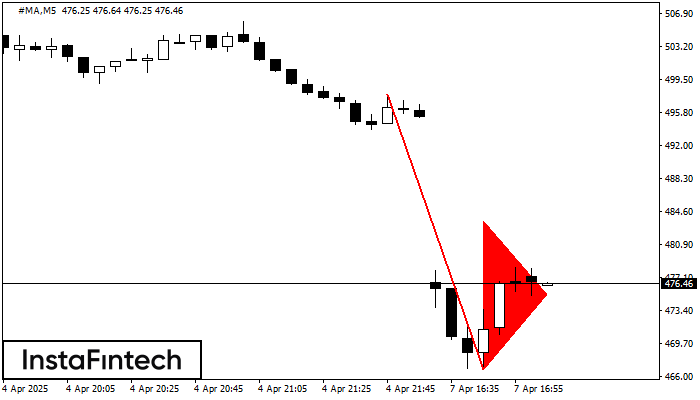

Bearish pennant

was formed on 07.04 at 16:04:58 (UTC+0)

signal strength 1 of 5

The Bearish pennant pattern has formed on the #MA M5 chart. It signals potential continuation of the existing trend. Specifications: the pattern’s bottom has the coordinate of 466.76; the projection of the flagpole height is equal to 3098 pips. In case the price breaks out the pattern’s bottom of 466.76, the downtrend is expected to continue for further level 466.61.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Double Top

сформирован 06.06 в 22:30:10 (UTC+0)

сила сигнала 2 из 5

On the chart of USDCAD M15 the Double Top reversal pattern has been formed. Characteristics: the upper boundary 1.3702; the lower boundary 1.3668; the width of the pattern 34 points

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

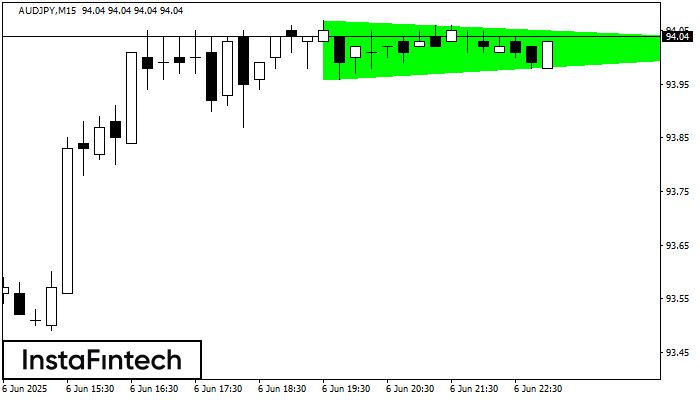

Bullish Symmetrical Triangle

сформирован 06.06 в 22:18:11 (UTC+0)

сила сигнала 2 из 5

According to the chart of M15, AUDJPY formed the Bullish Symmetrical Triangle pattern. The lower border of the pattern touches the coordinates 93.96/94.02 whereas the upper border goes across 94.07/94.02

The M5 and M15 time frames may have more false entry points.

Открыть график инструмента в новом окне

Triple Bottom

сформирован 06.06 в 22:01:08 (UTC+0)

сила сигнала 3 из 5

The Triple Bottom pattern has formed on the chart of the GBPAUD M30 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

Открыть график инструмента в новом окне