See also

28.10.2021 07:43 PM

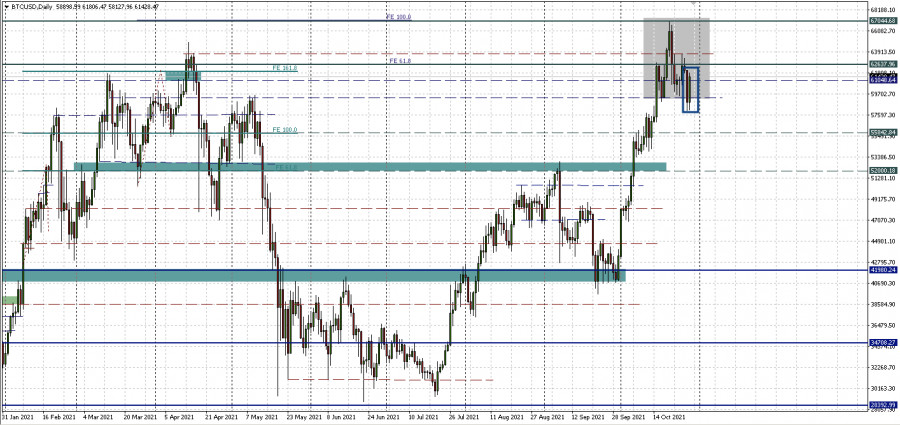

28.10.2021 07:43 PMAfter dropping to $58,000 on Wednesday, Bitcoin starts to look better and encouraging on Thursday. But don't jump to conclusions.

An important psychological and technical level of $60,000 per bitcoin is being traded. The battle for it is still going on, and how it will end is still unclear. But most of Wednesday's fall has been bought back. On Thursday, the redemption of the bottom became known from El Salvador. They love this tactic. And other participants, too, probably connected.

Hints of a possible bullish engulfing formation look encouraging in this situation. And if this pattern is formed, it will be possible to think about further growth.

Head and shoulders pattern has not lost its relevance

Yes, Thursday's daily candle calls into question anchoring below the $60,000 horizontal. But, it's not over yet. However, Thursday's growth does not guarantee that the price will not return to this level in the following days.

This means that the threat of working out the head and shoulders reversal pattern and a decline in the zone of $55,000 and even $52,000 for Bitcoin has not passed.

Yes, the situation is uncertain. It is difficult to make predictions, you have to observe.

Market growth is not canceled

At any position of the price relative to the level of $60,000 per coin, the bull market remains relevant. The only question is how deep the downward correction will be before the next return to strengthening.

As for the medium-term trend, many cryptanalysts agree that Bitcoin has now fulfilled only half of its growth potential.

For example, Mitch Klee, guided by the signals of the HODL Ratio (RHODL) indicator, notes that the main cryptocurrency is still far from its potential maximum values that can be reached. The expert notes that RHODL is showing seller depletion.

Other sources of this opinion include PlanB, the creator of the Bitcoin Stock-to-Flow model. PlanB believes bitcoin still has six months before the turning point and the market change from bullish to bearish.

Three reasons for the fall in BTCUSD

It is difficult to consider the current decline as anything more than an ordinary technical correction. A strong "Uptober" is coming to an end, and the update of historical values is a good reason to take some of the profit. So the sales started.

In addition, ETF funds were launched, enthusiastic expectations calmed down, traders began to sell on facts , also provoking a correction.

Finally, the euphoria of October and skyrocketing growth have traditionally led to a partial loss of vigilance in terms of risk. The estimated leverage ratio on cryptocurrency derivatives exchanges is about to hit an annual high, as we talked about earlier. Note that this reason intensified the market collapse in May: positions with leverage with a slight decrease in prices are quickly taken out, and accounts are closed by margin call.

If the fundamental background remains neutral and there is no bad news, the market in general and Bitcoin, in particular, will return to growth. Perhaps from current values, or from $55,000-$52,000. But it is difficult to predict the dynamics locally. It is necessary to observe, and, perhaps, the situation will clear up by the end of the week.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has successfully pushed above $90,000, while Ethereum added more than 10% in just one day, rebounding to $1800. The main catalyst was Donald Trump's statement yesterday, clarifying that firing

Bitcoin and Ethereum, having spent the entire weekend moving sideways within a range, surged sharply during today's Asian session. The rally was triggered by rumors that U.S. Federal Reserve Chair

Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However

After successfully exiting the Ascending Broadening Wedge pattern on the 4-hour chart of the Litecoin cryptocurrency followed by the appearance of Divergence between the Litecoin price movement and the Stochastic

Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two markets

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.