Triple Top

was formed on 08.04 at 08:30:23 (UTC+0)

signal strength 3 of 5

The Triple Top pattern has formed on the chart of the EURGBP M30 trading instrument. It is a reversal pattern featuring the following characteristics: resistance level 2, support level -5, and pattern’s width 23. Forecast If the price breaks through the support level 0.8564, it is likely to move further down to 0.8558.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

Bawah Triple

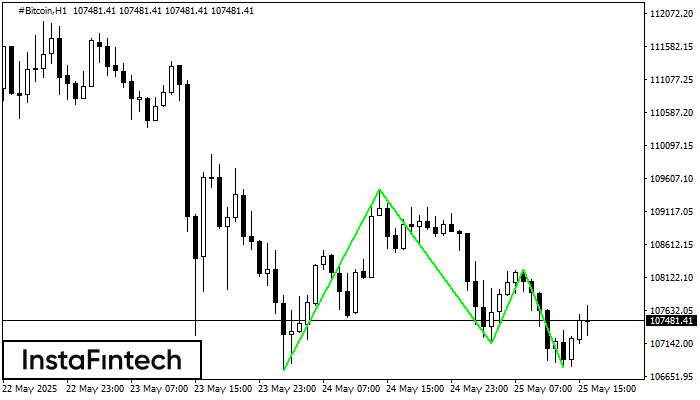

was formed on 25.05 at 15:59:45 (UTC+0)

signal strength 4 of 5

Pola Bawah Triple telah terbentuk pada grafik instrumen trading #Bitcoin H1. Pola tersebut menandakan perubahan dalam trend dari menurun menjadi naik jika terjadi pemecahan (breakdown) 109440.14/108246.73

Open chart in a new window

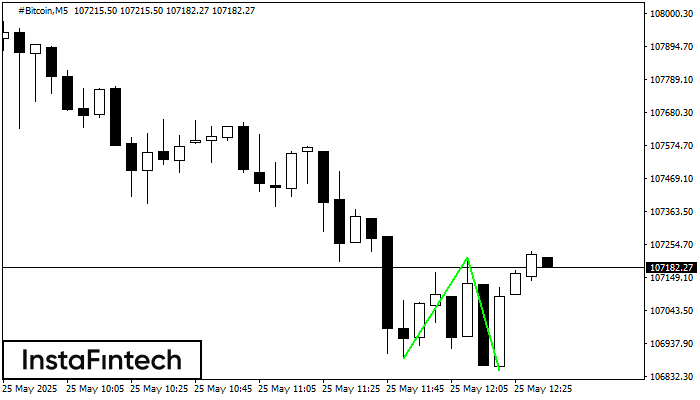

Bawah Ganda

was formed on 25.05 at 12:20:13 (UTC+0)

signal strength 1 of 5

Pola Bawah Ganda telah terbentuk pada #Bitcoin M5. Karakteristik: level support 106888.42; level resistance 107214.56; lebar pola 32614 poin. Jika level resistance ditembus, perubahan dalam tren dapat diprediksi dengan target

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window

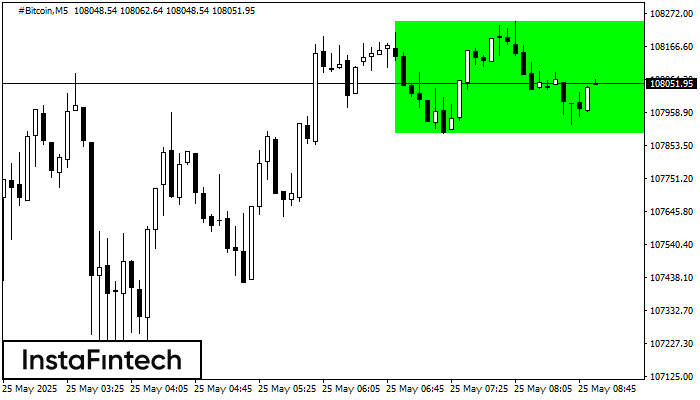

Persegi Bullish

was formed on 25.05 at 07:55:30 (UTC+0)

signal strength 1 of 5

Menurut grafik dari M5, #Bitcoin terbentuk Persegi Bullish yang merupakan pola dari kelanjutan tren. Pola terkandung dalam batas berikut: batas yang lebih rendah 107891.05 – 107891.05 dan batas atas 108246.73

Rangka waktu M5 dan M15 mungkin memiliki lebih dari titik entri yang keliru.

Open chart in a new window