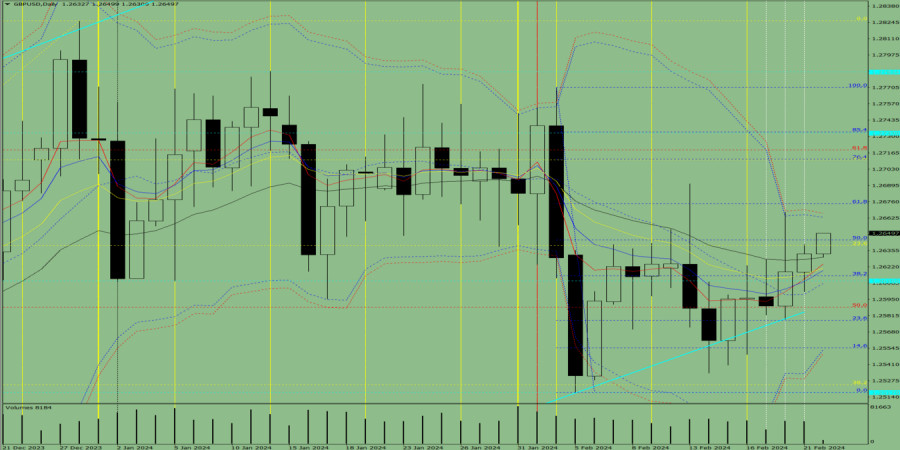

22.02.2024 09:53 AMTrend analysis (Fig. 1).

The GBP/USD currency pair may rise from the level of 1.2633 (closing of yesterday's daily candle) to 1.2665, the upper limit of the Bollinger Band indicator (red dotted line). Upon reaching this level, the price may decline with a target of 1.2644, the 50% pullback level (blue dotted line).

Fig. 1 (daily chart).

Comprehensive analysis:

General conclusion: Today, the price may rise from the level of 1.2633 (closing of yesterday's daily candle) to 1.2665, the upper limit of the Bollinger Band indicator (red dotted line). Upon reaching this level, the price may decline with a target of 1.2644, the 50% pullback level (blue dotted line).

Alternatively, from the level of 1.2633 (closing of yesterday's daily candle), the price may rise with a target of 1.2644, the 50% pullback level (blue dotted line). Upon reaching this level, a downward movement is possible with a target of 1.2621, the 13-day EMA (yellow thin line).

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On the hourly chart, the GBP/USD pair on Wednesday consolidated above the weak 161.8% retracement level at 1.3520. This consolidation allows for expectations of continued growth toward the next retracement

With the condition of the Stochastic Oscillator indicator at the Overbought level and a Divergence appears between the indicator and the Nasdaq 100 index price movement, so that

The eagle indicator is showing a negative signal for the euro, suggesting a possible fall in the coming days. Therefore, our outlook remains bearish as long as the price consolidates

On the other hand, if bullish strength prevails, we could expect a technical rebound around 3,355. This area has provided gold with a good rebounding point in the past

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.