See also

08.05.2023 06:59 PM

08.05.2023 06:59 PMJoe Biden and Kevin McCarthy have approached a decisive moment in their fight over the debt ceiling. The President is set to receive the House Speaker and other Congressional leaders at the White House on Tuesday, and during which McCarthy is likely to seek spending cuts as a condition for suspending or raising the debt limit. Biden, meanwhile, will most certainly insist on separating the issues and calls for an increase in the debt limit.

The stakes are higher than just politics as a default would trigger a market sell-off, as well as could cost millions of jobs. In fact, Treasury bill markets already showed new concerns about the possibility of the US defaulting on its debt in early June. However, expectations for the meeting are low.

Biden said he plans to keep his promise not to negotiate over the debt ceiling, arguing that it would create a dangerous precedent that allows Republicans to hold the country's economy hostage compared to their preferred political outcomes.

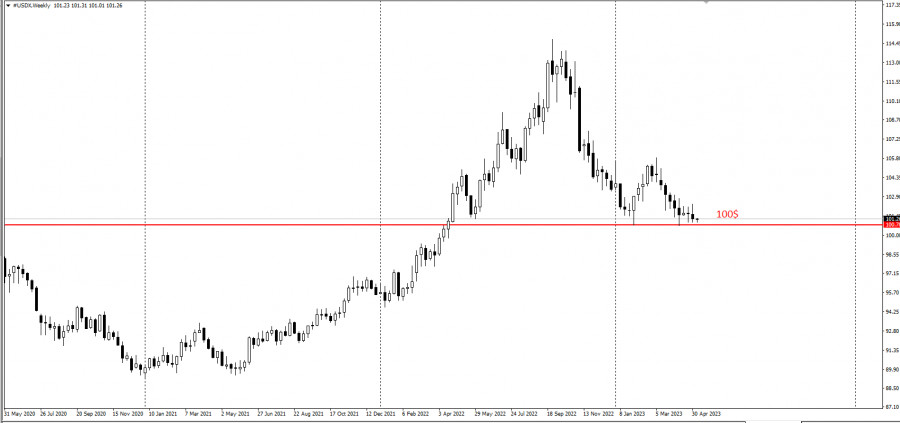

The dollar index once again approached the psychological level of 100:

McCarthy asserts that there is no alternative, and his position strengthened over the weekend, when 43 Senate Republicans, including minority leader Mitch McConnell, signed a letter stating that they would not support a clean debt ceiling increase. That is enough to prevent Democrats from overcoming a filibuster if they propose one without any conditions attached.

The situation on Pennsylvania Avenue has also prompted a new consideration of executive actions, such as Biden's reference to the 14th Amendment, which states that the validity of the country's public debt should not be questioned. But when asked in an interview last Friday, the President said he "hasn't gotten there yet."

US Treasury Secretary Janet Yellen warned that such a maneuver could trigger a "constitutional crisis" and do little to prevent unnecessary economic damage. Economic experts also said that it could not only lead to the court overturning the initiative and plunging the country into an immediate financial crisis, but also scare off investors and raise borrowing costs for the government.

"We will have an economic and financial disaster of our own making if we don't take any actions that President Biden and the US Treasury Department can take to prevent this," Yellen said.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Macroeconomic Reports: A fairly large number of macroeconomic publications are scheduled for Friday, but most of them will not interest traders. For example, the report on industrial production

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.