Double Bottom

was formed on 08.04 at 21:20:19 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDCAD M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 0.8506 is broken. The further movements will rely on the width of the current pattern 26 points.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Triángulo Simétrico Bajista

was formed on 22.05 at 19:51:05 (UTC+0)

signal strength 1 of 5

Según el gráfico de M5, el #KO formó el patrón Triángulo Simétrico Bajista. Recomendaciones de negociación: es posible que una ruptura del límite inferior 70.98 fomente una continuación

Los marcos de tiempo M5 y M15 pueden tener más puntos de entrada falsos.

Open chart in a new window

Triple Piso

was formed on 22.05 at 19:45:54 (UTC+0)

signal strength 1 of 5

El patrón Triple Piso ha sido formado en el gráfico de AUDUSD M5. Características del patrón: línea inferior del patrón tiene coordenadas 0.6420 con el límite superior 0.6420/0.6413, la proyección

Los marcos de tiempo M5 y M15 pueden tener más puntos de entrada falsos.

Open chart in a new window

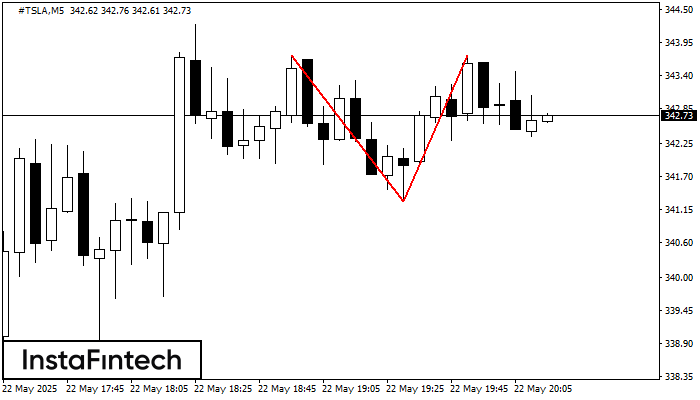

Doble Techo

was formed on 22.05 at 19:15:10 (UTC+0)

signal strength 1 of 5

El patrón de reversión Doble Techo ha sido formado en #TSLA M5. Características: el límite superior 343.73; el límite inferior 341.29; el ancho del patrón es 245 puntos. Es mejor

Los marcos de tiempo M5 y M15 pueden tener más puntos de entrada falsos.

Open chart in a new window