Triple Bottom

was formed on 13.04 at 23:50:17 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of GBPAUD M5. Features of the pattern: The lower line of the pattern has coordinates 2.0806 with the upper limit 2.0806/2.0764, the projection of the width is 56 points. The formation of the Triple Bottom pattern most likely indicates a change in the trend from downward to upward. This means that in the event of a breakdown of the resistance level 2.0750, the price is most likely to continue the upward movement.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

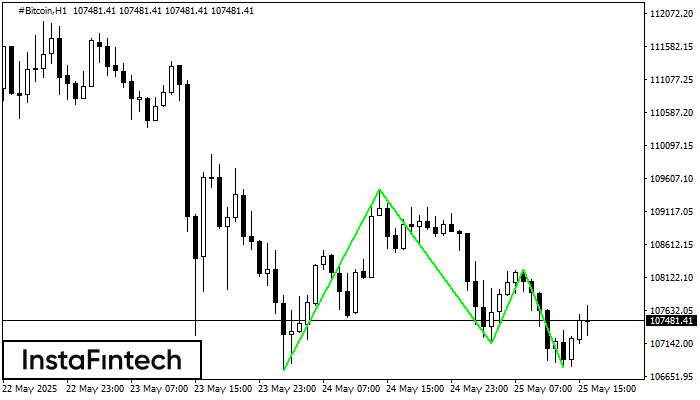

Тройное дно

сформирован 25.05 в 15:59:45 (UTC+0)

сила сигнала 4 из 5

Сформирована фигура «Тройное дно» по торговому инструменту #Bitcoin на H1. Фигура сигнализирует об изменении тенденции с нисходящей на восходящую в случае пробоя верхней границы 108246.73

Открыть график инструмента в новом окне

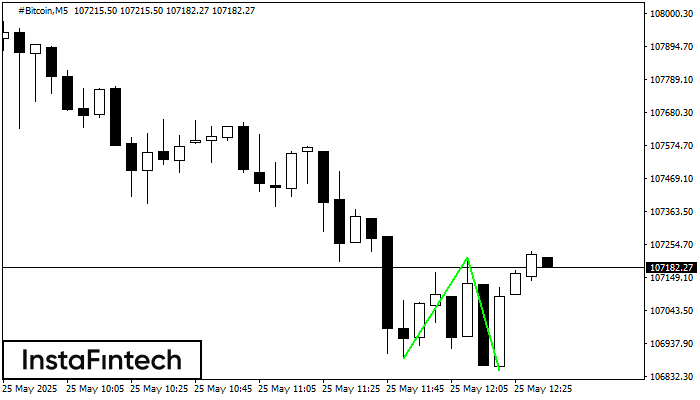

Двойное дно

сформирован 25.05 в 12:20:13 (UTC+0)

сила сигнала 1 из 5

Сформирована фигура «Двойное дно» на графике #Bitcoin M5. Характеристика: Уровень поддержки 106888.42; Уровень сопротивления 107214.56; Ширина фигуры 32614 пунктов. В случае пробоя уровня сопротивления можно будет прогнозировать изменение тенденции

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне

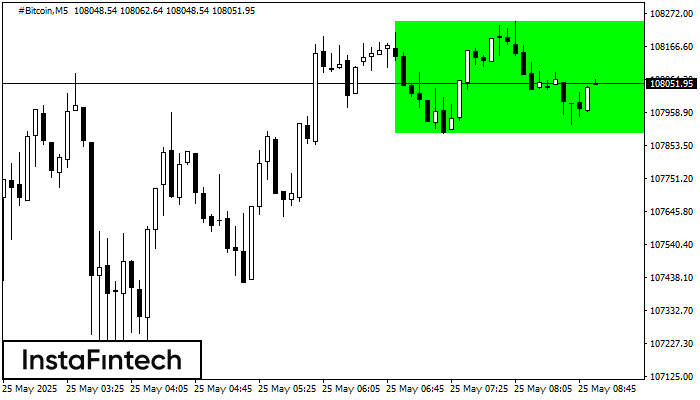

Прямоугольник

сформирован 25.05 в 07:55:30 (UTC+0)

сила сигнала 1 из 5

По торговому инструменту #Bitcoin на M5 сформировалась фигура продолжения тренда - «Прямоугольник». Фигура имеет границы: Нижняя 107891.05; Верхняя 108246.73. В случае пробоя верхней границы вероятно дальнейшее движение в сторону тренда

Таймфреймы М5 и М15 могут иметь больше ложных точек входа.

Открыть график инструмента в новом окне