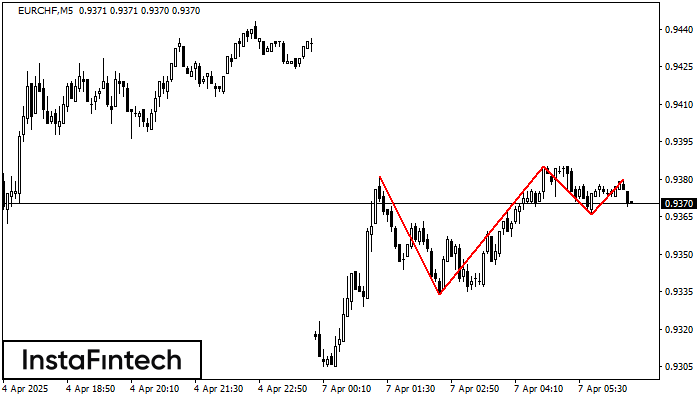

Triple Top

was formed on 07.04 at 05:36:16 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the EURCHF M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 0.9334/0.9366 with the upper limit 0.9381/0.9380; the projection of the width is 47 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 0.9334, the price is most likely to continue the downward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

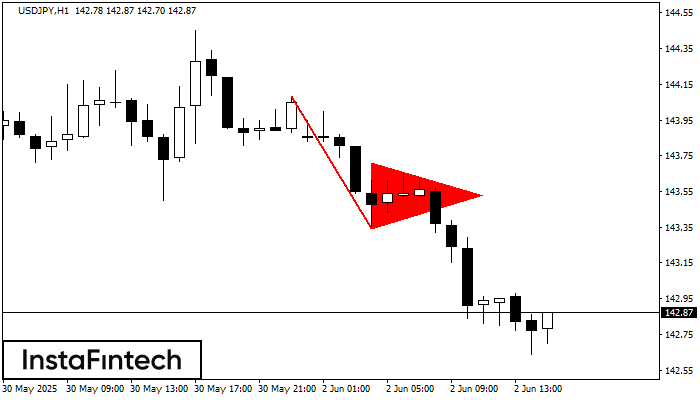

Медвежий вымпел

сформирован 02.06 в 14:45:11 (UTC+0)

сила сигнала 4 из 5

На графике USDJPY H1 сформировалась фигура «Медвежий вымпел», которая сигнализирует о возможном продолжении тренда. Характеристика: основание фигуры имеет координаты 143.34; проекция высоты флагштока равна 74 пунктов. В случае если цена

Открыть график инструмента в новом окне

Прямоугольник

сформирован 02.06 в 14:35:19 (UTC+0)

сила сигнала 2 из 5

По торговому инструменту EURUSD на M15 сформировалась фигура продолжения тренда - «Прямоугольник». Фигура имеет границы: Нижняя 1.1409; Верхняя 1.1437. В случае пробоя верхней границы вероятно дальнейшее движение в сторону тренда

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

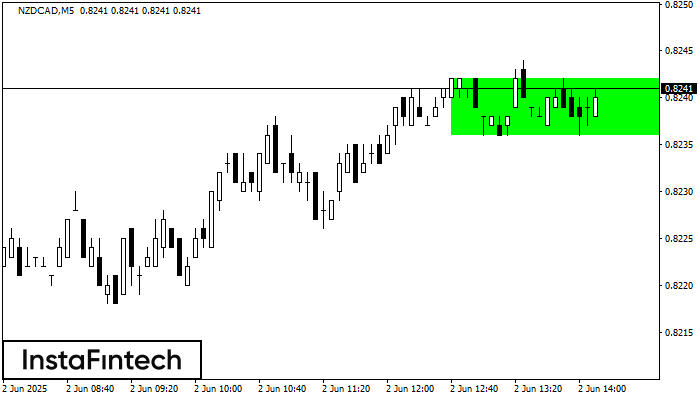

Прямоугольник

сформирован 02.06 в 13:16:37 (UTC+0)

сила сигнала 1 из 5

Сформирована фигура «Прямоугольник» на графике NZDCAD M5. Тип фигуры: Продолжение тренда; Границы: Верхняя 0.8242, Нижняя 0.8236; Сигнал: позицию на покупку следует открывать выше верхней границы прямоугольника 0.8242

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне