AUDJPY (Australian Dollar vs Japanese Yen). Exchange rate and online charts.

See Also

- Euro in Confusion Ahead of Trump Tariffs Taking Effect

Author: Laurie Bailey

05:20 2025-03-31 UTC+2

1093

Fundamental analysisEUR/USD. Hello, April: Eurozone Inflation Report, ISM Indices, and Nonfarm Payrolls

The first week of every month is the most informative for EUR/USD traders. April is no exception, meaning the upcoming week promises to be interesting and volatile.Author: Irina Manzenko

06:28 2025-03-31 UTC+2

718

Technical analysis / Video analyticsForex forecast 31/03/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and Bitcoin.Author: Sebastian Seliga

10:50 2025-03-31 UTC+2

718

- Fundamental analysis

GBP/USD Pair Overview – March 31: Nonfarm Payrolls, Trump, and Unemployment May Create New Problems for the Dollar

The GBP/USD currency pair continued to trade sideways near its highs on FridayAuthor: Paolo Greco

06:24 2025-03-31 UTC+2

703

The EUR/USD currency pair rose again on FridayAuthor: Paolo Greco

06:24 2025-03-31 UTC+2

658

Nikkei Falls 4%, Nasdaq Futures Fall 1.4% Trump Says U.S. Tariffs Will Apply to Every Country Gold Has Best Quarter Since 1986 Dollar Heading for Worst First Quarter Since Global Financial CrisisAuthor: Thomas Frank

09:35 2025-03-31 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 31

Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

643

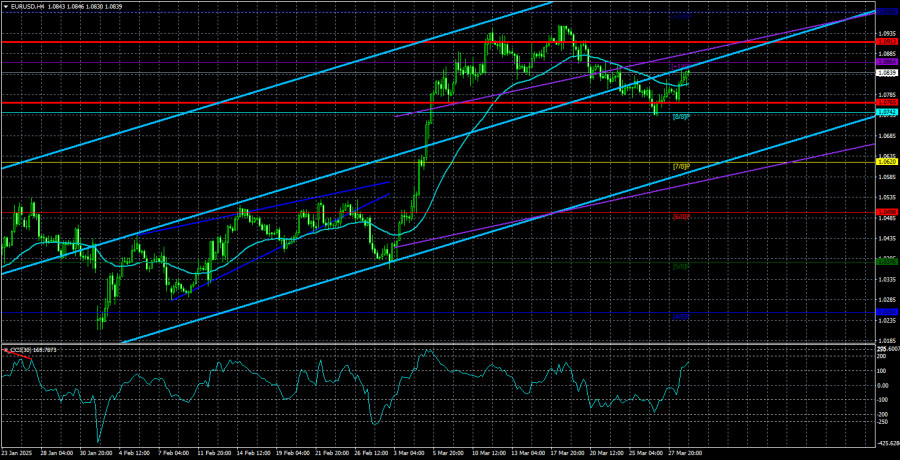

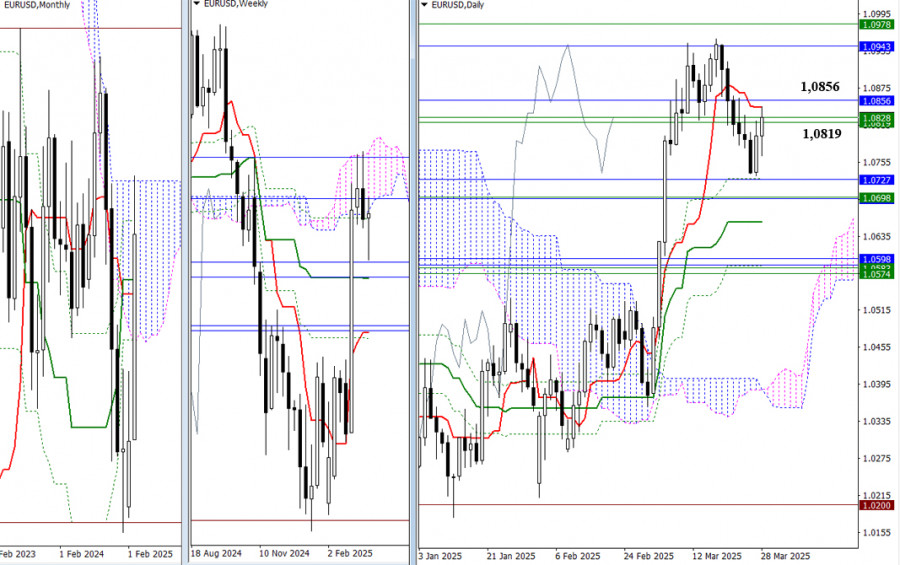

During the week, bearish players attempted to confirm the earlier-formed pullback and continue the decline but were unsuccessful, resulting in a long lower shadow on the weekly candlestick. The pair has returned to the cluster of resistance levels (1.0819–1.0856), which now represents the nearest r.Author: Evangelos Poulakis

09:07 2025-03-31 UTC+2

643

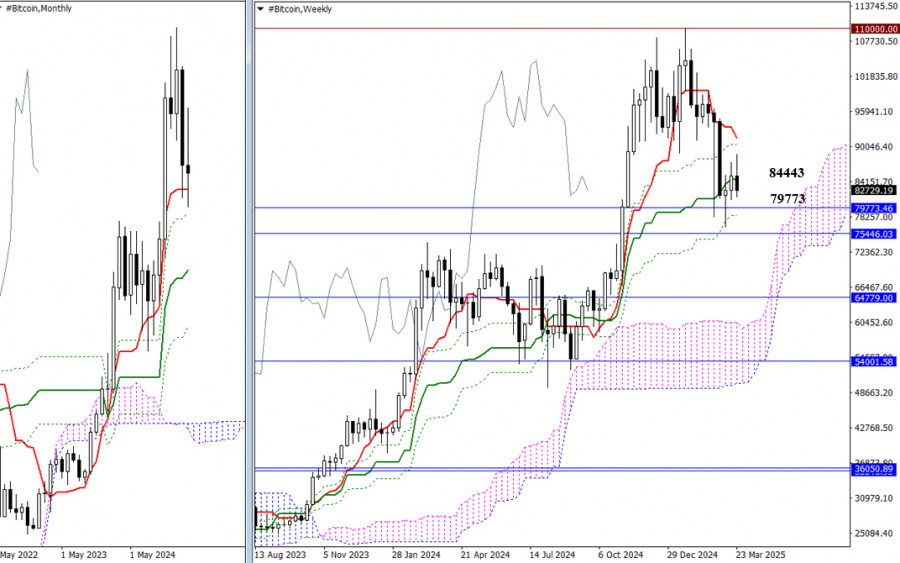

Uncertainty currently dominates the market. Participants have taken a wait-and-see approach. The support of the monthly short-term trend at 79,773 and the weekly medium-term trend at 84,443 continue to influence the situation. To shift the current setup, bears must break the recent low at 76,562.Author: Evangelos Poulakis

09:07 2025-03-31 UTC+2

628

- Euro in Confusion Ahead of Trump Tariffs Taking Effect

Author: Laurie Bailey

05:20 2025-03-31 UTC+2

1093

- Fundamental analysis

EUR/USD. Hello, April: Eurozone Inflation Report, ISM Indices, and Nonfarm Payrolls

The first week of every month is the most informative for EUR/USD traders. April is no exception, meaning the upcoming week promises to be interesting and volatile.Author: Irina Manzenko

06:28 2025-03-31 UTC+2

718

- Technical analysis / Video analytics

Forex forecast 31/03/2025: EUR/USD, GBP/USD, Gold, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, Gold, Oil and Bitcoin.Author: Sebastian Seliga

10:50 2025-03-31 UTC+2

718

- Fundamental analysis

GBP/USD Pair Overview – March 31: Nonfarm Payrolls, Trump, and Unemployment May Create New Problems for the Dollar

The GBP/USD currency pair continued to trade sideways near its highs on FridayAuthor: Paolo Greco

06:24 2025-03-31 UTC+2

703

- The EUR/USD currency pair rose again on Friday

Author: Paolo Greco

06:24 2025-03-31 UTC+2

658

- Nikkei Falls 4%, Nasdaq Futures Fall 1.4% Trump Says U.S. Tariffs Will Apply to Every Country Gold Has Best Quarter Since 1986 Dollar Heading for Worst First Quarter Since Global Financial Crisis

Author: Thomas Frank

09:35 2025-03-31 UTC+2

643

- Trading Recommendations for the Cryptocurrency Market on March 31

Author: Miroslaw Bawulski

11:02 2025-03-31 UTC+2

643

- During the week, bearish players attempted to confirm the earlier-formed pullback and continue the decline but were unsuccessful, resulting in a long lower shadow on the weekly candlestick. The pair has returned to the cluster of resistance levels (1.0819–1.0856), which now represents the nearest r.

Author: Evangelos Poulakis

09:07 2025-03-31 UTC+2

643

- Uncertainty currently dominates the market. Participants have taken a wait-and-see approach. The support of the monthly short-term trend at 79,773 and the weekly medium-term trend at 84,443 continue to influence the situation. To shift the current setup, bears must break the recent low at 76,562.

Author: Evangelos Poulakis

09:07 2025-03-31 UTC+2

628